正在加载图片...

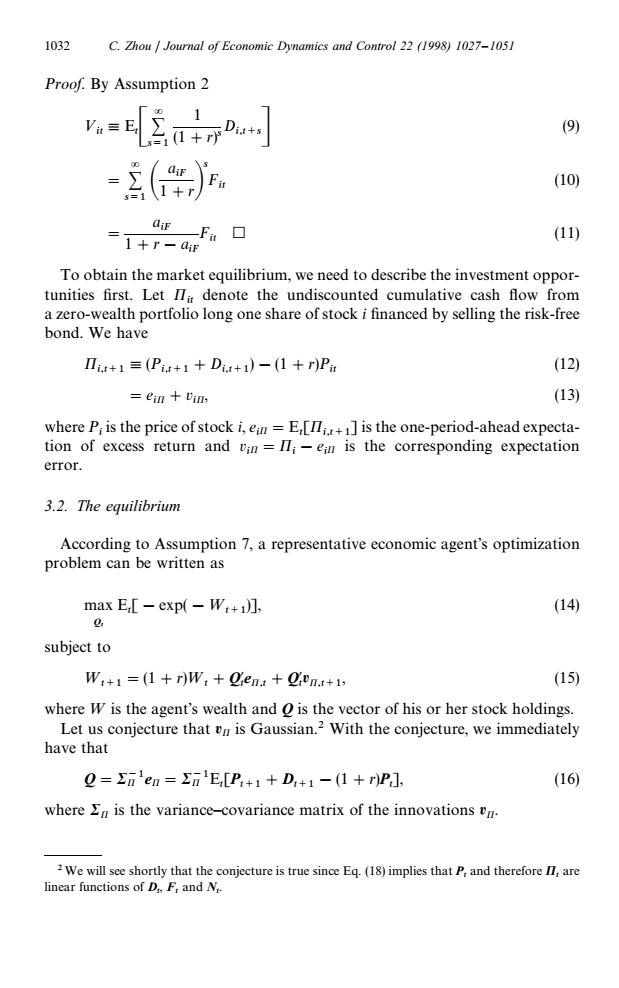

1032 C.Zhou Journal of Economic Dynamics and Control 22 (1998)1027-1051 Proof.By Assumption 2 Y.ELEtDo (9) (10) aF-Fa□ =T+r-diF (11) To obtain the market equilibrium,we need to describe the investment oppor- tunities first.Let I7i denote the undiscounted cumulative cash flow from a zero-wealth portfolio long one share of stock i financed by selling the risk-free bond.We have Ii+1(Pis+1+Dit+1)-(1 +r)Pir (12) ein vin, (13) where Pi is the price of stock i,ein =E,[i+1]is the one-period-ahead expecta- tion of excess return and vin=Ii-ein is the corresponding expectation error. 3.2.The equilibrium According to Assumption 7,a representative economic agent's optimization problem can be written as maxE[-exp(-Wt+i门, (14) subject to W:+1 =(1 r)W:Qen.Qien.+1, (15) where W is the agent's wealth and o is the vector of his or her stock holdings. Let us conjecture that Un is Gaussian.2 With the conjecture,we immediately have that Q=En'en EnE[P+1+D+1-(1+r)P ] (16) where En is the variance-covariance matrix of the innovations Un. 2We will see shortly that the conjecture is true since Eq.(18)implies that P,and therefore I,are linear functions of D.F:and N.2We will see shortly that the conjecture is true since Eq. (18) implies that Pt and therefore Pt are linear functions of Dt , Ft and Nt . Proof. By Assumption 2 »it,EtC = + s/1 1 (1#r)s Di,t`sD (9) " = + s/1 A a iF 1#rB s Fit (10) " a iF 1#r!a iF Fit h (11) To obtain the market equilibrium, we need to describe the investment opportunities first. Let Pit denote the undiscounted cumulative cash flow from a zero-wealth portfolio long one share of stock i financed by selling the risk-free bond. We have Pi,t`1 ,(Pi,t`1 #Di,t`1 )!(1#r)Pit (12) "e i P#v i P, (13) where Pi is the price of stock i, e i P"Et [Pi,t`1 ] is the one-period-ahead expectation of excess return and v i P"Pi !e i P is the corresponding expectation error. 3.2. The equilibrium According to Assumption 7, a representative economic agent’s optimization problem can be written as max Qt Et [!exp(!¼t`1 )], (14) subject to ¼t`1 "(1#r)¼t #Q@ t eP,t #Q@ t P,t`1 , (15) where ¼ is the agent’s wealth and Q is the vector of his or her stock holdings. Let us conjecture that P is Gaussian.2 With the conjecture, we immediately have that Q"R~1 P eP"RP~1Et [Pt`1 #Dt`1 !(1#r)Pt ], (16) where RP is the variance—covariance matrix of the innovations P. 1032 C. Zhou / Journal of Economic Dynamics and Control 22 (1998) 1027–1051