正在加载图片...

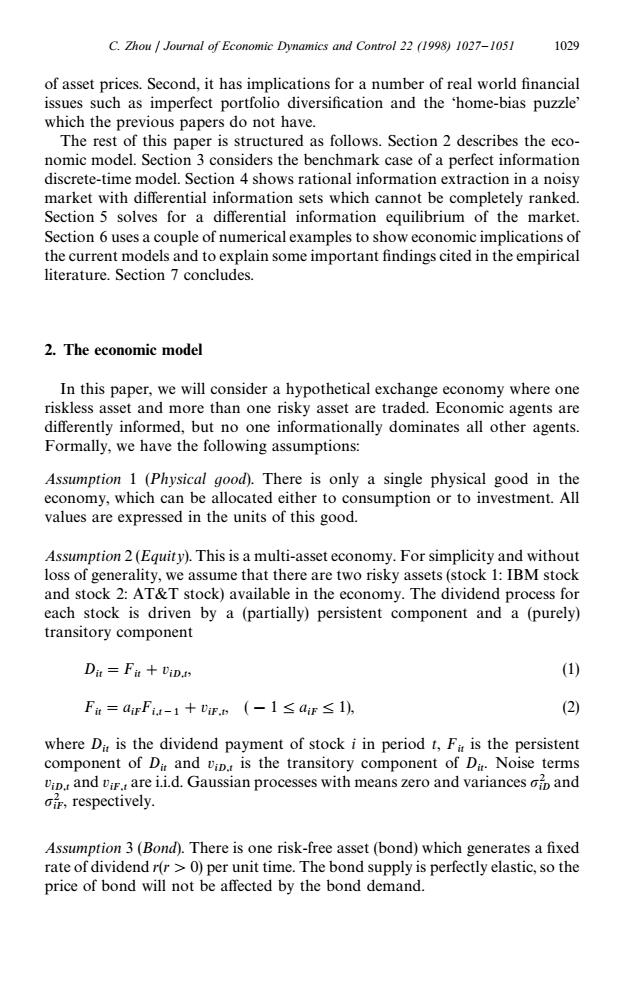

C.Zhou Journal of Economic Dynamics and Control 22 (1998)1027-1051 1029 of asset prices.Second,it has implications for a number of real world financial issues such as imperfect portfolio diversification and the home-bias puzzle' which the previous papers do not have. The rest of this paper is structured as follows.Section 2 describes the eco- nomic model.Section 3 considers the benchmark case of a perfect information discrete-time model.Section 4 shows rational information extraction in a noisy market with differential information sets which cannot be completely ranked. Section 5 solves for a differential information equilibrium of the market. Section 6 uses a couple of numerical examples to show economic implications of the current models and to explain some important findings cited in the empirical literature.Section 7 concludes. 2.The economic model In this paper,we will consider a hypothetical exchange economy where one riskless asset and more than one risky asset are traded.Economic agents are differently informed,but no one informationally dominates all other agents. Formally,we have the following assumptions: Assumption 1 (Physical good).There is only a single physical good in the economy,which can be allocated either to consumption or to investment.All values are expressed in the units of this good. Assumption 2(Equity).This is a multi-asset economy.For simplicity and without loss of generality,we assume that there are two risky assets(stock 1:IBM stock and stock 2:AT&T stock)available in the economy.The dividend process for each stock is driven by a(partially)persistent component and a(purely) transitory component Dit Fit+ViD. Ft=aiFFia-1+tF,n(-1≤aF≤1 (2) where Di is the dividend payment of stock i in period t,Fir is the persistent component of Dir and viD.is the transitory component of Dit.Noise terms iand vi.are i.i.d.Gaussian processes with means zero and variances and ir,respectively. Assumption 3(Bond).There is one risk-free asset(bond)which generates a fixed rate of dividend r(r>0)per unit time.The bond supply is perfectly elastic,so the price of bond will not be affected by the bond demand.of asset prices. Second, it has implications for a number of real world financial issues such as imperfect portfolio diversification and the ‘home-bias puzzle’ which the previous papers do not have. The rest of this paper is structured as follows. Section 2 describes the economic model. Section 3 considers the benchmark case of a perfect information discrete-time model. Section 4 shows rational information extraction in a noisy market with differential information sets which cannot be completely ranked. Section 5 solves for a differential information equilibrium of the market. Section 6 uses a couple of numerical examples to show economic implications of the current models and to explain some important findings cited in the empirical literature. Section 7 concludes. 2. The economic model In this paper, we will consider a hypothetical exchange economy where one riskless asset and more than one risky asset are traded. Economic agents are differently informed, but no one informationally dominates all other agents. Formally, we have the following assumptions: Assumption 1 (Physical good). There is only a single physical good in the economy, which can be allocated either to consumption or to investment. All values are expressed in the units of this good. Assumption 2 (Equity). This is a multi-asset economy. For simplicity and without loss of generality, we assume that there are two risky assets (stock 1: IBM stock and stock 2: AT&T stock) available in the economy. The dividend process for each stock is driven by a (partially) persistent component and a (purely) transitory component Dit"Fit#v iD,t , (1) Fit"a iFFi,t~1#v iF,t , (!14a iF41), (2) where Dit is the dividend payment of stock i in period t, Fit is the persistent component of Dit and v iD,t is the transitory component of Dit. Noise terms v iD,t and v iF,t are i.i.d. Gaussian processes with means zero and variances p2 iD and p2 iF, respectively. Assumption 3 (Bond). There is one risk-free asset (bond) which generates a fixed rate of dividend r(r'0) per unit time. The bond supply is perfectly elastic, so the price of bond will not be affected by the bond demand. C. Zhou / Journal of Economic Dynamics and Control 22 (1998) 1027—1051 1029