正在加载图片...

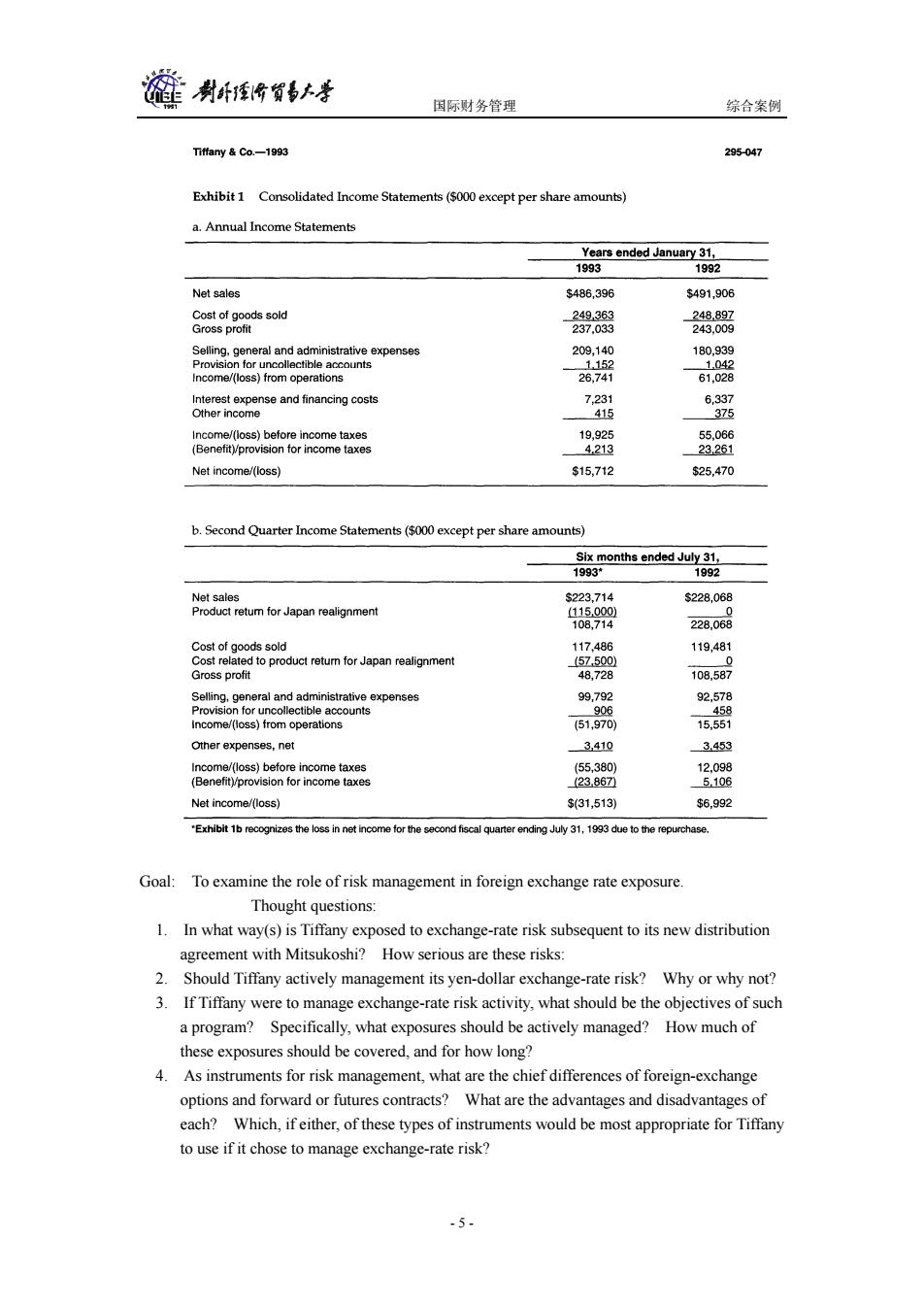

尉卧矮将贸号上孝 国际财务管理 综合案例 Tiffany Co.-1993 295-047 Exhibit 1 Consolidated Income Statements($000 except per share amounts) a.Annual Income Statements Years ended January 31, 1993 1992 Net sales $486,396 $491,906 Cost of goods sold 249363 248.897 Gross profit 237.033 243.009 Selling,general and administrative expenses 209.140 180,939 Provision for uncollectible accounts 1.152 1.042 Income/(loss)from operations 26,741 61,028 Interest expense and financing costs 7.231 6.337 Other income 415 375 Income/(loss)before income taxes 19,925 55,066 (Benefit)/provision for income taxes 4213 23.261 Net income/(loss) $15,712 $25,470 b.Second Quarter Income Statements($000 except per share amounts) Six months ended July 31, 1993 1992 Net sales $223,714 $228,068 Product retum for Japan realignment (115.000) 0 108,714 228,068 Cost of goods sold 117.486 119,481 Cost related to product retumn for Japan realignment (57500) 0 Gross profit 48,728 108,587 Selling,general and administrative expenses 99,792 92,578 Provision for uncollectible accounts 906 458 Income/(loss)from operations (51,970) 15,551 Other expenses,net 3,410 3.453 Income/(loss)before income taxes (55,380) 12.098 (Benefit)/provision for income taxes (23867☑ 5.106 Net income/(loss) $(31,513) $6,992 "Exhibit 1b recognizes the loss in net income for the second fiscal quarter ending July 31,1993 due to the repurchase. Goal:To examine the role of risk management in foreign exchange rate exposure. Thought questions: 1.In what way(s)is Tiffany exposed to exchange-rate risk subsequent to its new distribution agreement with Mitsukoshi?How serious are these risks: 2.Should Tiffany actively management its yen-dollar exchange-rate risk?Why or why not? 3.If Tiffany were to manage exchange-rate risk activity,what should be the objectives of such a program?Specifically,what exposures should be actively managed?How much of these exposures should be covered,and for how long? 4.As instruments for risk management,what are the chief differences of foreign-exchange options and forward or futures contracts?What are the advantages and disadvantages of each?Which,ifeither,of these types of instruments would be most appropriate for Tiffany to use if it chose to manage exchange-rate risk? -5-国际财务管理 综合案例 - 5 - Goal: To examine the role of risk management in foreign exchange rate exposure. Thought questions: 1. In what way(s) is Tiffany exposed to exchange-rate risk subsequent to its new distribution agreement with Mitsukoshi? How serious are these risks: 2. Should Tiffany actively management its yen-dollar exchange-rate risk? Why or why not? 3. If Tiffany were to manage exchange-rate risk activity, what should be the objectives of such a program? Specifically, what exposures should be actively managed? How much of these exposures should be covered, and for how long? 4. As instruments for risk management, what are the chief differences of foreign-exchange options and forward or futures contracts? What are the advantages and disadvantages of each? Which, if either, of these types of instruments would be most appropriate for Tiffany to use if it chose to manage exchange-rate risk?