正在加载图片...

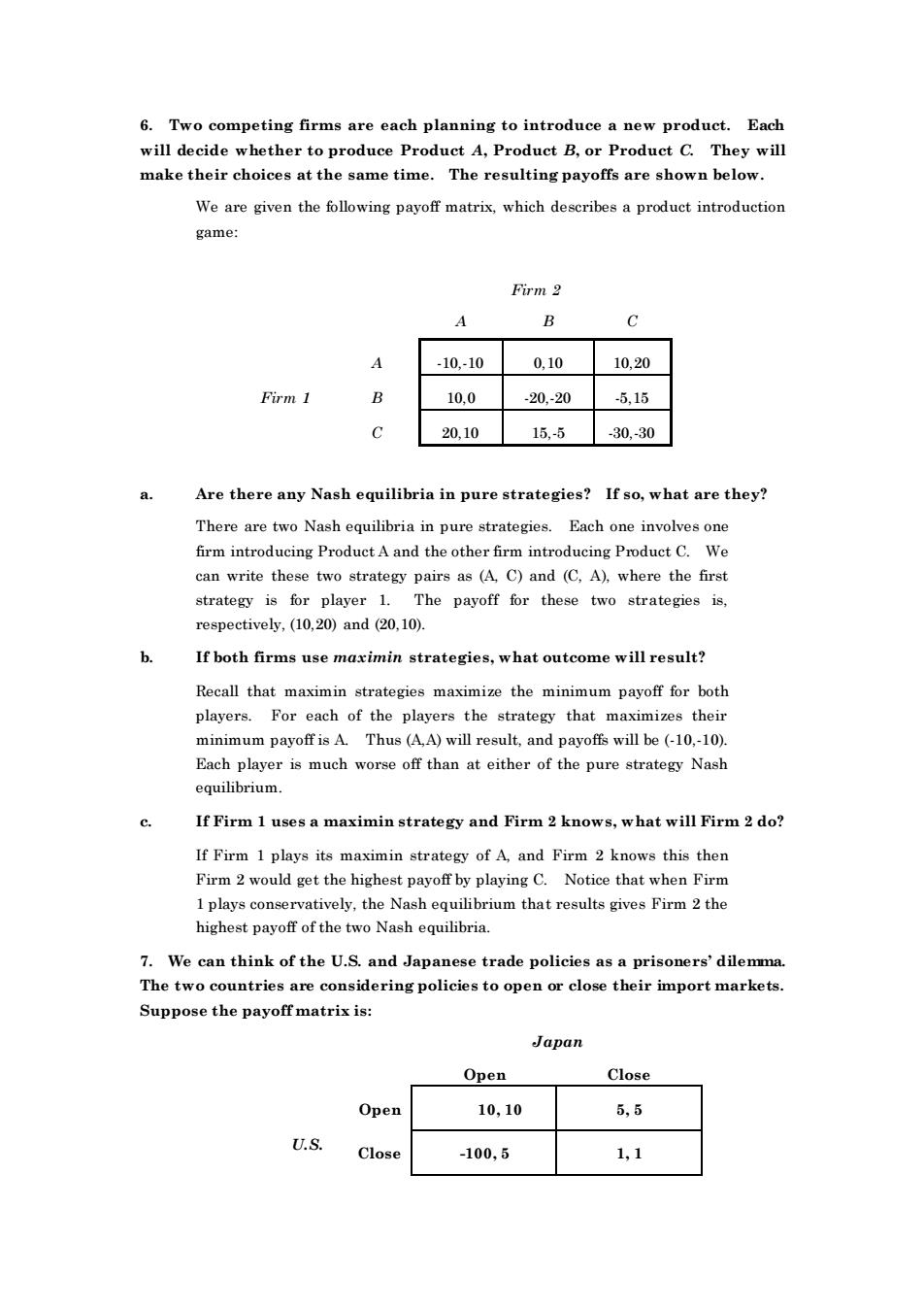

6.Two competing firms are each planning to introduce a new product.Each will decide whether to produce Produet A,Product B.or Product C.They will make their choices at the same time.The resulting payoffs are shown below. We are given the following payoff matrix.which describes a product introduction game: Firm? 4 B -10-10 0,1010,20 Firm 1 10.0 20,-205,15 20.10 15.5 .30.-30 Are there any Nash equilibria in pure strategies?If so,what are they? There are Nash in pure strategies.Each one invalve one firm introducing Product A and the other firm introdueing ProductC. we can write these two strategy pairs as (A.C)and (C.A).where the first strategy is for player 1.The payoff for these two strategies is, respectively.(10.20)and (20.10). If both firms use maximin strategies,what outcome will result? Recall that maximin strategies maximize the minimum payoff for both players each of the ers strategy that izes heir minimum payoff is A.Thus (A.A)will result,and payoffs will be (-10.-10) Each player is much worse off than at either of the pure strategy Nash equilibrium. c. If Firm 1 uses a maximin strategy and Firm 2 knows,what will Firm 2 do? If Firm 1 plays its maximin strategy of A.and Firm 2 knows this then Firm 2 would get the highest payoff by plaving c.Notice that when firm tively,the Nash equilibrium that results givesFirm 2 the highest payo of the two 7.We can think of the U.S.and Japanese trade policies as a prisoners'dilemma The two countries are considering policies to open or close their import markets. Suppose the payoffmatrix is: JJapan Open Close Open 10.10 5,5 U.S. Close -100.5 1,16. Two competing firms are each planning to introduce a new product. Each will decide whether to produce Product A, Product B, or Product C. They will make their choices at the same time. The resulting payoffs are shown below. We are given the following payoff matrix, which describes a product introduction game: Firm 2 A B C A -10,-10 0,10 10,20 Firm 1 B 10,0 -20,-20 -5,15 C 20,10 15,-5 -30,-30 a. Are there any Nash equilibria in pure strategies? If so, what are they? There are two Nash equilibria in pure strategies. Each one involves one firm introducing Product A and the other firm introducing Product C. We can write these two strategy pairs as (A, C) and (C, A), where the first strategy is for player 1. The payoff for these two strategies is, respectively, (10,20) and (20,10). b. If both firms use maximin strategies, what outcome will result? Recall that maximin strategies maximize the minimum payoff for both players. For each of the players the strategy that maximizes their minimum payoff is A. Thus (A,A) will result, and payoffs will be (-10,-10). Each player is much worse off than at either of the pure strategy Nash equilibrium. c. If Firm 1 uses a maximin strategy and Firm 2 knows, what will Firm 2 do? If Firm 1 plays its maximin strategy of A, and Firm 2 knows this then Firm 2 would get the highest payoff by playing C. Notice that when Firm 1 plays conservatively, the Nash equilibrium that results gives Firm 2 the highest payoff of the two Nash equilibria. 7. We can think of the U.S. and Japanese trade policies as a prisoners’ dilemma. The two countries are considering policies to open or close their import markets. Suppose the payoff matrix is: Japan Open Close Open 10, 10 5, 5 U.S. Close -100, 5 1, 1