正在加载图片...

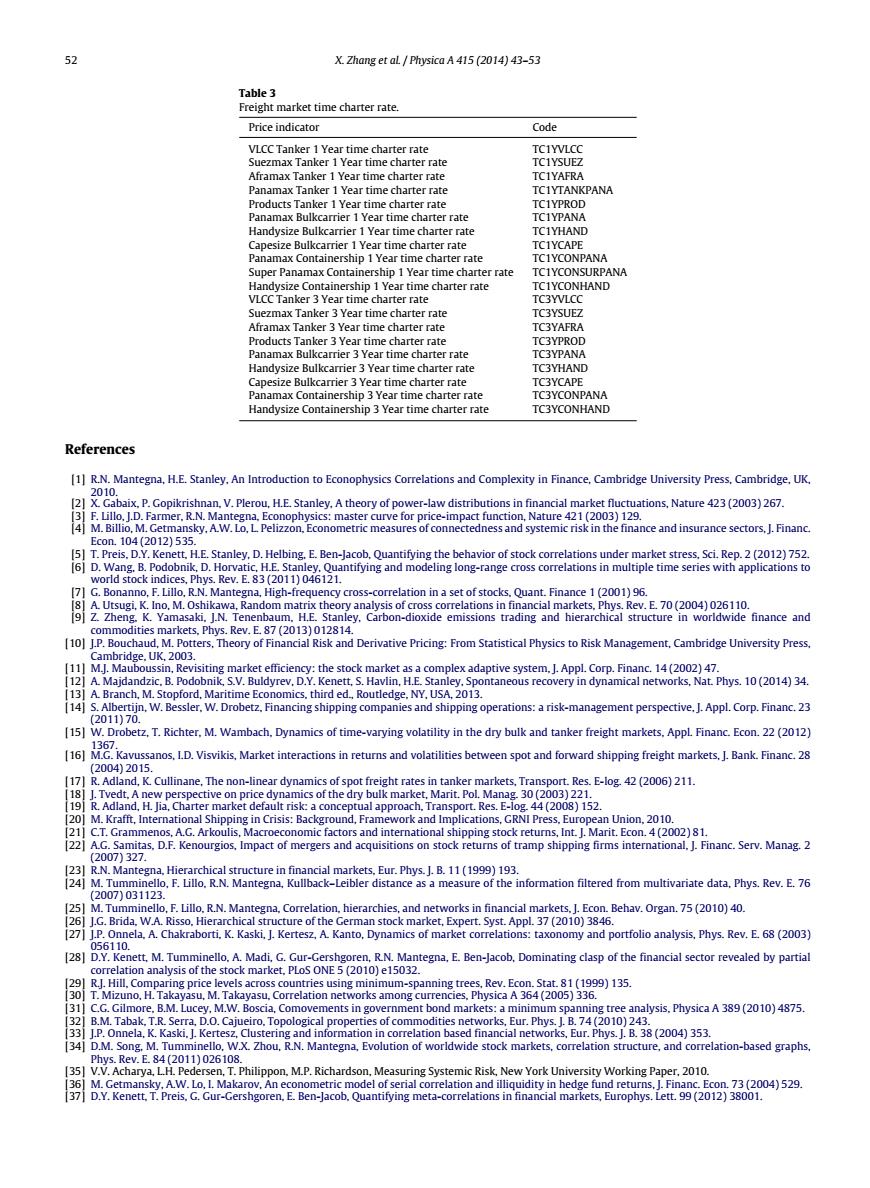

52 X.Zhang et aL Physica A 415 (2014)43-53 Table 3 Freight market time charter rate. Price indicator Code VLCC Tanker 1 Year time charter rate TC1YVLCC Suezmax Tanker 1 Year time charter rate TC1YSUEZ Aframax Tanker 1 Year time charter rate TC1YAFRA Panamax Tanker 1 Year time charter rate TC1YTANKPANA Products Tanker 1 Year time charter rate TC1YPROD Panamax Bulkcarrier 1 Year time charter rate TCIYPANA Handysize Bulkcarrier 1 Year time charter rate TC1YHAND Capesize Bulkcarrier 1 Year time charter rate TC1YCAPE Panamax Containership 1 Year time charter rate TC1YCONPANA Super Panamax Containership 1 Year time charter rate TC1YCONSURPANA Handysize Containership 1 Year time charter rate TC1YCONHAND VLCC Tanker 3 Year time charter rate TC3YVLCC Suezmax Tanker 3 Year time charter rate TC3YSUEZ Aframax Tanker 3 Year time charter rate TC3YAFRA Products Tanker 3 Year time charter rate TC3YPROD Panamax Bulkcarrier 3 Year time charter rate TC3YPANA Handysize Bulkcarrier 3 Year time charter rate TC3YHAND Capesize Bulkcarrier 3 Year time charter rate TC3YCAPE Panamax Containership 3 Year time charter rate TC3YCONPANA Handysize Containership 3 Year time charter rate TC3YCONHAND References [1]R.N.Mantegna,H.E.Stanley.An Introduction to Econophysics Correlations and Complexity in Finance,Cambridge University Press,Cambridge,UK, 2010 21 X.Gabaix.P.Gopikrishnan.V.Plerou,H.E.Stanley.A theory of power-law distributions in financial market fluctuations,Nature 423(2003)267. 3]F.Lillo.J.D.Farmer.R.N.Mantegna.Econophysics:master curve for price-impact function,Nature 421(2003)129. 4 M.Billio,M.Getmansky.A.W.Lo,LPelizzon.Econometric measures of connectedness and systemic risk in the finance and insurance sectors,J.Financ. Econ.104(2012)535. [5]T.Preis.D.Y.Kenett,H.E.Stanley,D.Helbing.E.Ben-Jacob,Quantifying the behavior of stock correlations under market stress,Sci.Rep.2(2012)752. 6]D.Wang.B.Podobnik,D.Horvatic,H.E.Stanley,Quantifying and modeling long-range cross correlations in multiple time series with applications to world stock indices,Phys.Rev.E.83(2011)046121. (7]G.Bonanno,F.Lillo,R.N.Mantegna,High-frequency cross-correlation in a set of stocks,Quant.Finance 1(2001)96. 8 A.Utsugi,K.Ino,M.Oshikawa,Random matrix theory analysis of cross correlations in financial markets,Phys.Rev.E.70(2004)026110. Z.Zheng.K.Yamasaki.J.N.Tenenbaum.H.E.Stanley.Carbon-dioxide emissions trading and hierarchical structure in worldwide finance and commodities markets,Phys.Rev.E.87 (2013)012814. 10]J.P.Bouchaud,M.Potters,Theory of Financial Risk and Derivative Pricing:From Statistical Physics to Risk Management,Cambridge University Press, Cambridge.UK,2003 (11]M.J.Mauboussin,Revisiting market efficiency:the stock market as a complex adaptive system,J.Appl.Corp.Financ.14(2002)47. 121 A.Majdandzic.B.Podobnik,S.V.Buldyrev,D.Y.Kenett.S.Havlin,H.E.Stanley.Spontaneous recovery in dynamical networks,Nat.Phys.10(2014)34. 13]A.Branch,M.Stopford,Maritime Economics,third ed.,Routledge,NY.USA,2013. 