正在加载图片...

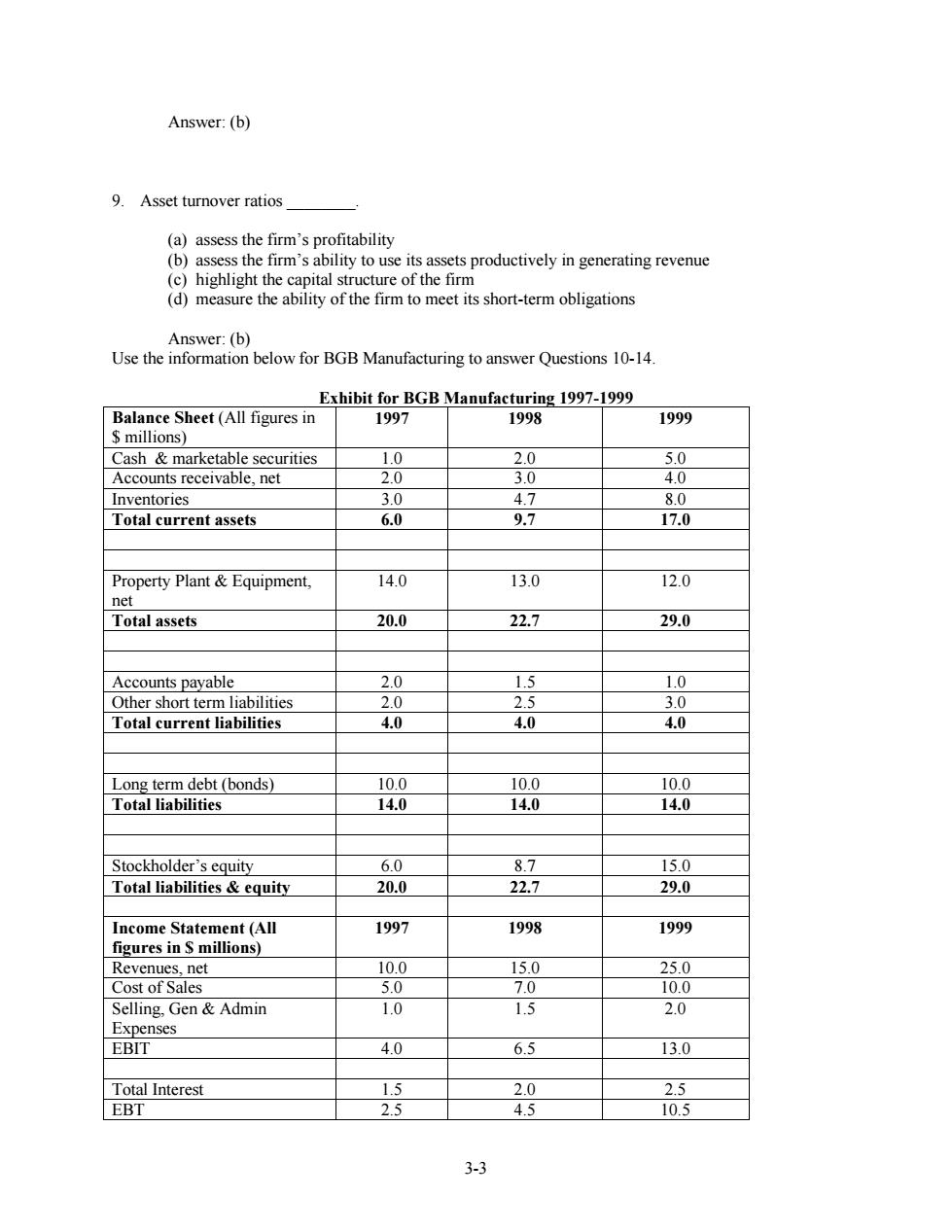

Answer:(b) 9.Asset turnover ratios (a)assess the firm's profitability (b)assess the firm's ability to use its assets productively in generating revenue (c)highlight the capital structure of the firm (d)measure the ability of the firm to meet its short-term obligations Answer:(b) Use the information below for BGB Manufacturing to answer Questions 10-14. Exhibit for BGB Manufacturing 1997-1999 Balance Sheet(All figures in 1997 1998 1999 millions) Cash marketable securities 1.0 2.0 5.0 Accounts receivable,net 2.0 3.0 4.0 Inventories 3.0 4.7 8.0 Total current assets 6.0 9.7 17.0 Property Plant Equipment, 14.0 13.0 12.0 net Total assets 20.0 22.7 29.0 Accounts payable 2.0 1.5 1.0 Other short term liabilities 2.0 2.5 3.0 Total current liabilities 4.0 4.0 4.0 Long term debt(bonds) 10.0 10.0 10.0 Total liabilities 14.0 14.0 14.0 Stockholder's equity 6.0 8.7 15.0 Total liabilities equity 20.0 22.7 29.0 Income Statement(All 1997 1998 1999 figures in millions) Revenues,net 10.0 15.0 25.0 Cost of Sales 5.0 7.0 10.0 Selling,Gen Admin 1.0 1.5 2.0 Expenses EBIT 4.0 6.5 13.0 Total Interest 1.5 2.0 2.5 EBT 2.5 4.5 10.5 3-33-3 Answer: (b) 9. Asset turnover ratios ________. (a) assess the firm’s profitability (b) assess the firm’s ability to use its assets productively in generating revenue (c) highlight the capital structure of the firm (d) measure the ability of the firm to meet its short-term obligations Answer: (b) Use the information below for BGB Manufacturing to answer Questions 10-14. Exhibit for BGB Manufacturing 1997-1999 Balance Sheet (All figures in $ millions) 1997 1998 1999 Cash & marketable securities 1.0 2.0 5.0 Accounts receivable, net 2.0 3.0 4.0 Inventories 3.0 4.7 8.0 Total current assets 6.0 9.7 17.0 Property Plant & Equipment, net 14.0 13.0 12.0 Total assets 20.0 22.7 29.0 Accounts payable 2.0 1.5 1.0 Other short term liabilities 2.0 2.5 3.0 Total current liabilities 4.0 4.0 4.0 Long term debt (bonds) 10.0 10.0 10.0 Total liabilities 14.0 14.0 14.0 Stockholder’s equity 6.0 8.7 15.0 Total liabilities & equity 20.0 22.7 29.0 Income Statement (All figures in $ millions) 1997 1998 1999 Revenues, net 10.0 15.0 25.0 Cost of Sales 5.0 7.0 10.0 Selling, Gen & Admin Expenses 1.0 1.5 2.0 EBIT 4.0 6.5 13.0 Total Interest 1.5 2.0 2.5 EBT 2.5 4.5 10.5