正在加载图片...

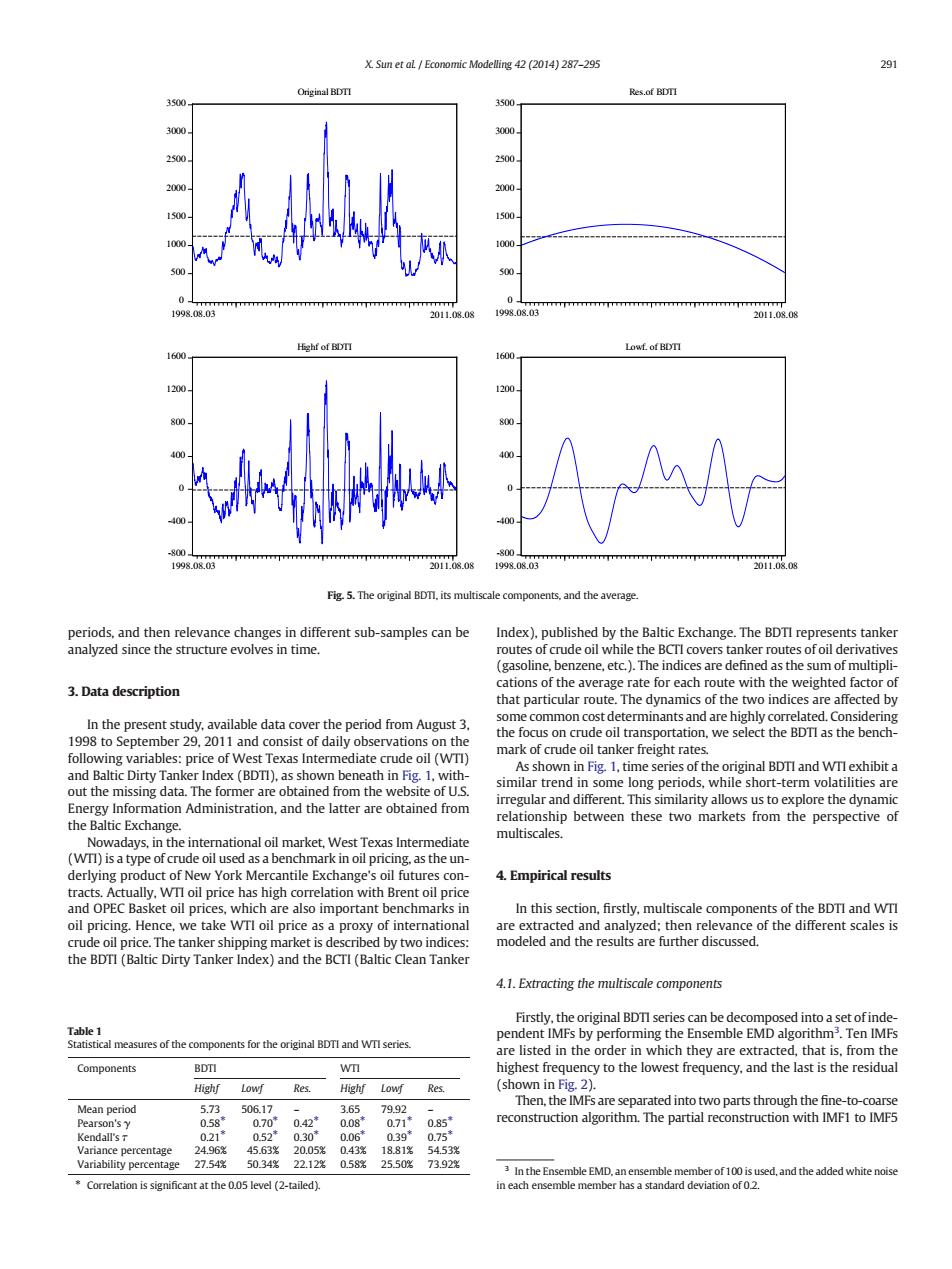

X.Sun et al Economic Modelling 42 (2014)287-295 291 Original BDTI Res.of BDTI 3500 3500 000 3000 2500 2000 1500 1000 500. 1998.08.03 2011.08.08 1998.08.03 2011.08.08 Highf of BDTI Lowf.of BDTI 1600 1600 1998.08.03 1998.08.03 2011.08.08 Fig.5.The original BDTI.its omponents. and the average. periods,and then relevance changes in different sub-samples can be Index),published by the Baltic Exchange.The BDTI represents tanker analyzed since the structure evolves in time. routes of crude oil while the BCTI covers tanker routes of oil derivatives (gasoline,benzene,etc.).The indices are defined as the sum of multipli- cations of the average rate for each route with the weighted factor of 3.Data description that particular route.The dynamics of the two indices are affected by In the present study,available data cover the period from August 3. some common cost determinants and are highly correlated.Considering 1998 to September 29,2011 and consist of daily observations on the the focus on crude oil transportation,we select the BDTI as the bench- following variables:price of West Texas Intermediate crude oil(WTI) mark of crude oil tanker freight rates. and Baltic Dirty Tanker Index(BDTI),as shown beneath in Fig.1,with- As shown in Fig.1,time series of the original BDTI and WTI exhibit a out the missing data.The former are obtained from the website of U.S. similar trend in some long periods,while short-term volatilities are Energy Information Administration,and the latter are obtained from irregular and different.This similarity allows us to explore the dynamic the Baltic Exchange. relationship between these two markets from the perspective of multiscales. Nowadays,in the international oil market,West Texas Intermediate (WTI)is a type of crude oil used as a benchmark in oil pricing.as the un- derlying product of New York Mercantile Exchange's oil futures con- 4.Empirical results tracts.Actually,WTI oil price has high correlation with Brent oil price and OPEC Basket oil prices,which are also important benchmarks in In this section,firstly,multiscale components of the BDTI and WTI oil pricing.Hence,we take WTl oil price as a proxy of international are extracted and analyzed;then relevance of the different scales is crude oil price.The tanker shipping market is described by two indices: modeled and the results are further discussed. the BDTI(Baltic Dirty Tanker Index)and the BCTI(Baltic Clean Tanker 4.1.Extracting the multiscale components Firstly,the original BDTI series can be decomposed into a set of inde- Table 1 pendent IMFs by performing the Ensemble EMD algorithm3.Ten IMFs Statistical measures of the components for the original BDTI and WTI series. are listed in the order in which they are extracted,that is,from the Components BDTI wn highest frequency to the lowest frequency,and the last is the residual Highf Lowf Res. Highf Lowf Res. (shown in Fig.2). Then,the IMFs are separated into two parts through the fine-to-coarse Mean period 5.73 506.17 3.65 79.92 Pearson'sy 0.58 0.70* 0.42* 008 0.71* 0.85* reconstruction algorithm.The partial reconstruction with IMF1 to IMF5 Kendall's T 0.21* 0.52* 0.30* 0.06 039* 0.75* Variance percentage 24.96% 45.63% 20.05%0.43% 1881% 54.53% Variability percentage 27.54% 50.34%22.12%0.58%25.50% 73.92% In the Ensemble EMD.anensemble member of 100isused,and the added white noise Correlation is significant at the 0.05 level (2-tailed). in each ensemble member has a standard deviation of 0.2.periods, and then relevance changes in different sub-samples