14]S.Albertijn,W.Bessler.W.Drobetz.Financing shipping companies and shipping operations:a risk-management perspective.J.Appl.Corp.Financ.23 (2011)70. [15]W.Drobetz,T.Richter,M.Wambach,Dynamics of time-varying volatility in the dry bulk and tanker freight markets,AppL Financ.Econ.22(2012) 1367 16]M.G.Kavussanos,I.D.Visvikis,Market interactions in returns and volatilities between spot and forward shipping freight markets.J.Bank.Financ.28 (2004)2015. (17]R.Adland,K.Cullinane,The non-linear dynamics of spot freight rates in tanker markets,Transport.Res.E-log.42(2006)211. 8 J.Tvedt,A new perspective on price dynamics of the dry bulk market,Marit.Pol.Manag.30(2003)221. R.Adland,H.Jia,Charter market default risk:a conceptual approach.Transport.Res.E-log.44(2008)152 20]M.Krafft,International Shipping in Crisis:Background,Framework and Implications,GRNI Press,European Union,2010 21]C.T.Grammenos,A.G.Arkoulis,Macroeconomic factors and international shipping stock returns,Int.J.Marit.Econ.4(2002)81. 221 A.G.Samitas,D.F.Kenourgios,Impact of mergers and acquisitions on stock returns of tramp shipping firms international,J.Financ.Serv.Manag.2 (2007)327. 23 R.N.Mantegna,Hierarchical structure in financial markets,Eur.Phys.J.B.11(1999)193 24]M.Tumminello,F.Lillo.R.N.Mantegna,Kullback-Leibler distance as a measure of the information filtered from multivariate data,Phys.Rev.E.76 (2007)031123 25 M.Tumminello,F.Lillo.R.N.Mantegna,Correlation,hierarchies,and networks in financial markets,J.Econ.Behav.Organ.75(2010)40. 26]J.G.Brida,W.A.Risso.Hierarchical structure of the German stock market,Expert.Syst.Appl.37(2010)3846. 27]J.P.Onnela,A.Chakraborti,K.Kaski,J.Kertesz,A.Kanto,Dynamics of market correlations:taxonomy and portfolio analysis,Phys.Rev.E.68(2003) 056110. [2]D.Y.Kenett.M.Tumminello.A.Madi.G.Gur-Gershgoren,RN.Mantegna,E.Ben-Jacob,Dominating clasp of the financial sector revealed by partial correlation analysis of the stock market,PLoS ONE 5(2010)e15032. 1291 R.J.Hill,Comparing price levels across countries using minimum-spanning trees,Rev.Econ.Stat.81(1999)135. 30 T.Mizuno,H.Takayasu,M.Takayasu,Correlation networks among currencies,Physica A 364 (2005)336. 31 C.G.Gilmore,B.M.Lucey,M.W.Boscia,Comovements in government bond markets:a minimum spanning tree analysis.Physica A 389(2010)4875. 321 B.M.Tabak.T.R.Serra,D.O.Cajueiro.Topological properties of commodities networks,Eur.Phys.J.B.74(2010)243. J.P.Onnela,K.Kaski.J.Kertesz,Clustering and information in correlation based financial networks,Eur.Phys.J.B.38(2004)353 34]D.M.Song,M.Tumminello,W.X.Zhou,R.N.Mantegna,Evolution of worldwide stock markets,correlation structure,and correlation-based graphs. Phys.Rev.E.84(2011)026108. 35]V.V.Acharya,L.H.Pedersen,T.Philippon,M.P.Richardson,Measuring Systemic Risk,New York University Working Paper,2010. 36]M.Getmansky,A.W.Lo,I.Makarov,An econometric model of serial correlation and illiquidity in hedge fund returns,J.Financ.Econ.73(2004)529. 