正在加载图片...

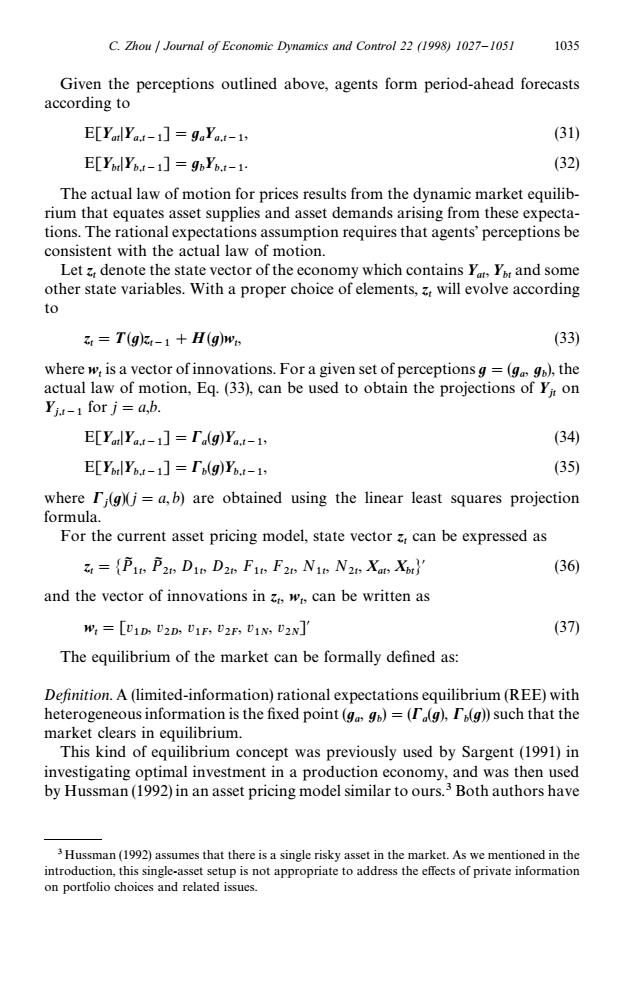

C.Zhou Journal of Economic Dynamics and Control 22 (1998)1027-1051 1035 Given the perceptions outlined above,agents form period-ahead forecasts according to E[Yatl Ya.t-1]=gaYa.t-1, (310 E[Yhal Yb.-1]=goYb.t-1. (32) The actual law of motion for prices results from the dynamic market equilib- rium that equates asset supplies and asset demands arising from these expecta- tions.The rational expectations assumption requires that agents'perceptions be consistent with the actual law of motion. Let denote the state vector of the economy which contains Yt,Yor and some other state variables.With a proper choice of elements,will evolve according to =T(g-1+H(g)we (33) where w,is a vector of innovations.For a given set of perceptionsg=(ga g),the actual law of motion,Eq.(33),can be used to obtain the projections of Yir on Yja-1 for j=a,b. E[Yal Ya.t-1]=Ia(g)Ya.t-1, (34) E[YbrlYb.t-1]=Th(g)Yb.t-1, (35) where rj(g)(j=a,b)are obtained using the linear least squares projection formula. For the current asset pricing model,state vector z can be expressed as =(Pie P20 Die D2e Fi F2e Nie N2 Xat Xit' (36) and the vector of innovations in w,can be written as W:=[U1D U2D,UiF,U2F,UIN,U2N]' (37) The equilibrium of the market can be formally defined as: Definition.A(limited-information)rational expectations equilibrium(REE)with heterogeneous information is the fixed point (gg)=(r(g),T(g))such that the market clears in equilibrium. This kind of equilibrium concept was previously used by Sargent(1991)in investigating optimal investment in a production economy,and was then used by Hussman(1992)in an asset pricing model similar to ours.3 Both authors have 3 Hussman(1992)assumes that there is a single risky asset in the market.As we mentioned in the introduction,this single-asset setup is not appropriate to address the effects of private information on portfolio choices and related issues.3 Hussman (1992) assumes that there is a single risky asset in the market. As we mentioned in the introduction, this single-asset setup is not appropriate to address the effects of private information on portfolio choices and related issues. Given the perceptions outlined above, agents form period-ahead forecasts according to E[YatDYa,t~1]"ua Ya,t~1, (31) E[YbtDYb,t~1]"ub Yb,t~1. (32) The actual law of motion for prices results from the dynamic market equilibrium that equates asset supplies and asset demands arising from these expectations. The rational expectations assumption requires that agents’ perceptions be consistent with the actual law of motion. Let z t denote the state vector of the economy which contains Yat, Ybt and some other state variables. With a proper choice of elements, z t will evolve according to z t "T (u)z t~1#H (u)wt , (33) where wt is a vector of innovations. For a given set of perceptions u"(u a , u b ), the actual law of motion, Eq. (33), can be used to obtain the projections of Yjt on Yj,t~1 for j"a,b. E[YatDYa,t~1]"Ca (u)Ya,t~1, (34) E[YbtDYb,t~1]"Cb (u)Yb,t~1, (35) where Cj (u)( j"a, b) are obtained using the linear least squares projection formula. For the current asset pricing model, state vector z t can be expressed as z t "MPI 1t , PI 2t , D1t , D2t , F1t , F2t , N1t , N2t , Xat, XbtN@ (36) and the vector of innovations in z t , wt , can be written as wt "[v 1D , v 2D , v 1F , v 2F , v 1N , v 2N ]@ (37) The equilibrium of the market can be formally defined as: Definition. A (limited-information) rational expectations equilibrium (REE) with heterogeneous information is the fixed point (u a , u b )"(Ca (u), Cb (u)) such that the market clears in equilibrium. This kind of equilibrium concept was previously used by Sargent (1991) in investigating optimal investment in a production economy, and was then used by Hussman (1992) in an asset pricing model similar to ours.3 Both authors have C. Zhou / Journal of Economic Dynamics and Control 22 (1998) 1027—1051 1035