正在加载图片...

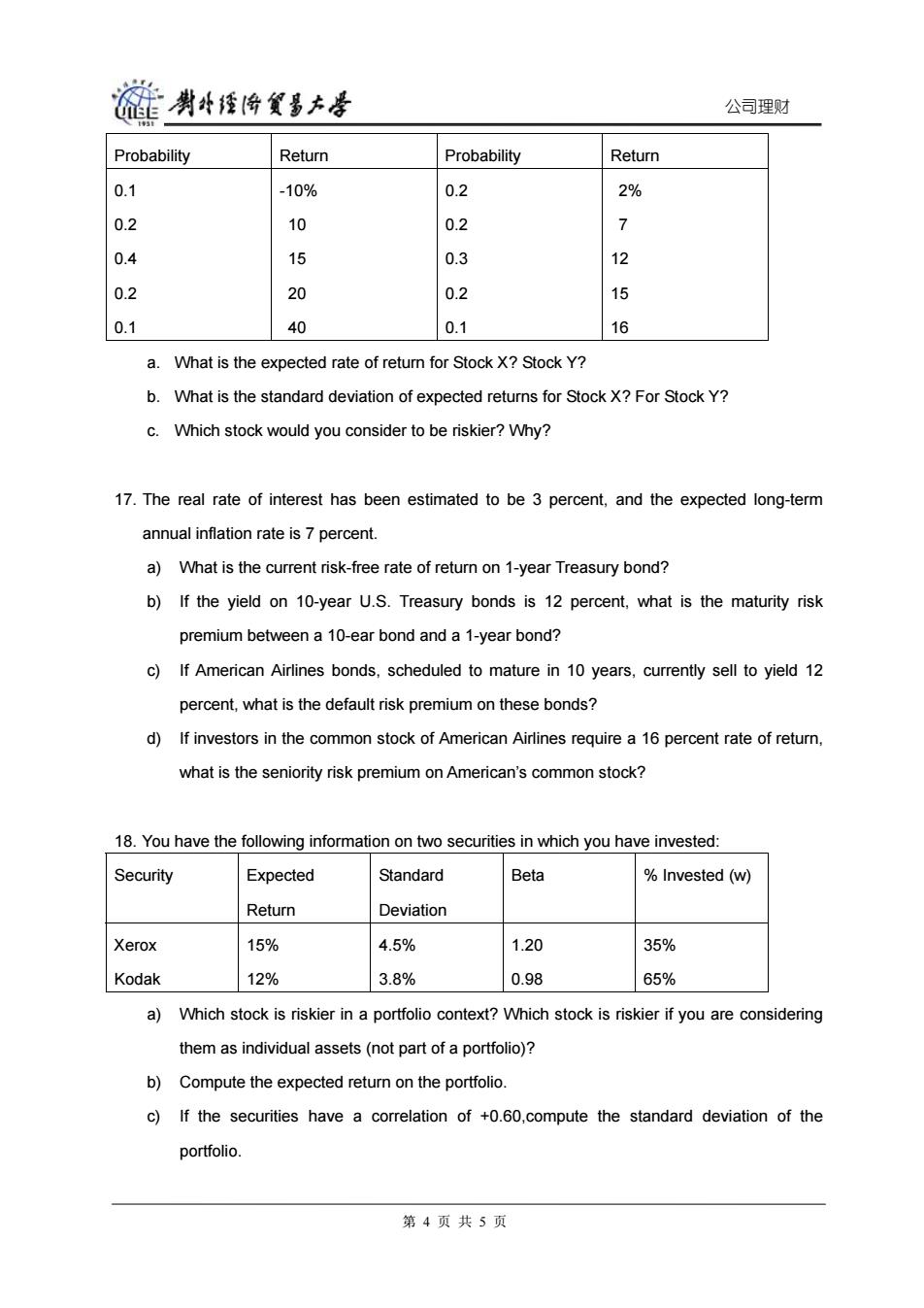

旋剥经降贸多去号 公司理财 Probability Return Probability Return 0.1 -10% 0.2 2% 0.2 10 0.2 7 0.4 15 0.3 12 0.2 20 0.2 15 0.1 40 0.1 16 a. What is the expected rate of return for Stock X?Stock Y? b.What is the standard deviation of expected returns for Stock X?For Stock Y? c.Which stock would you consider to be riskier?Why? 17.The real rate of interest has been estimated to be 3 percent,and the expected long-term annual inflation rate is 7 percent. a)What is the current risk-free rate of return on 1-year Treasury bond? b)If the yield on 10-year U.S.Treasury bonds is 12 percent,what is the maturity risk premium between a 10-ear bond and a 1-year bond? c)If American Airlines bonds,scheduled to mature in 10 years,currently sell to yield 12 percent,what is the default risk premium on these bonds? d)If investors in the common stock of American Airlines require a 16 percent rate of return, what is the seniority risk premium on American's common stock? 18.You have the following information on two securities in which you have invested: Security Expected Standard Beta Invested (w) Return Deviation Xerox 15% 4.5% 1.20 35% Kodak 12% 3.8% 0.98 65% a) Which stock is riskier in a portfolio context?Which stock is riskier if you are considering them as individual assets(not part of a portfolio)? b)Compute the expected return on the portfolio. c)If the securities have a correlation of +0.60,compute the standard deviation of the portfolio. 第4页共5页公司理财 Probability Return Probability Return 0.1 0.2 0.4 0.2 0.1 -10% 10 15 20 40 0.2 0.2 0.3 0.2 0.1 2% 7 12 15 16 a. What is the expected rate of return for Stock X? Stock Y? b. What is the standard deviation of expected returns for Stock X? For Stock Y? c. Which stock would you consider to be riskier? Why? 17. The real rate of interest has been estimated to be 3 percent, and the expected long-term annual inflation rate is 7 percent. a) What is the current risk-free rate of return on 1-year Treasury bond? b) If the yield on 10-year U.S. Treasury bonds is 12 percent, what is the maturity risk premium between a 10-ear bond and a 1-year bond? c) If American Airlines bonds, scheduled to mature in 10 years, currently sell to yield 12 percent, what is the default risk premium on these bonds? d) If investors in the common stock of American Airlines require a 16 percent rate of return, what is the seniority risk premium on American’s common stock? 18. You have the following information on two securities in which you have invested: Security Expected Return Standard Deviation Beta % Invested (w) Xerox Kodak 15% 12% 4.5% 3.8% 1.20 0.98 35% 65% a) Which stock is riskier in a portfolio context? Which stock is riskier if you are considering them as individual assets (not part of a portfolio)? b) Compute the expected return on the portfolio. c) If the securities have a correlation of +0.60,compute the standard deviation of the portfolio. 第 4 页 共 5 页