正在加载图片...

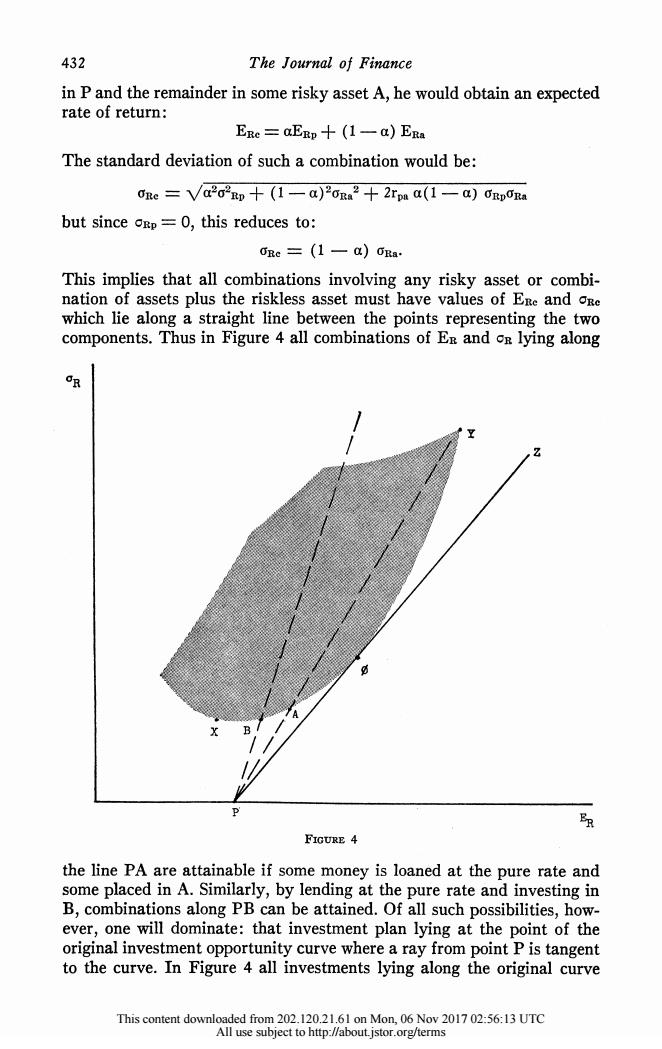

432 The Journal of Finance in P and the remainder in some risky asset A,he would obtain an expected rate of return: ERe=aEp十(1一a)ERa The standard deviation of such a combination would be: cre=Va2o2o十(1-am)2ora2十2raa(1-a)0Rpra but since oEp=0,this reduces to: rc=(1一a)Ra This implies that all combinations involving any risky asset or combi- nation of assets plus the riskless asset must have values of Ere and cRe which lie along a straight line between the points representing the two components.Thus in Figure 4 all combinations of En and cs lying along FIGURE 4 the line PA are attainable if some money is loaned at the pure rate and some placed in A.Similarly,by lending at the pure rate and investing in B,combinations along PB can be attained.Of all such possibilities,how- ever,one will dominate:that investment plan lying at the point of the original investment opportunity curve where a ray from point P is tangent to the curve.In Figure 4 all investments lying along the original curve This content downloaded from 202.120.21.61 on Mon,06 Nov 2017 02:56:13 UTC All use subject to http://about.istor.org/terms432 The Journal of Finance in P and the remainder in some risky asset A, he would obtain an expected rate of return: ERC= aERP + (1 - a) ER1a The standard deviation of such a combination would be: 0Rc - V\a202Rp + ( -a)2aua2 + 2rpa a(1-a) (}RplRa but since ORp = 0, this reduces to: CrR = (1 a) (Ra. This implies that all combinations involving any risky asset or combi- nation of assets plus the riskless asset must have values of ERC and OCR which lie along a straight line between the points representing the two components. Thus in Figure 4 all combinations of ER and OR lying along OaR P' 'v FIGURiE 4 the line PA are attainable 'if some money is loaned at the pure rate and some pBlaced in A. Similarly, by lending at the pure rate and investing in B, combinations along PB can be attained. Of all such possibilities, how- ever, one will dominate: that investment plan lying at the point of the original investment opprortunity curve where a ray from point P is tangent to the curve. In Figure 4 all investments lying along the original curve This content downloaded from 202.120.21.61 on Mon, 06 Nov 2017 02:56:13 UTC All use subject to http://about.jstor.org/terms