正在加载图片...

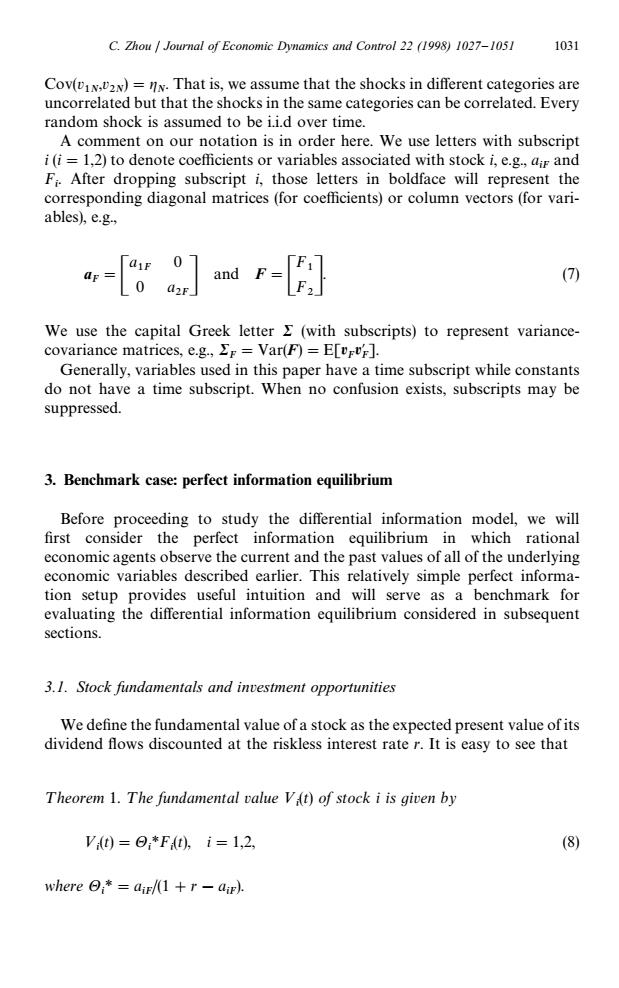

C.Zhou Journal of Economic Dynamics and Control 22 (1998)1027-1051 1031 Cov(vIN,)=nN.That is,we assume that the shocks in different categories are uncorrelated but that the shocks in the same categories can be correlated.Every random shock is assumed to be i.i.d over time. A comment on our notation is in order here.We use letters with subscript i(i=1,2)to denote coefficients or variables associated with stock i,e.g,air and Fi.After dropping subscript i,those letters in boldface will represent the corresponding diagonal matrices (for coefficients)or column vectors (for vari- ables),e.g, and F (7) 0 d2F F2 We use the capital Greek letter >(with subscripts)to represent variance- covariance matrices,e.g.,r Var(F)=E[rF]. Generally,variables used in this paper have a time subscript while constants do not have a time subscript.When no confusion exists,subscripts may be suppressed. 3.Benchmark case:perfect information equilibrium Before proceeding to study the differential information model,we will first consider the perfect information equilibrium in which rational economic agents observe the current and the past values of all of the underlying economic variables described earlier.This relatively simple perfect informa- tion setup provides useful intuition and will serve as a benchmark for evaluating the differential information equilibrium considered in subsequent sections. 3.1.Stock fundamentals and investment opportunities We define the fundamental value of a stock as the expected present value ofits dividend flows discounted at the riskless interest rate r.It is easy to see that Theorem 1.The fundamental value Vit)of stock i is given by Vt)=⊙:*Ft),i=1,2 (8) where⊙:*=ar/1+r-ae.Cov(v 1N ,v 2N )"g N . That is, we assume that the shocks in different categories are uncorrelated but that the shocks in the same categories can be correlated. Every random shock is assumed to be i.i.d over time. A comment on our notation is in order here. We use letters with subscript i (i"1,2) to denote coefficients or variables associated with stock i, e.g., a iF and Fi . After dropping subscript i, those letters in boldface will represent the corresponding diagonal matrices (for coefficients) or column vectors (for variables), e.g., a F "C a 1F 0 0 a 2F D and F"C F1 F2 D . (7) We use the capital Greek letter R (with subscripts) to represent variancecovariance matrices, e.g., RF "Var(F)"E[ F @ F ]. Generally, variables used in this paper have a time subscript while constants do not have a time subscript. When no confusion exists, subscripts may be suppressed. 3. Benchmark case: perfect information equilibrium Before proceeding to study the differential information model, we will first consider the perfect information equilibrium in which rational economic agents observe the current and the past values of all of the underlying economic variables described earlier. This relatively simple perfect information setup provides useful intuition and will serve as a benchmark for evaluating the differential information equilibrium considered in subsequent sections. 3.1. Stock fundamentals and investment opportunities We define the fundamental value of a stock as the expected present value of its dividend flows discounted at the riskless interest rate r. It is easy to see that ¹heorem 1. ¹he fundamental value »i (t) of stock i is given by »i (t)"Hi *Fi (t), i"1,2, (8) where Hi *"a iF/(1#r!a iF). C. Zhou / Journal of Economic Dynamics and Control 22 (1998) 1027—1051 1031