137 D.Y.Kenett,T.Preis,G.Gur-Gershgoren,E.Ben-Jacob.Quantifying meta-correlations in financial markets,Europhys.Lett.99(2012)38001.52 X. Zhang et al. / Physica A 415 (2014) 43–53 Table 3 Freight market time charter rate. Price indicator Code VLCC Tanker 1 Year time charter rate TC1YVLCC Suezmax Tanker 1 Year time charter rate TC1YSUEZ Aframax Tanker 1 Year time charter rate TC1YAFRA Panamax Tanker 1 Year time charter rate TC1YTANKPANA Products Tanker 1 Year time charter rate TC1YPROD Panamax Bulkcarrier 1 Year time charter rate TC1YPANA Handysize Bulkcarrier 1 Year time charter rate TC1YHAND Capesize Bulkcarrier 1 Year time charter rate TC1YCAPE Panamax Containership 1 Year time charter rate TC1YCONPANA Super Panamax Containership 1 Year time charter rate TC1YCONSURPANA Handysize Containership 1 Year time charter rate TC1YCONHAND VLCC Tanker 3 Year time charter rate TC3YVLCC Suezmax Tanker 3 Year time charter rate TC3YSUEZ Aframax Tanker 3 Year time charter rate TC3YAFRA Products Tanker 3 Year time charter rate TC3YPROD Panamax Bulkcarrier 3 Year time charter rate TC3YPANA Handysize Bulkcarrier 3 Year time charter rate TC3YHAND Capesize Bulkcarrier 3 Year time charter rate TC3YCAPE Panamax Containership 3 Year time charter rate TC3YCONPANA Handysize Containership 3 Year time charter rate TC3YCONHAND References [1] R.N. Mantegna, H.E. Stanley, An Introduction to Econophysics Correlations and Complexity in Finance, Cambridge University Press, Cambridge, UK, 2010. [2] X. Gabaix, P. Gopikrishnan, V. Plerou, H.E. Stanley, A theory of power-law distributions in financial market fluctuations, Nature 423 (2003) 267. [3] F. Lillo, J.D. Farmer, R.N. Mantegna, Econophysics: master curve for price-impact function, Nature 421 (2003) 129. [4] M. Billio, M. Getmansky, A.W. Lo, L. Pelizzon, Econometric measures of connectedness and systemic risk in the finance and insurance sectors, J. Financ. Econ. 104 (2012) 535. [5] T. Preis, D.Y. Kenett, H.E. Stanley, D. Helbing, E. Ben-Jacob, Quantifying the behavior of stock correlations under market stress, Sci. Rep. 2 (2012) 752. [6] D. Wang, B. Podobnik, D. Horvatic, H.E. Stanley, Quantifying and modeling long-range cross correlations in multiple time series with applications to world stock indices, Phys. Rev. E. 83 (2011) 046121. [7] G. Bonanno, F. Lillo, R.N. Mantegna, High-frequency cross-correlation in a set of stocks, Quant. Finance 1 (2001) 96. [8] A. Utsugi, K. Ino, M. Oshikawa, Random matrix theory analysis of cross correlations in financial markets, Phys. Rev. E. 70 (2004) 026110. [9] Z. Zheng, K. Yamasaki, J.N. Tenenbaum, H.E. Stanley, Carbon-dioxide emissions trading and hierarchical structure in worldwide finance and commodities markets, Phys. Rev. E. 87 (2013) 012814. [10] J.P. Bouchaud, M. Potters, Theory of Financial Risk and Derivative Pricing: From Statistical Physics to Risk Management, Cambridge University Press, Cambridge, UK, 2003. [11] M.J. Mauboussin, Revisiting market efficiency: the stock market as a complex adaptive system, J. Appl. Corp. Financ. 14 (2002) 47. [12] A. Majdandzic, B. Podobnik, S.V. Buldyrev, D.Y. Kenett, S. Havlin, H.E. Stanley, Spontaneous recovery in dynamical networks, Nat. Phys. 10 (2014) 34. [13] A. Branch, M. Stopford, Maritime Economics, third ed., Routledge, NY, USA, 2013. [14] S. Albertijn, W. Bessler, W. Drobetz, Financing shipping companies and shipping operations: a risk-management perspective, J. Appl. Corp. Financ. 