正在加载图片...

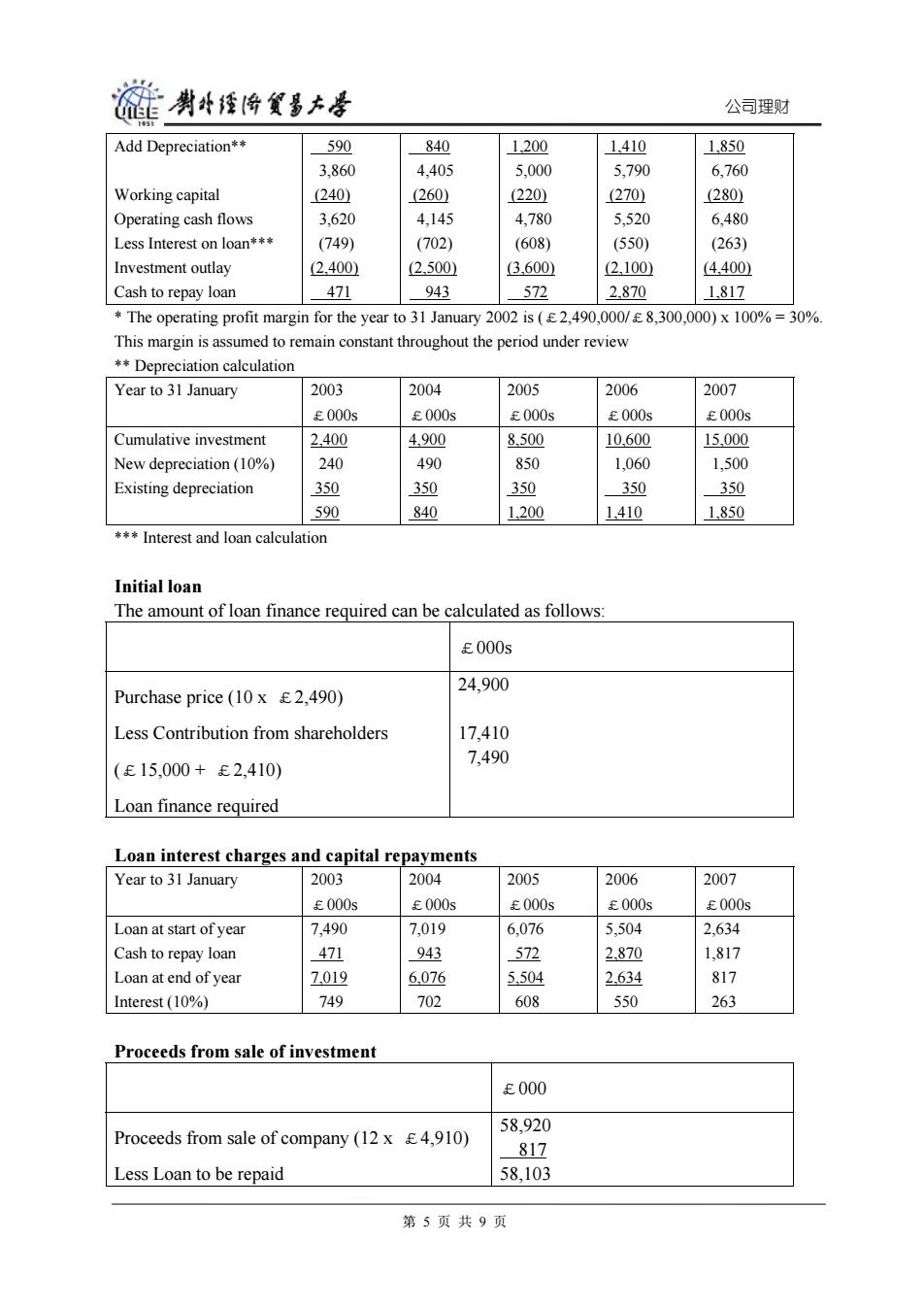

链黄科特倚食事大香 公司理财 Add Depreciation** 590 840 1.200 1.410 1.850 3.860 4.405 5.000 5,790 6,760 Working capital (240) (260) (220 (270) (280) Operating cash flows 3.620 4,145 4,780 5.520 6.480 Less Interest on loan*** (749) (702) (608) (550) (263) Investment outlay (2.400 (2.500 (3,600) (2.100 (4.400 Cash to repay loan 471 943 572 2.870 1.817 The operating profit margin for the year to 31 January 2002 is(2,490,000/E8,300,000)x 100%=30%. This margin is assumed to remain constant throughout the period under review **Depreciation calculation Year to 31 January 2003 2004 2005 2006 2007 £000s £000s £000s £000s £000s Cumulative investment 2.400 4.900 8.500 10.600 15,000 New depreciation(10%) 240 490 850 1.060 1,500 Existing depreciation 350 350 350 350 350 590 840 1.200 1.410 1.850 **Interest and loan calculation Initial loan The amount of loan finance required can be calculated as follows: £000s 24,900 Purchase price(10 x E2,490) Less Contribution from shareholders 17,410 7,490 (£15,000+£2,410) Loan finance required Loan interest charges and capital repayments Year to 31 January 2003 2004 2005 2006 2007 £000s £000s £000s £000s £000s Loan at start of year 7,490 7,019 6.076 5,504 2,634 Cash to repay loan 471 943 572 2.870 1,817 Loan at end of year 7.019 6.076 5.504 2.634 817 Interest(10%) 749 702 608 550 263 Proceeds from sale of investment £000 58,920 Proceeds from sale of company (12 x 4,910) 817 Less Loan to be repaid 58,103 第5页共9页公司理财 Add Depreciation** Working capital Operating cash flows Less Interest on loan*** Investment outlay Cash to repay loan 590 3,860 (240) 3,620 (749) (2,400) 471 840 4,405 (260) 4,145 (702) (2,500) 943 1,200 5,000 (220) 4,780 (608) (3,600) 572 1,410 5,790 (270) 5,520 (550) (2,100) 2,870 1,850 6,760 (280) 6,480 (263) (4,400) 1,817 * The operating profit margin for the year to 31 January 2002 is (£2,490,000/£8,300,000) x 100% = 30%. This margin is assumed to remain constant throughout the period under review ** Depreciation calculation Year to 31 January 2003 £000s 2004 £000s 2005 £000s 2006 £000s 2007 £000s Cumulative investment New depreciation (10%) Existing depreciation 2,400 240 350 590 4,900 490 350 840 8,500 850 350 1,200 10,600 1,060 350 1,410 15,000 1,500 350 1,850 *** Interest and loan calculation Initial loan The amount of loan finance required can be calculated as follows: £000s Purchase price (10 x £2,490) Less Contribution from shareholders (£15,000 + £2,410) Loan finance required 24,900 17,410 7,490 Loan interest charges and capital repayments Year to 31 January 2003 £000s 2004 £000s 2005 £000s 2006 £000s 2007 £000s Loan at start of year Cash to repay loan Loan at end of year Interest (10%) 7,490 471 7,019 749 7,019 943 6,076 702 6,076 572 5,504 608 5,504 2,870 2,634 550 2,634 1,817 817 263 Proceeds from sale of investment £000 Proceeds from sale of company (12 x £4,910) Less Loan to be repaid 58,920 817 58,103 第 5 页 共 9 页