正在加载图片...

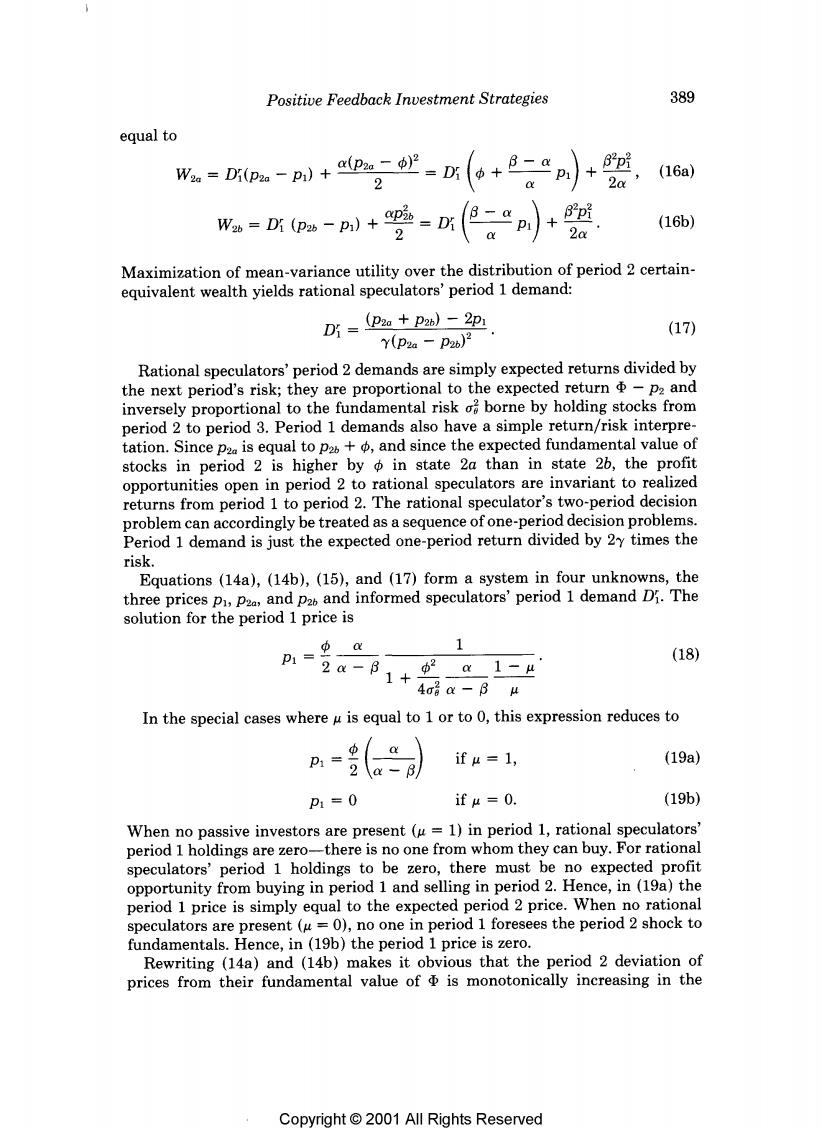

Positive Feedback Investment Strategies 389 equal to W。=Di(pa-p)+aPa- 2 -=Di(o+8-a Bpi D1 (16a) 2a Wa Di (pa -p:)+p=Di p 2 (16b) 2a Maximization of mean-variance utility over the distribution of period 2 certain- equivalent wealth yields rational speculators'period 1 demand: D5=P2a+p2)-2p (17) Y(p2a-p26)2 Rational speculators'period 2 demands are simply expected returns divided by the next period's risk;they are proportional to the expected return-pa and inversely proportional to the fundamental risk borne by holding stocks from period 2 to period 3.Period 1 demands also have a simple return/risk interpre- tation.Since pza is equal to pa+,and since the expected fundamental value of stocks in period 2 is higher byo in state 2a than in state 26,the profit opportunities open in period 2 to rational speculators are invariant to realized returns from period 1 to period 2.The rational speculator's two-period decision problem can accordingly be treated as a sequence of one-period decision problems. Period 1 demand is just the expected one-period return divided by 2y times the risk. Equations (14a),(14b),(15),and (17)form a system in four unknowns,the three prices p1,p2a,and pab and informed speculators'period 1 demand Di.The solution for the period 1 price is (18) 2-B, ax1-4 4员X-B4 In the special cases where u is equal to 1 or to 0,this expression reduces to 功 a if4=1, (19a) 2ax-8 P1=0 if4=0. (19b) When no passive investors are present (u=1)in period 1,rational speculators' period 1 holdings are zero-there is no one from whom they can buy.For rational speculators'period 1 holdings to be zero,there must be no expected profit opportunity from buying in period 1 and selling in period 2.Hence,in (19a)the period 1 price is simply equal to the expected period 2 price.When no rational speculators are present (u=0),no one in period 1 foresees the period 2 shock to fundamentals.Hence,in (19b)the period 1 price is zero. Rewriting (14a)and (14b)makes it obvious that the period 2 deviation of prices from their fundamental value of is monotonically increasing in the Copyright 2001 All Riahts Reserved