正在加载图片...

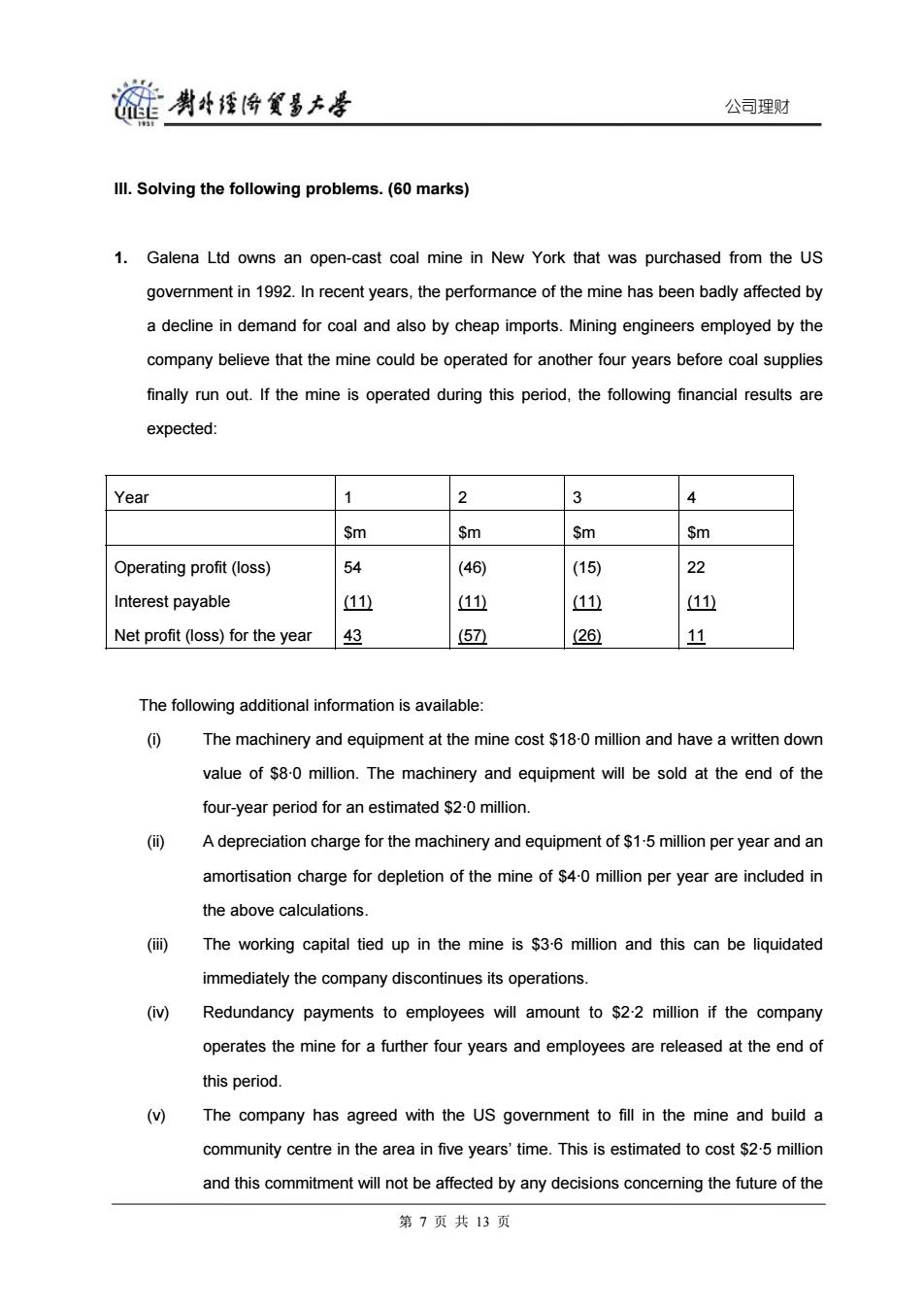

旋剥经降贸多大号 公司理财 Ill.Solving the following problems.(60 marks) 1.Galena Ltd owns an open-cast coal mine in New York that was purchased from the US government in 1992.In recent years,the performance of the mine has been badly affected by a decline in demand for coal and also by cheap imports.Mining engineers employed by the company believe that the mine could be operated for another four years before coal supplies finally run out.If the mine is operated during this period,the following financial results are expected: Year 2 3 4 $m Sm Sm Sm Operating profit (loss) 54 (46) (15) 22 Interest payable (11 11) (11) (11 Net profit (loss)for the year 43 (57 (26) 11 The following additional information is available: (0 The machinery and equipment at the mine cost $18-0 million and have a written down value of $8-0 million.The machinery and equipment will be sold at the end of the four-year period for an estimated $2-0 million. ( A depreciation charge for the machinery and equipment of $1-5 million per year and an amortisation charge for depletion of the mine of $4-0 million per year are included in the above calculations. (m) The working capital tied up in the mine is $3-6 million and this can be liquidated immediately the company discontinues its operations. () Redundancy payments to employees will amount to $2.2 million if the company operates the mine for a further four years and employees are released at the end of this period. () The company has agreed with the US government to fill in the mine and build a community centre in the area in five years'time.This is estimated to cost $2.5 million and this commitment will not be affected by any decisions concerning the future of the 第7页共13页公司理财 III. Solving the following problems. (60 marks) 1. Galena Ltd owns an open-cast coal mine in New York that was purchased from the US government in 1992. In recent years, the performance of the mine has been badly affected by a decline in demand for coal and also by cheap imports. Mining engineers employed by the company believe that the mine could be operated for another four years before coal supplies finally run out. If the mine is operated during this period, the following financial results are expected: Year 1 2 3 4 $m $m $m $m Operating profit (loss) Interest payable Net profit (loss) for the year 54 (11) 43 (46) (11) (57) (15) (11) (26) 22 (11) 11 The following additional information is available: (i) The machinery and equipment at the mine cost $18·0 million and have a written down value of $8·0 million. The machinery and equipment will be sold at the end of the four-year period for an estimated $2·0 million. (ii) A depreciation charge for the machinery and equipment of $1·5 million per year and an amortisation charge for depletion of the mine of $4·0 million per year are included in the above calculations. (iii) The working capital tied up in the mine is $3·6 million and this can be liquidated immediately the company discontinues its operations. (iv) Redundancy payments to employees will amount to $2·2 million if the company operates the mine for a further four years and employees are released at the end of this period. (v) The company has agreed with the US government to fill in the mine and build a community centre in the area in five years’ time. This is estimated to cost $2·5 million and this commitment will not be affected by any decisions concerning the future of the 第 7 页 共 13 页