正在加载图片...

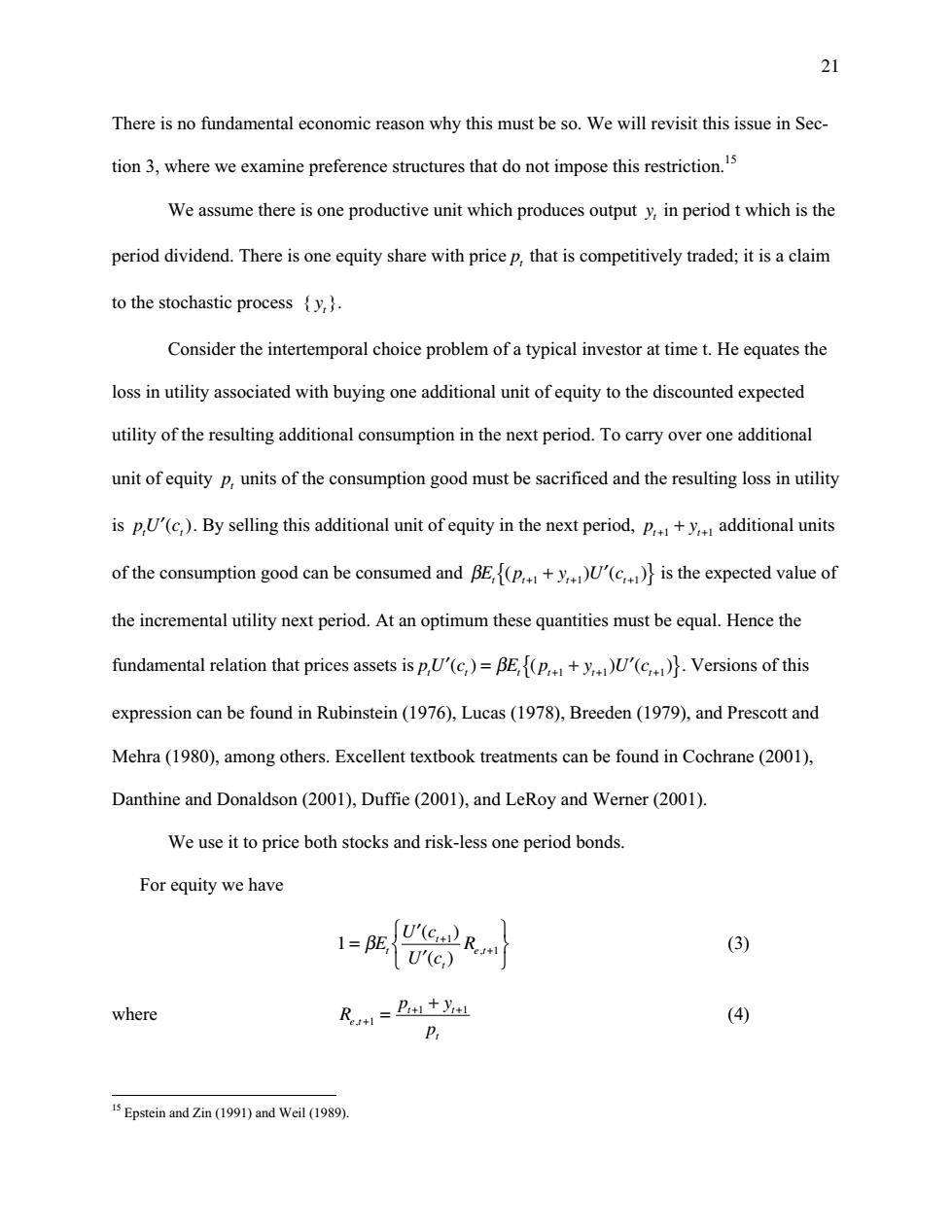

21 There is no fundamental economic reason why this must be so.We will revisit this issue in Sec- tion 3,where we examine preference structures that do not impose this restriction.5 We assume there is one productive unit which produces output y,in period t which is the period dividend.There is one equity share with price p,that is competitively traded;it is a claim to the stochastic process y,. Consider the intertemporal choice problem of a typical investor at time t.He equates the loss in utility associated with buying one additional unit of equity to the discounted expected utility of the resulting additional consumption in the next period.To carry over one additional unit of equity p,units of the consumption good must be sacrificed and the resulting loss in utility is p,U'(c,).By selling this additional unit of equity in the next period,p+y additional units of the consumption good can be consumed and BE,(p+yU(c)is the expected value of the incremental utility next period.At an optimum these quantities must be equal.Hence the fundamental relation that prices assets is p,U'(c,)=BE(p+yU'(c).Versions of this expression can be found in Rubinstein(1976),Lucas(1978),Breeden (1979),and Prescott and Mehra(1980),among others.Excellent textbook treatments can be found in Cochrane(2001), Danthine and Donaldson(2001),Duffie(2001),and LeRoy and Werner(2001). We use it to price both stocks and risk-less one period bonds. For equity we have 1=E, UCR U'(c,) (3) where R=Posl+yil (4) 15 Epstein and Zin(1991)and Weil (1989).21 There is no fundamental economic reason why this must be so. We will revisit this issue in Section 3, where we examine preference structures that do not impose this restriction.15 We assume there is one productive unit which produces output yt in period t which is the period dividend. There is one equity share with price pt that is competitively traded; it is a claim to the stochastic process { yt }. Consider the intertemporal choice problem of a typical investor at time t. He equates the loss in utility associated with buying one additional unit of equity to the discounted expected utility of the resulting additional consumption in the next period. To carry over one additional unit of equity pt units of the consumption good must be sacrificed and the resulting loss in utility is pU c t t ¢( ). By selling this additional unit of equity in the next period, p y t t + + 1 1 + additional units of the consumption good can be consumed and bE p y Uc tt t t ( )( ) { } ++ + + ¢ 11 1 is the expected value of the incremental utility next period. At an optimum these quantities must be equal. Hence the fundamental relation that prices assets is pU c E p y U c t t tt t t ¢ = + { } ¢ ++ + () ( ) ( ) b 11 1 . Versions of this expression can be found in Rubinstein (1976), Lucas (1978), Breeden (1979), and Prescott and Mehra (1980), among others. Excellent textbook treatments can be found in Cochrane (2001), Danthine and Donaldson (2001), Duffie (2001), and LeRoy and Werner (2001). We use it to price both stocks and risk-less one period bonds. For equity we have 1 1 = 1 ¢ ¢ Ï Ì Ó ¸ ˝ ˛ + bE + U c U c t R t t e t ( ) ( ) , (3) where R p y p e t t t t , + + + = + 1 1 1 (4) 15 Epstein and Zin (1991) and Weil (1989)