can be analyzed since the structure evolves in time. 3. Data description In the present study, available data cover the period from August 3, 1998 to September 29, 2011 and consist of daily observations on the following variables: price of West Texas Intermediate crude oil (WTI) and Baltic Dirty Tanker Index (BDTI), as shown beneath in Fig. 1, without the missing data. The former are obtained from the website of U.S. Energy Information Administration, and the latter are obtained from the Baltic Exchange. Nowadays, in the international oil market, West Texas Intermediate (WTI) is a type of crude oil used as a benchmark in oil pricing, as the underlying product of New York Mercantile Exchange's oil futures contracts. Actually, WTI oil price has high correlation with Brent oil price and OPEC Basket oil prices, which are also important benchmarks in oil pricing. Hence, we take WTI oil price as a proxy of international crude oil price. The tanker shipping market is described by two indices: the BDTI (Baltic Dirty Tanker Index) and the BCTI (Baltic Clean Tanker Index), published by the Baltic Exchange. The BDTI represents tanker routes of crude oil while the BCTI covers tanker routes of oil derivatives (gasoline, benzene, etc.). The indices are defined as the sum of multiplications of the average rate for each route with the weighted factor of that particular route. The dynamics of the two indices are affected by some common cost determinants and are highly correlated. Considering the focus on crude oil transportation, we select the BDTI as the benchmark of crude oil tanker freight rates. As shown in Fig. 1, time series of the original BDTI and WTI exhibit a similar trend in some long periods, while short-term volatilities are irregular and different. This similarity allows us to explore the dynamic relationship between these two markets from the perspective of multiscales. 4. Empirical results In this section, firstly, multiscale components of the BDTI and WTI are extracted and analyzed; then relevance of the different scales is modeled and the results are further discussed. 4.1. Extracting the multiscale components Firstly, the original BDTI series can be decomposed into a set of independent IMFs by performing the Ensemble EMD algorithm3 . Ten IMFs are listed in the order in which they are extracted, that is, from the highest frequency to the lowest frequency, and the last is the residual (shown in Fig. 2). Then, the IMFs are separated into two parts through the fine-to-coarse reconstruction algorithm. The partial reconstruction with IMF1 to IMF5 0 500 1000 1500 2000 2500 3000 3500 Original BDTI 0 500 1000 1500 2000 2500 3000 3500 Res.of BDTI -800 -400 0 400 800 1200 1600 Highf of BDTI -800 -400 0 400 800 1200 1600 Lowf. of BDTI 1998.08.03 1998.08.03 1998.08.03 1998.08.03 2011.08.08 2011.08.08 2011.08.08 2011.08.08 Fig. 5. The original BDTI, its multiscale components, and the average. Table 1 Statistical measures of the components for the original BDTI and WTI series. Components BDTI WTI Highf Lowf Res. Highf Lowf Res. Mean period 5.73 506.17 – 3.65 79.92 – Pearson's γ 0.58⁎ 0.70⁎ 0.42⁎ 0.08⁎ 0.71⁎ 0.85⁎ Kendall's τ 0.21⁎ 0.52⁎ 0.30⁎ 0.06⁎ 0.39⁎ 0.75⁎ Variance percentage 24.96% 45.63% 20.05% 0.43% 18.81% 54.53% Variability percentage 27.54% 50.34% 22.12% 0.58% 25.50% 73.92% ⁎ Correlation is significant at the 0.05 level (2-tailed). 3 In the Ensemble EMD, an ensemble member of 100 is used, and the added white noise in each ensemble member has a standard deviation of 0.2. X. Sun et al. / Economic Modelling 42 (2014) 287–295 291