正在加载图片...

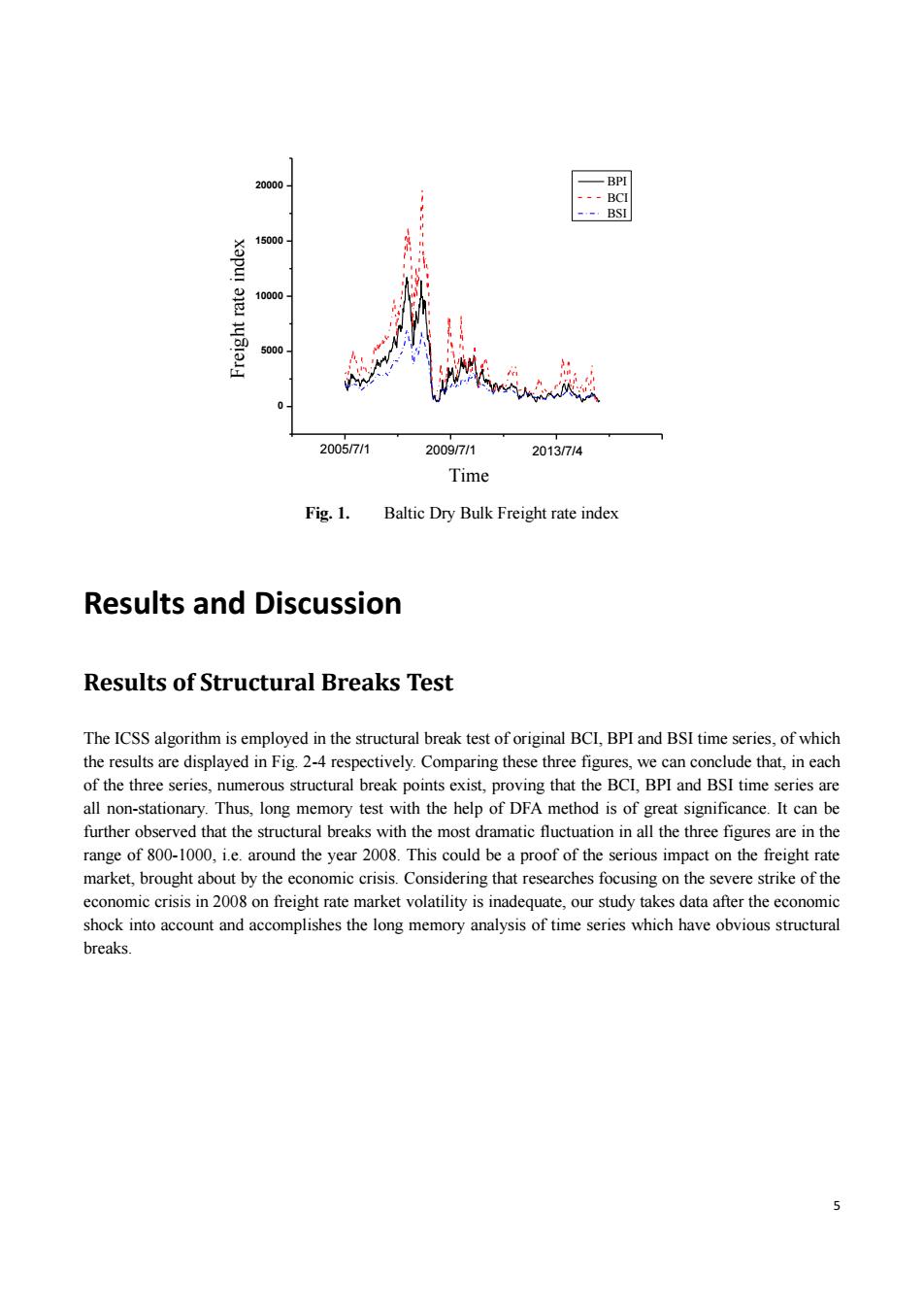

20000 -BPI ---BCI --BSI 15000 10000 5000 2005/7/1 2009/7/1 2013/7/4 Time Fig.1. Baltic Dry Bulk Freight rate index Results and Discussion Results of Structural Breaks Test The ICSS algorithm is employed in the structural break test of original BCI,BPI and BSI time series,of which the results are displayed in Fig.2-4 respectively.Comparing these three figures,we can conclude that,in each of the three series,numerous structural break points exist,proving that the BCI,BPI and BSI time series are all non-stationary.Thus,long memory test with the help of DFA method is of great significance.It can be further observed that the structural breaks with the most dramatic fluctuation in all the three figures are in the range of 800-1000,i.e.around the year 2008.This could be a proof of the serious impact on the freight rate market,brought about by the economic crisis.Considering that researches focusing on the severe strike of the economic crisis in 2008 on freight rate market volatility is inadequate,our study takes data after the economic shock into account and accomplishes the long memory analysis of time series which have obvious structural breaks. 55 0 5000 10000 15000 20000 2009/7/1 2013/7/4 Freight rate index Time BPI BCI BSI 2005/7/1 Fig. 1. Baltic Dry Bulk Freight rate index Results and Discussion Results of Structural Breaks Test The ICSS algorithm is employed in the structural break test of original BCI, BPI and BSI time series, of which the results are displayed in Fig. 2-4 respectively. Comparing these three figures, we can conclude that, in each of the three series, numerous structural break points exist, proving that the BCI, BPI and BSI time series are all non-stationary. Thus, long memory test with the help of DFA method is of great significance. It can be further observed that the structural breaks with the most dramatic fluctuation in all the three figures are in the range of 800-1000, i.e. around the year 2008. This could be a proof of the serious impact on the freight rate market, brought about by the economic crisis. Considering that researches focusing on the severe strike of the economic crisis in 2008 on freight rate market volatility is inadequate, our study takes data after the economic shock into account and accomplishes the long memory analysis of time series which have obvious structural breaks