正在加载图片...

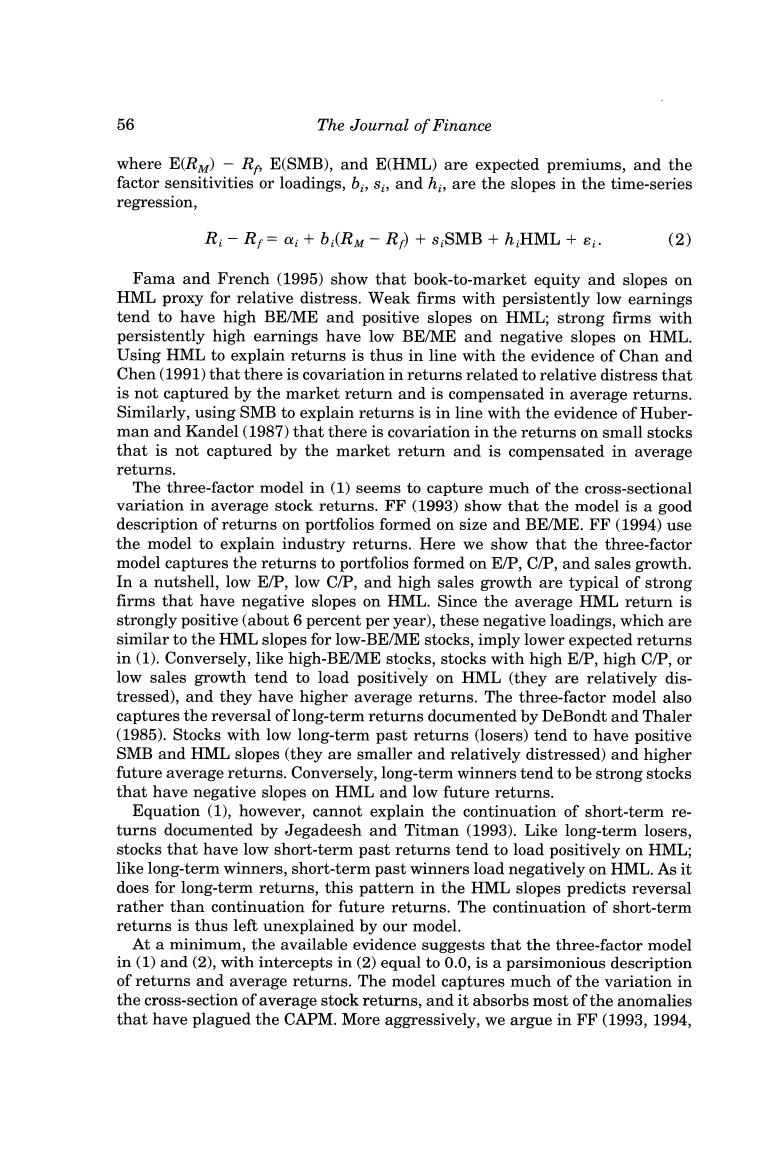

56 The Journal of Finance where E(Ry)-R E(SMB),and E(HML)are expected premiums,and the factor sensitivities or loadings,bi,si,and hi,are the slopes in the time-series regression, Ri-R=ai+b(RM-R+s:SMB+hHML+8i. (2) Fama and French (1995)show that book-to-market equity and slopes on HML proxy for relative distress.Weak firms with persistently low earnings tend to have high BE/ME and positive slopes on HML;strong firms with persistently high earnings have low BE/ME and negative slopes on HML. Using HML to explain returns is thus in line with the evidence of Chan and Chen(1991)that there is covariation in returns related to relative distress that is not captured by the market return and is compensated in average returns. Similarly,using SMB to explain returns is in line with the evidence of Huber- man and Kandel(1987)that there is covariation in the returns on small stocks that is not captured by the market return and is compensated in average returns. The three-factor model in (1)seems to capture much of the cross-sectional variation in average stock returns.FF(1993)show that the model is a good description of returns on portfolios formed on size and BE/ME.FF(1994)use the model to explain industry returns.Here we show that the three-factor model captures the returns to portfolios formed on E/P,C/P,and sales growth In a nutshell,low E/P,low C/P,and high sales growth are typical of strong firms that have negative slopes on HML.Since the average HML return is strongly positive(about 6 percent per year),these negative loadings,which are similar to the HML slopes for low-BE/ME stocks,imply lower expected returns in (1).Conversely,like high-BE/ME stocks,stocks with high E/P,high C/P,or low sales growth tend to load positively on HML (they are relatively dis- tressed),and they have higher average returns.The three-factor model also captures the reversal of long-term returns documented by DeBondt and Thaler (1985).Stocks with low long-term past returns (losers)tend to have positive SMB and HML slopes (they are smaller and relatively distressed)and higher future average returns.Conversely,long-term winners tend to be strong stocks that have negative slopes on HML and low future returns. Equation (1),however,cannot explain the continuation of short-term re- turns documented by Jegadeesh and Titman (1993).Like long-term losers, stocks that have low short-term past returns tend to load positively on HML; like long-term winners,short-term past winners load negatively on HML.As it does for long-term returns,this pattern in the HML slopes predicts reversal rather than continuation for future returns.The continuation of short-term returns is thus left unexplained by our model. At a minimum,the available evidence suggests that the three-factor model in (1)and(2),with intercepts in(2)equal to 0.0,is a parsimonious description of returns and average returns.The model captures much of the variation in the cross-section of average stock returns,and it absorbs most of the anomalies that have plagued the CAPM.More aggressively,we argue in FF(1993,1994