正在加载图片...

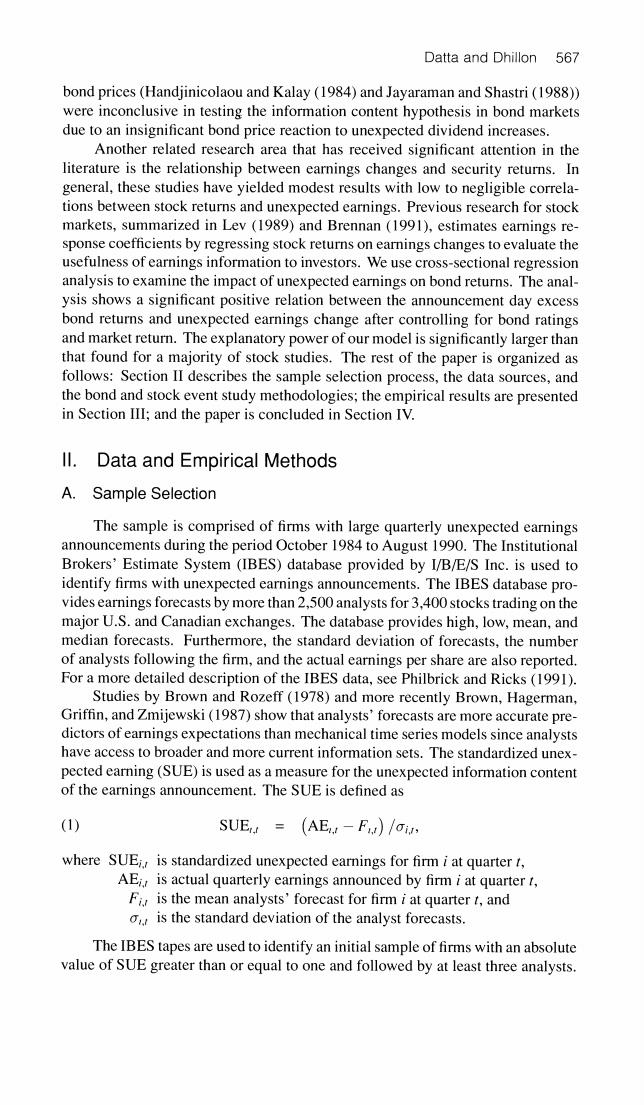

Datta and Dhillon 567 bond prices (Handjinicolaou and Kalay (1984)and Jayaraman and Shastri(1988)) were inconclusive in testing the information content hypothesis in bond markets due to an insignificant bond price reaction to unexpected dividend increases. Another related research area that has received significant attention in the literature is the relationship between earnings changes and security returns.In general,these studies have yielded modest results with low to negligible correla- tions between stock returns and unexpected earnings.Previous research for stock markets,summarized in Lev (1989)and Brennan (1991),estimates earnings re- sponse coefficients by regressing stock returns on earnings changes to evaluate the usefulness of earnings information to investors.We use cross-sectional regression analysis to examine the impact of unexpected earnings on bond returns.The anal- ysis shows a significant positive relation between the announcement day excess bond returns and unexpected earnings change after controlling for bond ratings and market return.The explanatory power of our model is significantly larger than that found for a majority of stock studies.The rest of the paper is organized as follows:Section II describes the sample selection process,the data sources,and the bond and stock event study methodologies;the empirical results are presented in Section III;and the paper is concluded in Section IV. l. Data and Empirical Methods A.Sample Selection The sample is comprised of firms with large quarterly unexpected earnings announcements during the period October 1984 to August 1990.The Institutional Brokers'Estimate System (IBES)database provided by I/B/E/S Inc.is used to identify firms with unexpected earnings announcements.The IBES database pro- vides earnings forecasts by more than 2,500 analysts for 3,400 stocks trading on the major U.S.and Canadian exchanges.The database provides high,low,mean,and median forecasts.Furthermore,the standard deviation of forecasts,the number of analysts following the firm,and the actual earnings per share are also reported. For a more detailed description of the IBES data,see Philbrick and Ricks (1991). Studies by Brown and Rozeff(1978)and more recently Brown,Hagerman, Griffin,and Zmijewski(1987)show that analysts'forecasts are more accurate pre- dictors of earnings expectations than mechanical time series models since analysts have access to broader and more current information sets.The standardized unex- pected earning(SUE)is used as a measure for the unexpected information content of the earnings announcement.The SUE is defined as (1) SUE (AE!-F)/in, where SUEi,is standardized unexpected earnings for firm i at quarter t, AEi,is actual quarterly earnings announced by firm i at quarter t, Fi is the mean analysts'forecast for firm i at quarter t,and o,.is the standard deviation of the analyst forecasts. The IBES tapes are used to identify an initial sample of firms with an absolute value of SUE greater than or equal to one and followed by at least three analysts