正在加载图片...

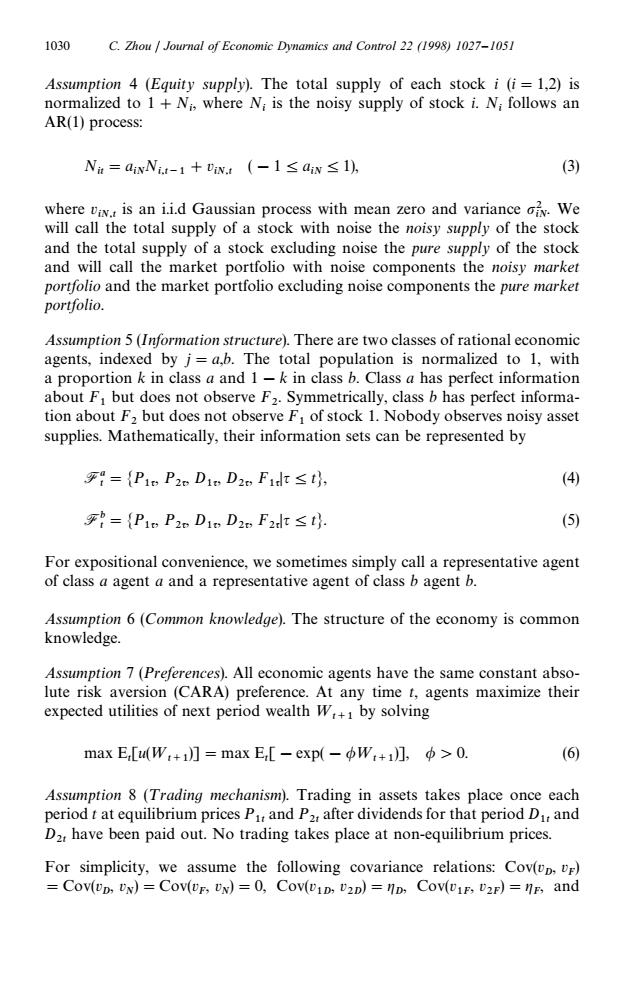

1030 C.Zhou Journal of Economic Dynamics and Control 22 (1998)1027-1051 Assumption 4 (Equity supply).The total supply of each stock i (i=1,2)is normalized to 1+Ni,where Ni is the noisy supply of stock i.Ni follows an AR(1)process: Na=awNa-1+tw.t(-1≤aw≤1, (3) where viN.is an ii.d Gaussian process with mean zero and variance i.We will call the total supply of a stock with noise the noisy supply of the stock and the total supply of a stock excluding noise the pure supply of the stock and will call the market portfolio with noise components the noisy market portfolio and the market portfolio excluding noise components the pure market portfolio. Assumption 5(Information structure).There are two classes of rational economic agents,indexed by j=a,b.The total population is normalized to 1,with a proportion k in class a and 1-k in class b.Class a has perfect information about F but does not observe F2.Symmetrically,class b has perfect informa- tion about F2 but does not observe F of stock 1.Nobody observes noisy asset supplies.Mathematically,their information sets can be represented by 乎日={P1P2oD1,D2e,F1t≤t, (4) 乎={P1eP2oD1D2F2lt≤t (5) For expositional convenience,we sometimes simply call a representative agent of class a agent a and a representative agent of class b agent b. Assumption 6 (Common knowledge).The structure of the economy is common knowledge. Assumption 7 (Preferences).All economic agents have the same constant abso- lute risk aversion (CARA)preference.At any time t,agents maximize their expected utilities of next period wealth W,+by solving maxE,[u(W+i门=maxE,[-exp(-φWr+i】中>0. (6) Assumption 8(Trading mechanism).Trading in assets takes place once each period t at equilibrium prices P and P2 after dividends for that period D and D2,have been paid out.No trading takes place at non-equilibrium prices. For simplicity,we assume the following covariance relations:Cov(Up,vr) Cov(UD,UN)=Cov(UF,UN)=0,Cov(v1D,D2D)=ID,Cov(U1F,U2F)=F,andAssumption 4 (Equity supply). The total supply of each stock i (i"1,2) is normalized to 1#Ni , where Ni is the noisy supply of stock i. Ni follows an AR(1) process: Nit"a iNNi,t~1#v iN,t (!14a iN41), (3) where v iN,t is an i.i.d Gaussian process with mean zero and variance p2 iN. We will call the total supply of a stock with noise the noisy supply of the stock and the total supply of a stock excluding noise the pure supply of the stock and will call the market portfolio with noise components the noisy market portfolio and the market portfolio excluding noise components the pure market portfolio. Assumption 5 (Information structure). There are two classes of rational economic agents, indexed by j"a,b. The total population is normalized to 1, with a proportion k in class a and 1!k in class b. Class a has perfect information about F1 but does not observe F2 . Symmetrically, class b has perfect information about F2 but does not observe F1 of stock 1. Nobody observes noisy asset supplies. Mathematically, their information sets can be represented by Fa t "MP1q , P2q , D1q , D2q , F1q Dq4tN, (4) Fb t "MP1q , P2q , D1q , D2q , F2q Dq4tN. (5) For expositional convenience, we sometimes simply call a representative agent of class a agent a and a representative agent of class b agent b. Assumption 6 (Common knowledge). The structure of the economy is common knowledge. Assumption 7 (Preferences). All economic agents have the same constant absolute risk aversion (CARA) preference. At any time t, agents maximize their expected utilities of next period wealth ¼t`1 by solving max Et [u(¼t`1 )]"max Et [!exp(!/¼t`1 )], /'0. (6) Assumption 8 (¹rading mechanism). Trading in assets takes place once each period t at equilibrium prices P1t and P2t after dividends for that period D1t and D2t have been paid out. No trading takes place at non-equilibrium prices. For simplicity, we assume the following covariance relations: Cov(v D , v F ) "Cov(v D , v N )"Cov(v F , v N )"0, Cov(v 1D , v 2D )"g D , Cov(v 1F , v 2F )"g F , and 1030 C. Zhou / Journal of Economic Dynamics and Control 22 (1998) 1027–1051