正在加载图片...

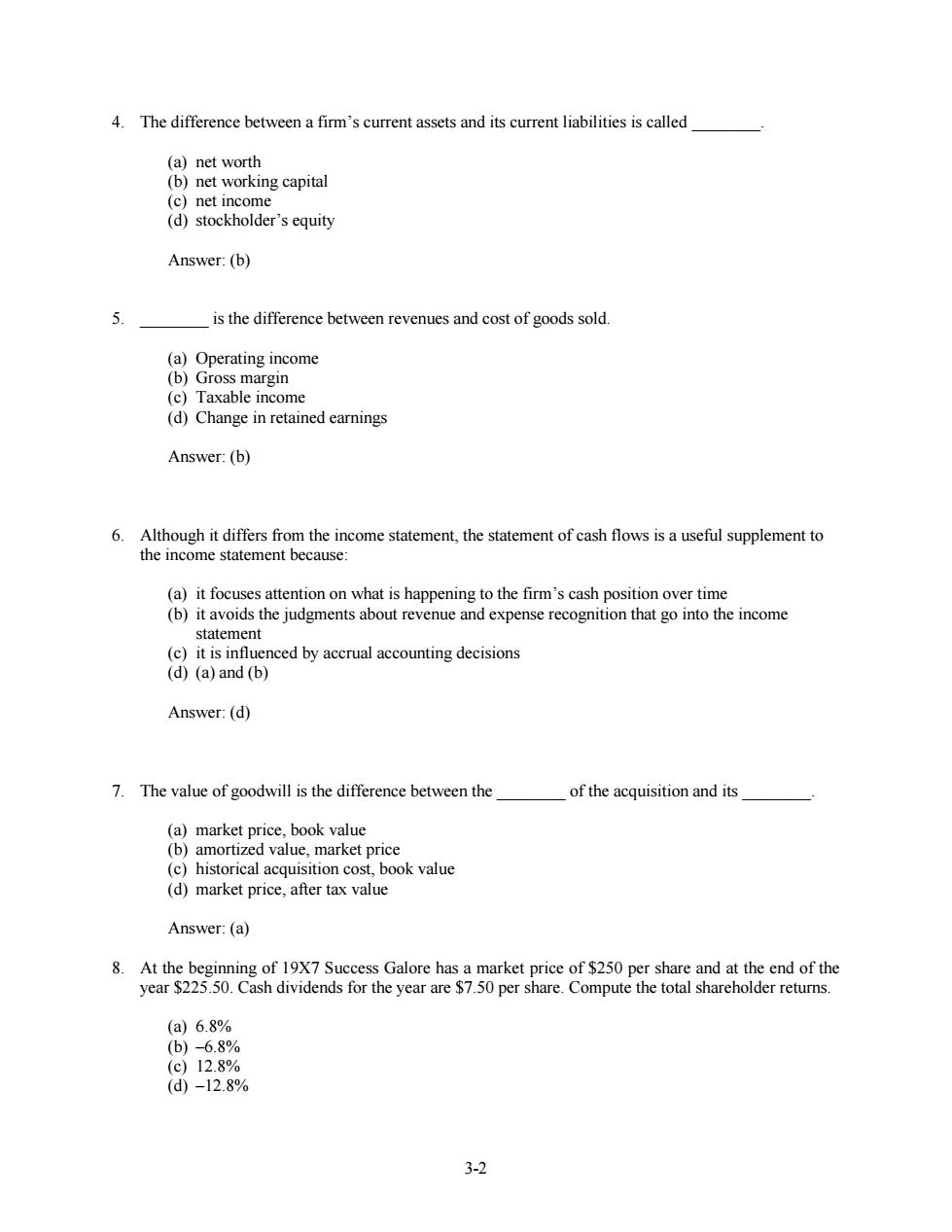

4.The difference between a firm's current assets and its current liabilities is called (a)net worth (b)net working capital (c)net income (d)stockholder's equity Answer:(b) 5. is the difference between revenues and cost of goods sold. (a)Operating income (b)Gross margin (c)Taxable income (d)Change in retained earnings Answer:(b) 6.Although it differs from the income statement,the statement of cash flows is a useful supplement to the income statement because: (a)it focuses attention on what is happening to the firm's cash position over time (b)it avoids the judgments about revenue and expense recognition that go into the income statement (c)it is influenced by accrual accounting decisions (d)(a)and(b) Answer:(d) 7.The value of goodwill is the difference between the of the acquisition and its (a)market price,book value (b)amortized value,market price (c)historical acquisition cost,book value (d)market price,after tax value Answer:(a) 8.At the beginning of 19X7 Success Galore has a market price of $250 per share and at the end of the year $225.50.Cash dividends for the year are $7.50 per share.Compute the total shareholder returns. (a)6.8% (b)-6.8% (c)12.8% (d)-12.8% 3-23-2 4. The difference between a firm’s current assets and its current liabilities is called ________. (a) net worth (b) net working capital (c) net income (d) stockholder’s equity Answer: (b) 5. ________ is the difference between revenues and cost of goods sold. (a) Operating income (b) Gross margin (c) Taxable income (d) Change in retained earnings Answer: (b) 6. Although it differs from the income statement, the statement of cash flows is a useful supplement to the income statement because: (a) it focuses attention on what is happening to the firm’s cash position over time (b) it avoids the judgments about revenue and expense recognition that go into the income statement (c) it is influenced by accrual accounting decisions (d) (a) and (b) Answer: (d) 7. The value of goodwill is the difference between the ________ of the acquisition and its ________. (a) market price, book value (b) amortized value, market price (c) historical acquisition cost, book value (d) market price, after tax value Answer: (a) 8. At the beginning of 19X7 Success Galore has a market price of $250 per share and at the end of the year $225.50. Cash dividends for the year are $7.50 per share. Compute the total shareholder returns. (a) 6.8% (b) –6.8% (c) 12.8% (d) –12.8%