正在加载图片...

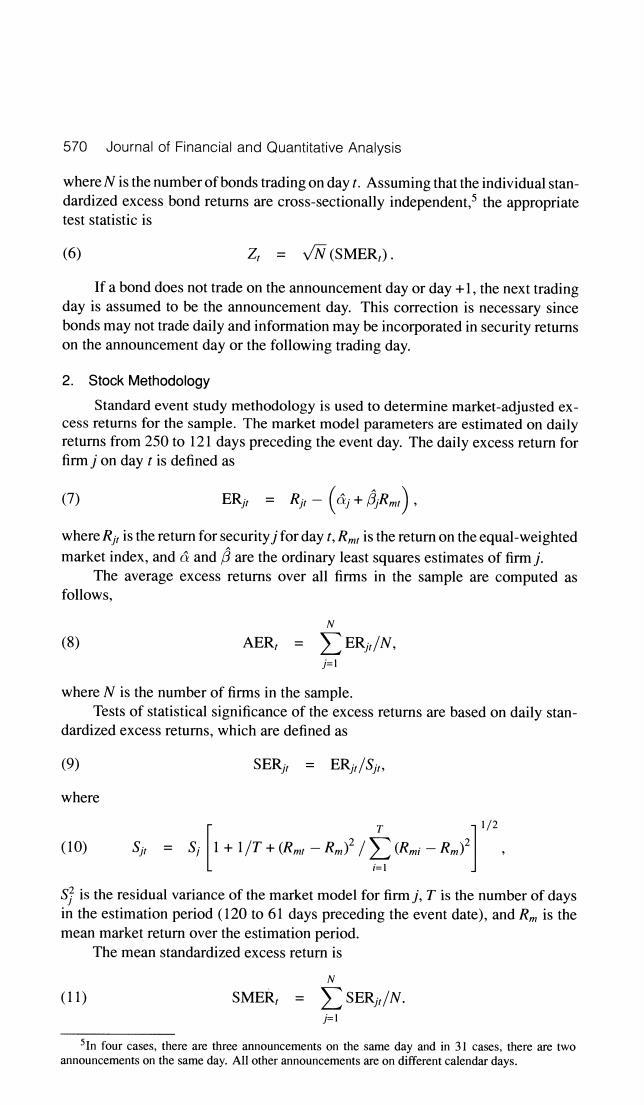

570 Journal of Financial and Quantitative Analysis where N is the number of bonds trading on day t.Assuming that the individual stan- dardized excess bond returns are cross-sectionally independent,the appropriate test statistic is (6) Z,=VN(SMER,). If a bond does not trade on the announcement day or day +1,the next trading day is assumed to be the announcement day.This correction is necessary since bonds may not trade daily and information may be incorporated in security returns on the announcement day or the following trading day. 2.Stock Methodology Standard event study methodology is used to determine market-adjusted ex- cess returns for the sample.The market model parameters are estimated on daily returns from 250 to 121 days preceding the event day.The daily excess return for firm j on day t is defined as (7) ERn=Rn-(a+月,Rm) where Ri is the return for security jfor day t,Rmr is the return on the equal-weighted market index,andand are the ordinary least squares estimates of firm j. The average excess returns over all firms in the sample are computed as follows, N (8) AER, ERit/N, where N is the number of firms in the sample. Tests of statistical significance of the excess returns are based on daily stan- dardized excess returns,which are defined as (9) SERi=ERjit/Sit where T 1/2 (10) Si Si 1+1/T+(Rm-Rm)/>(Rm-Rm)2 iel S?is the residual variance of the market model for firm j.T is the number of days in the estimation period (120 to 61 days preceding the event date),and R is the mean market return over the estimation period. The mean standardized excess return is N (11) SMER,= SERit/N. 5In four cases,there are three announcements on the same day and in 31 cases.there are two announcements on the same day.All other announcements are on different calendar days