正在加载图片...

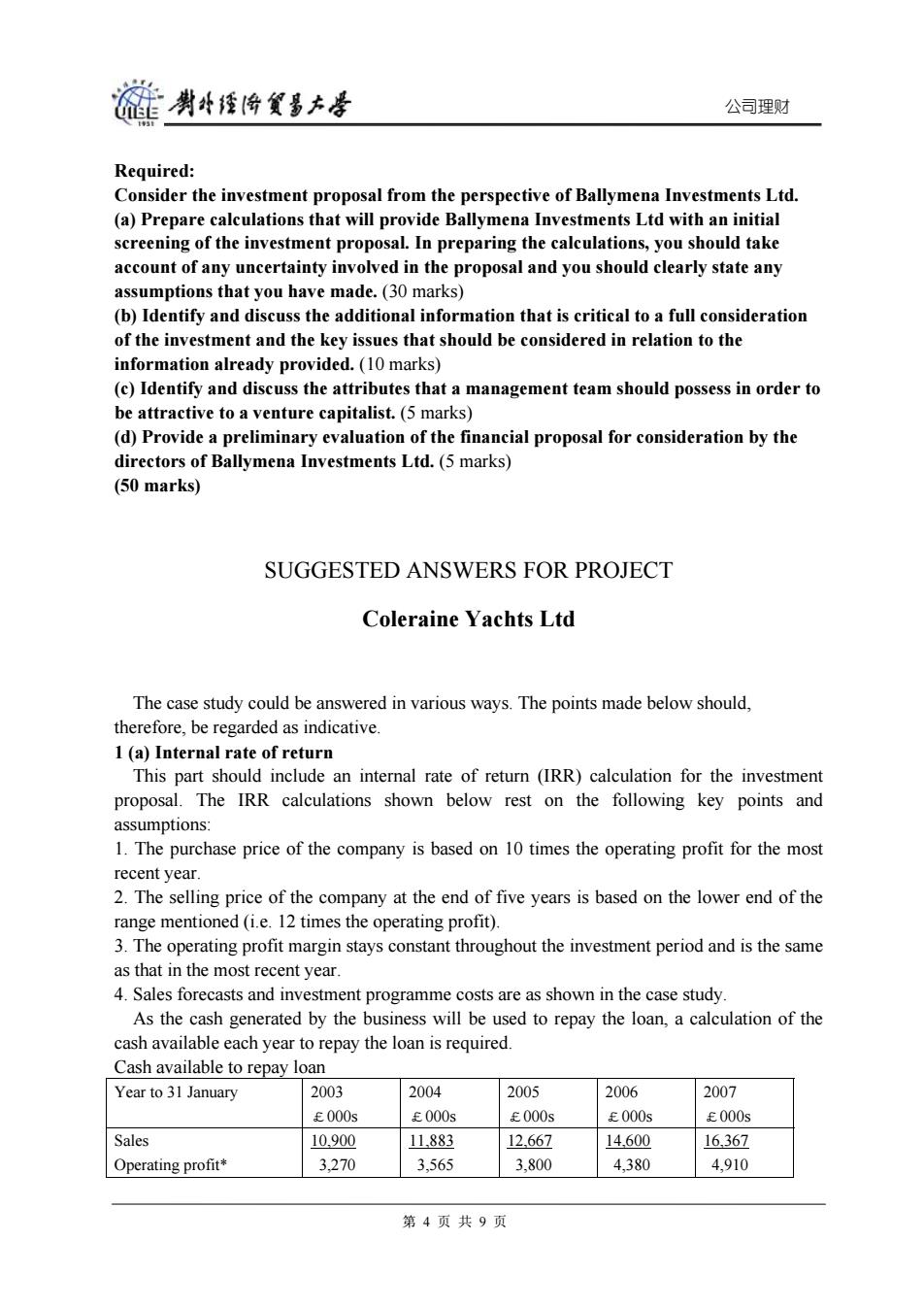

爸剥斗煙怜食多本学 公司理财 Required: Consider the investment proposal from the perspective of Ballymena Investments Ltd. (a)Prepare calculations that will provide Ballymena Investments Ltd with an initial screening of the investment proposal.In preparing the calculations,you should take account of any uncertainty involved in the proposal and you should clearly state any assumptions that you have made.(30 marks) (b)Identify and discuss the additional information that is critical to a full consideration of the investment and the key issues that should be considered in relation to the information already provided.(10 marks) (c)Identify and discuss the attributes that a management team should possess in order to be attractive to a venture capitalist.(5 marks) (d)Provide a preliminary evaluation of the financial proposal for consideration by the directors of Ballymena Investments Ltd.(5 marks) (50 marks) SUGGESTED ANSWERS FOR PROJECT Coleraine Yachts Ltd The case study could be answered in various ways.The points made below should, therefore,be regarded as indicative 1 (a)Internal rate of return This part should include an internal rate of return (IRR)calculation for the investment proposal.The IRR calculations shown below rest on the following key points and assumptions: 1.The purchase price of the company is based on 10 times the operating profit for the most recent year. 2.The selling price of the company at the end of five years is based on the lower end of the range mentioned(i.e.12 times the operating profit). 3.The operating profit margin stays constant throughout the investment period and is the same as that in the most recent year. 4.Sales forecasts and investment programme costs are as shown in the case study. As the cash generated by the business will be used to repay the loan,a calculation of the cash available each year to repay the loan is required. Cash available to repay loan Year to 31 January 2003 2004 2005 2006 2007 £000s £000s £000s £000s £000s Sales 10.900 11.883 12.667 14.600 16.367 Operating profit* 3,270 3,565 3,800 4,380 4,910 第4页共9页公司理财 Required: Consider the investment proposal from the perspective of Ballymena Investments Ltd. (a) Prepare calculations that will provide Ballymena Investments Ltd with an initial screening of the investment proposal. In preparing the calculations, you should take account of any uncertainty involved in the proposal and you should clearly state any assumptions that you have made. (30 marks) (b) Identify and discuss the additional information that is critical to a full consideration of the investment and the key issues that should be considered in relation to the information already provided. (10 marks) (c) Identify and discuss the attributes that a management team should possess in order to be attractive to a venture capitalist. (5 marks) (d) Provide a preliminary evaluation of the financial proposal for consideration by the directors of Ballymena Investments Ltd. (5 marks) (50 marks) SUGGESTED ANSWERS FOR PROJECT Coleraine Yachts Ltd The case study could be answered in various ways. The points made below should, therefore, be regarded as indicative. 1 (a) Internal rate of return This part should include an internal rate of return (IRR) calculation for the investment proposal. The IRR calculations shown below rest on the following key points and assumptions: 1. The purchase price of the company is based on 10 times the operating profit for the most recent year. 2. The selling price of the company at the end of five years is based on the lower end of the range mentioned (i.e. 12 times the operating profit). 3. The operating profit margin stays constant throughout the investment period and is the same as that in the most recent year. 4. Sales forecasts and investment programme costs are as shown in the case study. As the cash generated by the business will be used to repay the loan, a calculation of the cash available each year to repay the loan is required. Cash available to repay loan Year to 31 January 2003 £000s 2004 £000s 2005 £000s 2006 £000s 2007 £000s Sales Operating profit* 10,900 3,270 11,883 3,565 12,667 3,800 14,600 4,380 16,367 4,910 第 4 页 共 9 页