正在加载图片...

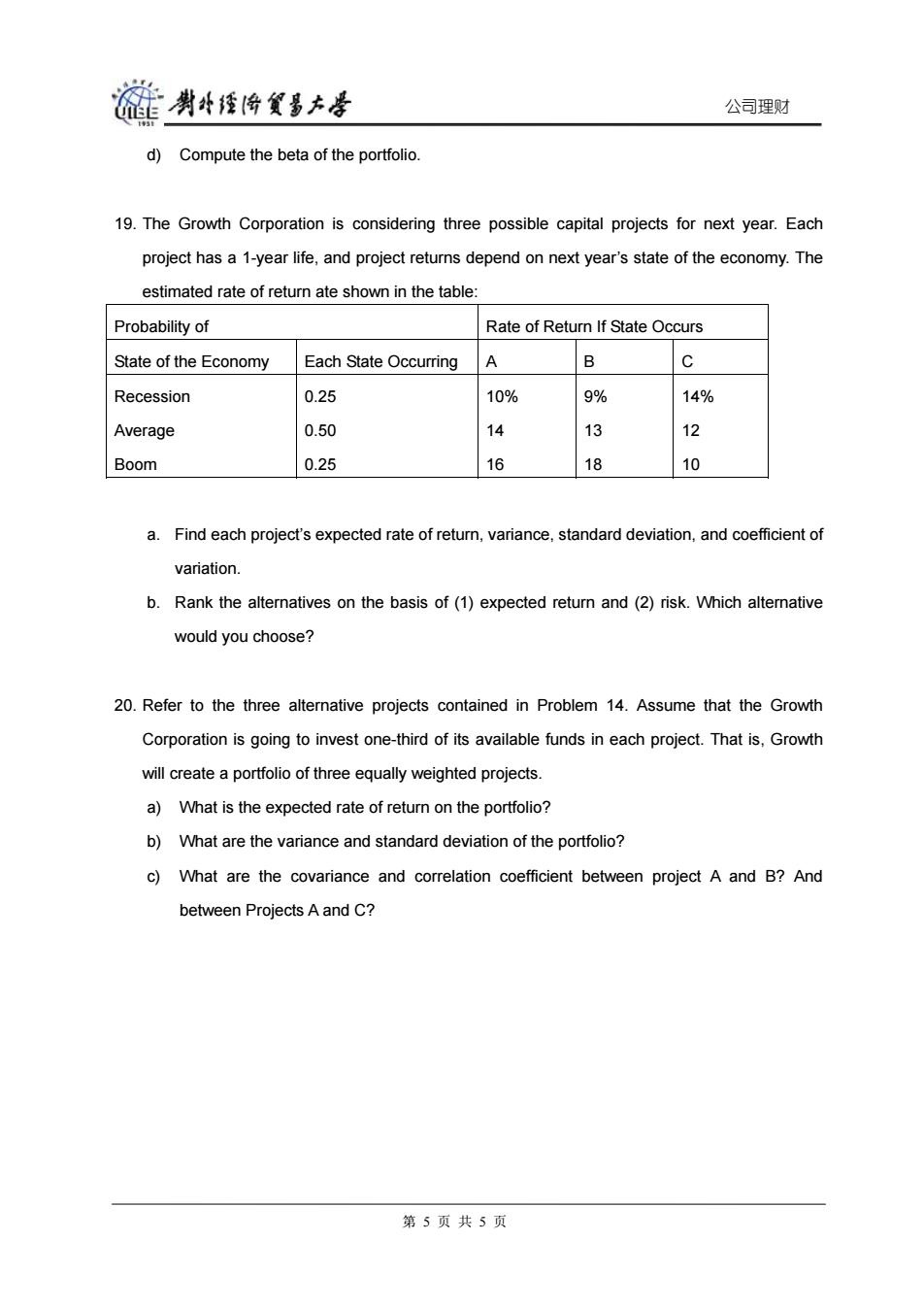

莲喇母透悔贸男大岸 公司理财 d)Compute the beta of the portfolio. 19.The Growth Corporation is considering three possible capital projects for next year.Each project has a 1-year life,and project returns depend on next year's state of the economy.The estimated rate of return ate shown in the table: Probability of Rate of Return If State Occurs State of the Economy Each State Occurring A B C Recession 0.25 10% 9% 14% Average 0.50 14 13 12 Boom 0.25 16 18 10 a.Find each project's expected rate of return,variance.standard deviation,and coefficient of variation b.Rank the alternatives on the basis of(1)expected return and(2)risk.Which alternative would you choose? 20.Refer to the three alternative projects contained in Problem 14.Assume that the Growth Corporation is going to invest one-third of its available funds in each project.That is,Growth will create a portfolio of three equally weighted projects. a)What is the expected rate of return on the portfolio? b)What are the variance and standard deviation of the portfolio? c)What are the covariance and correlation coefficient between project A and B?And between Projects A and C? 第5页共5页公司理财 d) Compute the beta of the portfolio. 19. The Growth Corporation is considering three possible capital projects for next year. Each project has a 1-year life, and project returns depend on next year’s state of the economy. The estimated rate of return ate shown in the table: Probability of Rate of Return If State Occurs State of the Economy Each State Occurring A B C Recession Average Boom 0.25 0.50 0.25 10% 14 16 9% 13 18 14% 12 10 a. Find each project’s expected rate of return, variance, standard deviation, and coefficient of variation. b. Rank the alternatives on the basis of (1) expected return and (2) risk. Which alternative would you choose? 20. Refer to the three alternative projects contained in Problem 14. Assume that the Growth Corporation is going to invest one-third of its available funds in each project. That is, Growth will create a portfolio of three equally weighted projects. a) What is the expected rate of return on the portfolio? b) What are the variance and standard deviation of the portfolio? c) What are the covariance and correlation coefficient between project A and B? And between Projects A and C? 第 5 页 共 5 页