正在加载图片...

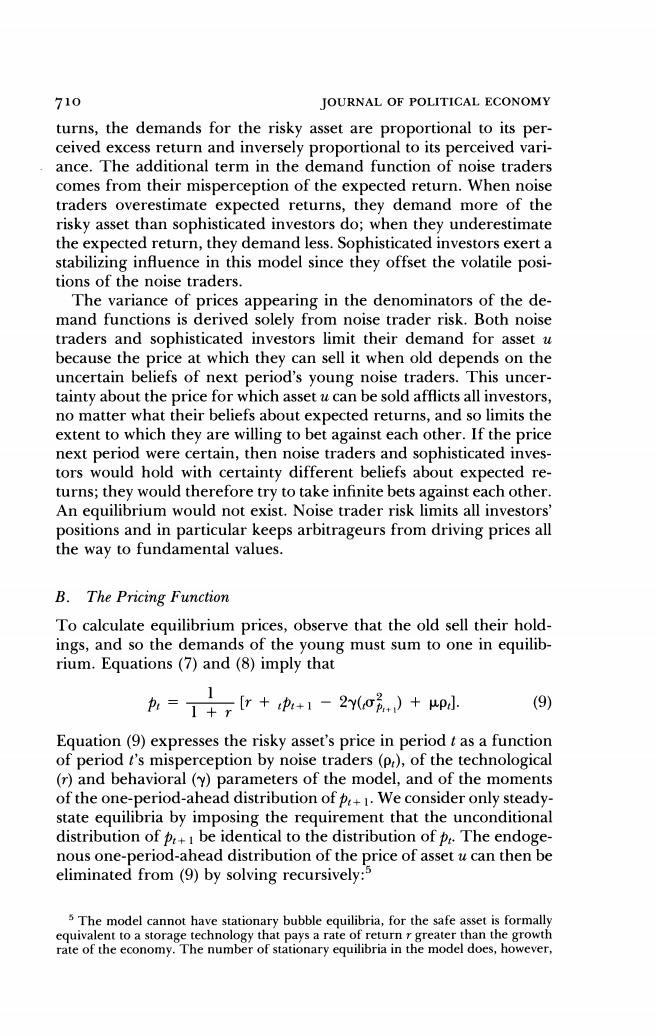

710 JOURNAL OF POLITICAL ECONOMY turns,the demands for the risky asset are proportional to its per- ceived excess return and inversely proportional to its perceived vari- ance.The additional term in the demand function of noise traders comes from their misperception of the expected return.When noise traders overestimate expected returns,they demand more of the risky asset than sophisticated investors do;when they underestimate the expected return,they demand less.Sophisticated investors exert a stabilizing influence in this model since they offset the volatile posi- tions of the noise traders. The variance of prices appearing in the denominators of the de- mand functions is derived solely from noise trader risk.Both noise traders and sophisticated investors limit their demand for asset u because the price at which they can sell it when old depends on the uncertain beliefs of next period's young noise traders.This uncer- tainty about the price for which asset u can be sold afflicts all investors, no matter what their beliefs about expected returns,and so limits the extent to which they are willing to bet against each other.If the price next period were certain,then noise traders and sophisticated inves- tors would hold with certainty different beliefs about expected re- turns;they would therefore try to take infinite bets against each other. An equilibrium would not exist.Noise trader risk limits all investors' positions and in particular keeps arbitrageurs from driving prices all the way to fundamental values. B.The Pricing Function To calculate equilibrium prices,observe that the old sell their hold- ings,and so the demands of the young must sum to one in equilib- rium.Equations(7)and(8)imply that A=+,+A1-2)+pl (9) Equation(9)expresses the risky asset's price in period t as a function of period t's misperception by noise traders(P),of the technological (r)and behavioral(Y)parameters of the model,and of the moments of the one-period-ahead distribution ofp+1.We consider only steady- state equilibria by imposing the requirement that the unconditional distribution of+be identical to the distribution ofp The endoge- nous one-period-ahead distribution of the price of asset u can then be eliminated from(9)by solving recursively: s The model cannot have stationary bubble equilibria,for the safe asset is formally equivalent to a storage technology that pays a rate of return r greater than the growth rate of the economy.The number of stationary equilibria in the model does,however