23 (2011) 70. [15] W. Drobetz, T. Richter, M. Wambach, Dynamics of time-varying volatility in the dry bulk and tanker freight markets, Appl. Financ. Econ. 22 (2012) 1367. [16] M.G. Kavussanos, I.D. Visvikis, Market interactions in returns and volatilities between spot and forward shipping freight markets, J. Bank. Financ. 28 (2004) 2015. [17] R. Adland, K. Cullinane, The non-linear dynamics of spot freight rates in tanker markets, Transport. Res. E-log. 42 (2006) 211. [18] J. Tvedt, A new perspective on price dynamics of the dry bulk market, Marit. Pol. Manag. 30 (2003) 221. [19] R. Adland, H. Jia, Charter market default risk: a conceptual approach, Transport. Res. E-log. 44 (2008) 152. [20] M. Krafft, International Shipping in Crisis: Background, Framework and Implications, GRNI Press, European Union, 2010. [21] C.T. Grammenos, A.G. Arkoulis, Macroeconomic factors and international shipping stock returns, Int. J. Marit. Econ. 4 (2002) 81. [22] A.G. Samitas, D.F. Kenourgios, Impact of mergers and acquisitions on stock returns of tramp shipping firms international, J. Financ. Serv. Manag. 2 (2007) 327. [23] R.N. Mantegna, Hierarchical structure in financial markets, Eur. Phys. J. B. 11 (1999) 193. [24] M. Tumminello, F. Lillo, R.N. Mantegna, Kullback–Leibler distance as a measure of the information filtered from multivariate data, Phys. Rev. E. 76 (2007) 031123. [25] M. Tumminello, F. Lillo, R.N. Mantegna, Correlation, hierarchies, and networks in financial markets, J. Econ. Behav. Organ. 75 (2010) 40. [26] J.G. Brida, W.A. Risso, Hierarchical structure of the German stock market, Expert. Syst. Appl. 37 (2010) 3846. [27] J.P. Onnela, A. Chakraborti, K. Kaski, J. Kertesz, A. Kanto, Dynamics of market correlations: taxonomy and portfolio analysis, Phys. Rev. E. 68 (2003) 056110. [28] D.Y. Kenett, M. Tumminello, A. Madi, G. Gur-Gershgoren, R.N. Mantegna, E. Ben-Jacob, Dominating clasp of the financial sector revealed by partial correlation analysis of the stock market, PLoS ONE 5 (2010) e15032. [29] R.J. Hill, Comparing price levels across countries using minimum-spanning trees, Rev. Econ. Stat. 81 (1999) 135. [30] T. Mizuno, H. Takayasu, M. Takayasu, Correlation networks among currencies, Physica A 364 (2005) 336. [31] C.G. Gilmore, B.M. Lucey, M.W. Boscia, Comovements in government bond markets: a minimum spanning tree analysis, Physica A 389 (2010) 4875. [32] B.M. Tabak, T.R. Serra, D.O. Cajueiro, Topological properties of commodities networks, Eur. Phys. J. B. 74 (2010) 243. [33] J.P. Onnela, K. Kaski, J. Kertesz, Clustering and information in correlation based financial networks, Eur. Phys. J. B. 38 (2004) 353. [34] D.M. Song, M. Tumminello, W.X. Zhou, R.N. Mantegna, Evolution of worldwide stock markets, correlation structure, and correlation-based graphs, Phys. Rev. E. 84 (2011) 026108. [35] V.V. Acharya, L.H. Pedersen, T. Philippon, M.P. Richardson, Measuring Systemic Risk, New York University Working Paper, 2010. [36] M. Getmansky, A.W. Lo, I. Makarov, An econometric model of serial correlation and illiquidity in hedge fund returns, J. Financ. Econ. 73 (2004) 529. [37] D.Y. Kenett, T. Preis, G. Gur-Gershgoren, E. Ben-Jacob, Quantifying meta-correlations in financial markets, Europhys. Lett. 99 (2012) 38001