正在加载图片...

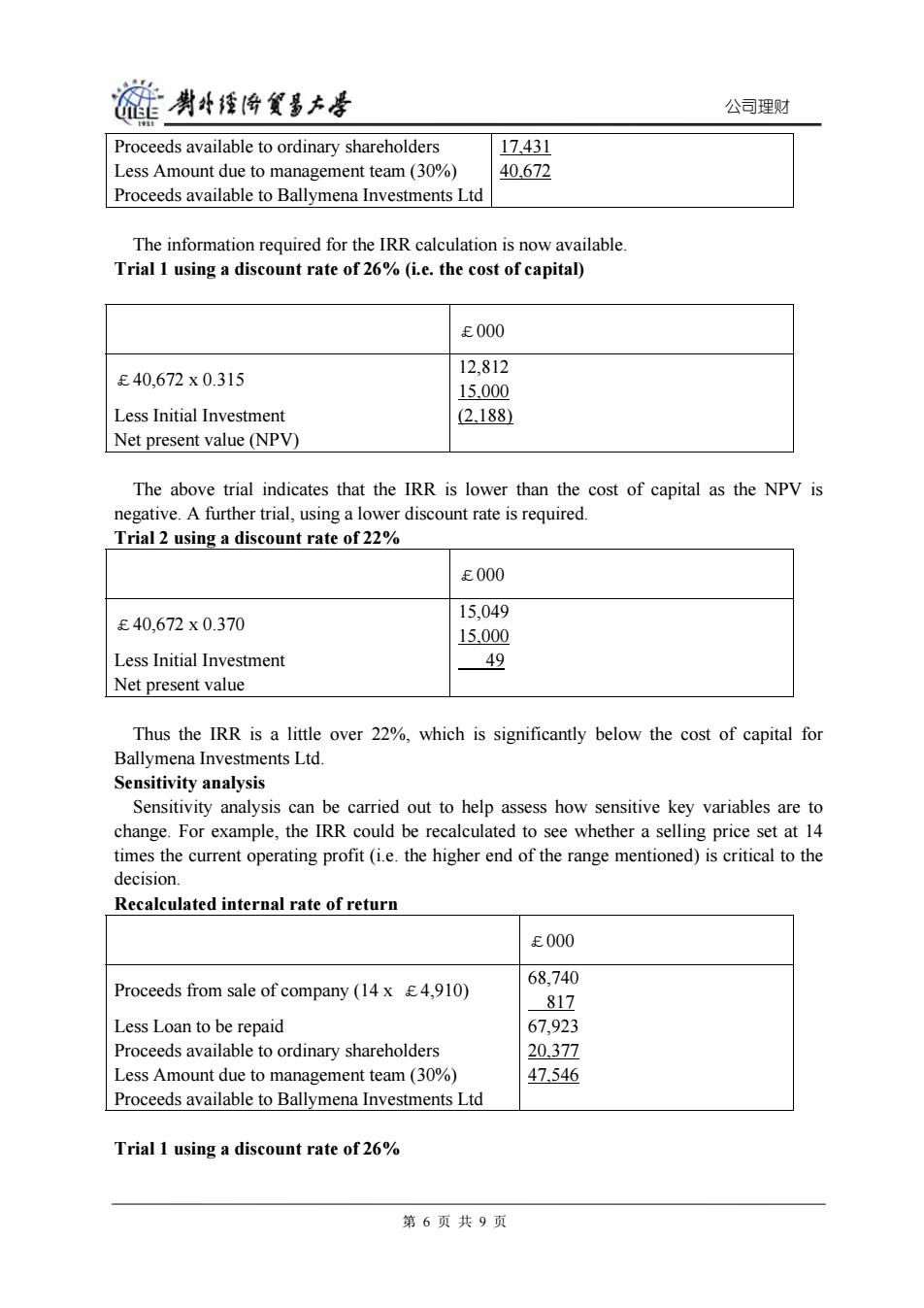

链黄科特倚食事大香 公司理财 Proceeds available to ordinary shareholders 17.431 Less Amount due to management team(30%) 40.672 Proceeds available to Ballymena Investments Ltd The information required for the IRR calculation is now available. Trial 1 using a discount rate of 26%(i.e.the cost of capital) £000 12,812 £40,672x0.315 15.000 Less Initial Investment 2.188) Net present value (NPV) The above trial indicates that the IRR is lower than the cost of capital as the NPV is negative.A further trial,using a lower discount rate is required. Trial 2 using a discount rate of 22% £000 15.049 £40,672x0.370 15,000 Less Initial Investment 49 Net present value Thus the IRR is a little over 22%,which is significantly below the cost of capital for Ballymena Investments Ltd. Sensitivity analysis Sensitivity analysis can be carried out to help assess how sensitive key variables are to change.For example,the IRR could be recalculated to see whether a selling price set at 14 times the current operating profit (i.e.the higher end of the range mentioned)is critical to the decision. Recalculated internal rate of return £000 68,740 Proceeds from sale of company (14 x E4,910) 817 Less Loan to be repaid 67,923 Proceeds available to ordinary shareholders 20.377 Less Amount due to management team(30%) 47.546 Proceeds available to Ballymena Investments Ltd Trial 1 using a discount rate of 26% 第6页共9页公司理财 Proceeds available to ordinary shareholders Less Amount due to management team (30%) Proceeds available to Ballymena Investments Ltd 17,431 40,672 The information required for the IRR calculation is now available. Trial 1 using a discount rate of 26% (i.e. the cost of capital) £000 £40,672 x 0.315 Less Initial Investment Net present value (NPV) 12,812 15,000 (2,188) The above trial indicates that the IRR is lower than the cost of capital as the NPV is negative. A further trial, using a lower discount rate is required. Trial 2 using a discount rate of 22% £000 £40,672 x 0.370 Less Initial Investment Net present value 15,049 15,000 49 Thus the IRR is a little over 22%, which is significantly below the cost of capital for Ballymena Investments Ltd. Sensitivity analysis Sensitivity analysis can be carried out to help assess how sensitive key variables are to change. For example, the IRR could be recalculated to see whether a selling price set at 14 times the current operating profit (i.e. the higher end of the range mentioned) is critical to the decision. Recalculated internal rate of return £000 Proceeds from sale of company (14 x £4,910) Less Loan to be repaid Proceeds available to ordinary shareholders Less Amount due to management team (30%) Proceeds available to Ballymena Investments Ltd 68,740 817 67,923 20,377 47,546 Trial 1 using a discount rate of 26% 第 6 页 共 9 页