正在加载图片...

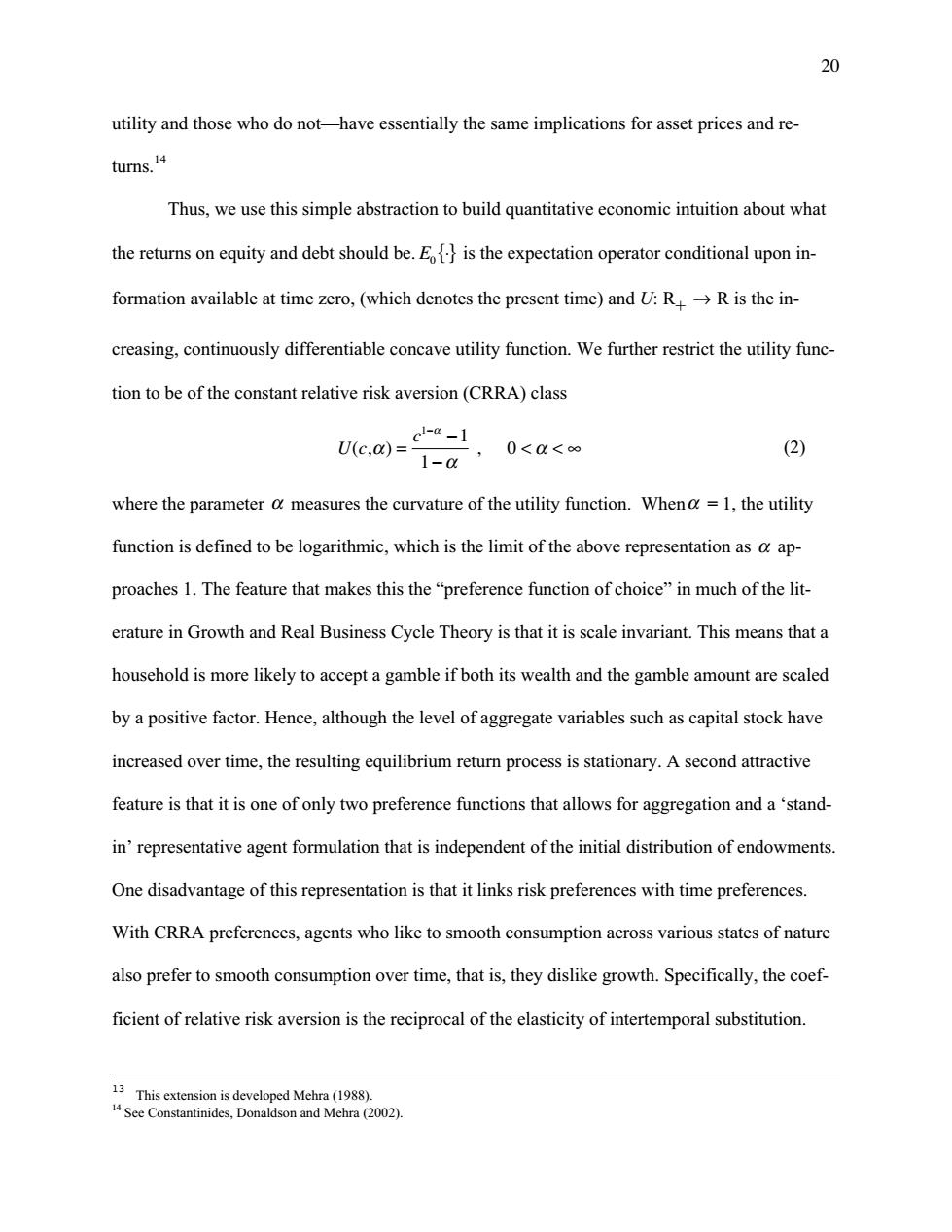

20 utility and those who do not-have essentially the same implications for asset prices and re- turns.14 Thus,we use this simple abstraction to build quantitative economic intuition about what the returns on equity and debt should be.E is the expectation operator conditional upon in- formation available at time zero,(which denotes the present time)and U:R->R is the in- creasing,continuously differentiable concave utility function.We further restrict the utility func- tion to be of the constant relative risk aversion(CRRA)class cl-a-1 U(c,0)= 0<a<o∞ (2) 1-a where the parameter o measures the curvature of the utility function.Wheno=1,the utility function is defined to be logarithmic,which is the limit of the above representation as a ap- proaches 1.The feature that makes this the "preference function of choice"in much of the lit- erature in Growth and Real Business Cycle Theory is that it is scale invariant.This means that a household is more likely to accept a gamble if both its wealth and the gamble amount are scaled by a positive factor.Hence,although the level of aggregate variables such as capital stock have increased over time,the resulting equilibrium return process is stationary.A second attractive feature is that it is one of only two preference functions that allows for aggregation and a'stand- in'representative agent formulation that is independent of the initial distribution of endowments. One disadvantage of this representation is that it links risk preferences with time preferences. With CRRA preferences,agents who like to smooth consumption across various states of nature also prefer to smooth consumption over time,that is,they dislike growth.Specifically,the coef- ficient of relative risk aversion is the reciprocal of the elasticity of intertemporal substitution. 13 This extension is developed Mehra(1988). 4See Constantinides,Donaldson and Mehra(2002).20 utility and those who do not—have essentially the same implications for asset prices and returns.14 Thus, we use this simple abstraction to build quantitative economic intuition about what the returns on equity and debt should be. E0 { }◊ is the expectation operator conditional upon information available at time zero, (which denotes the present time) and U: R+ Æ R is the increasing, continuously differentiable concave utility function. We further restrict the utility function to be of the constant relative risk aversion (CRRA) class U c c (, ) a a a a = - - < <• 1- 1 1 , 0 (2) where the parameter a measures the curvature of the utility function. Whena = 1, the utility function is defined to be logarithmic, which is the limit of the above representation as a approaches 1. The feature that makes this the “preference function of choice” in much of the literature in Growth and Real Business Cycle Theory is that it is scale invariant. This means that a household is more likely to accept a gamble if both its wealth and the gamble amount are scaled by a positive factor. Hence, although the level of aggregate variables such as capital stock have increased over time, the resulting equilibrium return process is stationary. A second attractive feature is that it is one of only two preference functions that allows for aggregation and a ‘standin’ representative agent formulation that is independent of the initial distribution of endowments. One disadvantage of this representation is that it links risk preferences with time preferences. With CRRA preferences, agents who like to smooth consumption across various states of nature also prefer to smooth consumption over time, that is, they dislike growth. Specifically, the coefficient of relative risk aversion is the reciprocal of the elasticity of intertemporal substitution. 13 This extension is developed Mehra (1988). 14 See Constantinides, Donaldson and Mehra (2002)