正在加载图片...

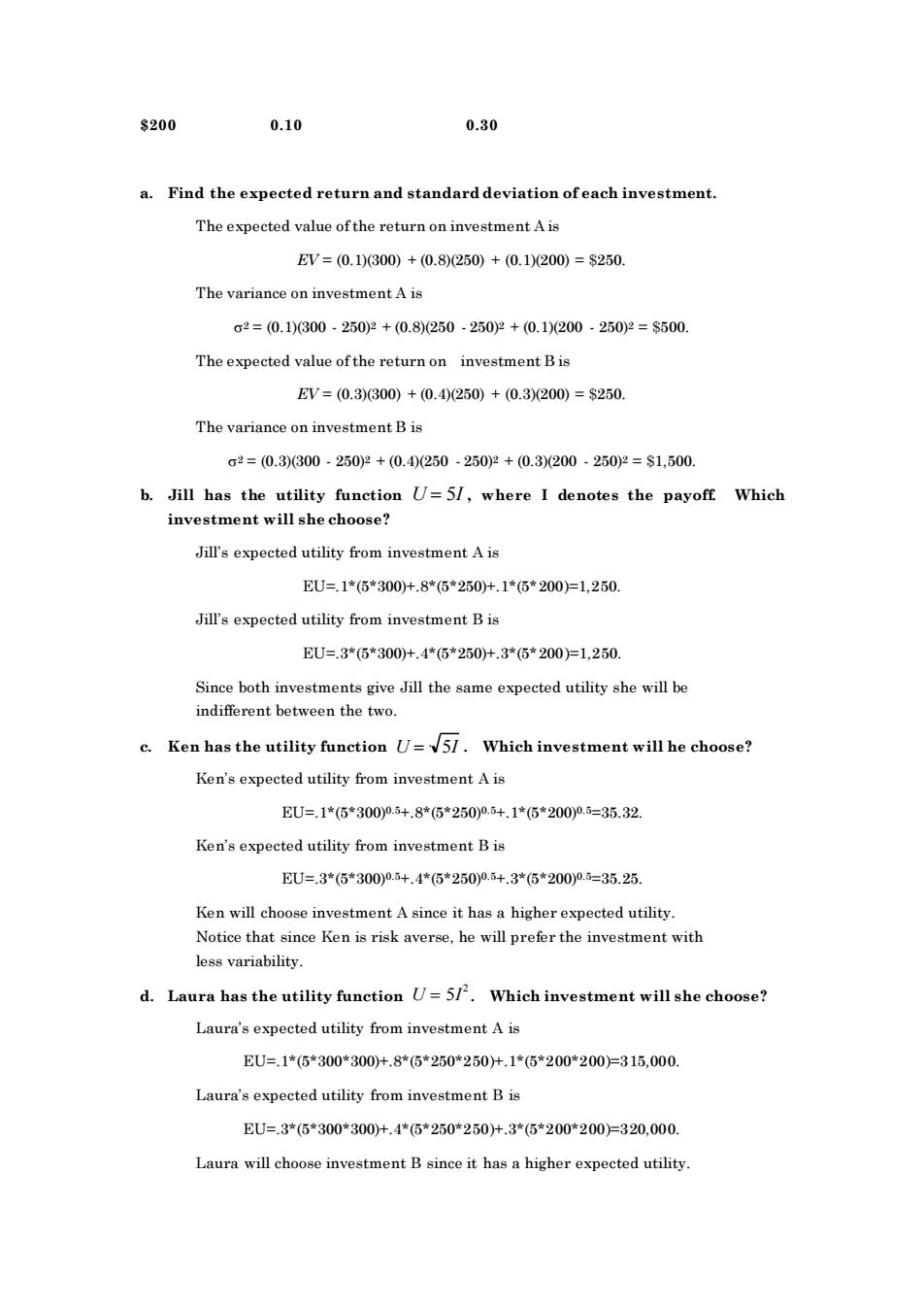

8200 0.10 0.30 a.Find the expected return and standard deviation ofeach investment The expected value ofthe return on investment Ais EV=0.1300)+(0.8250)+(0.1200)=s250 The variance on investment A is 2=(0.1300-250+(0.8250-2502+(0.1200-250P=$500 The expected value ofthe return on investment Bis EV=(0.3)300)+(0.4250)+(0.3200)=s250 The variance on investment B is 2=(0.3)300250p2+(0.4250-250y+0.3)200250p=$1,500 b.Jill has the utility function U=5/,where I denotes the payoff Which investment will she choose? Jill's expected utility from investment A is EU=.1*6*300)+.8*6*250)+.1*6*200=1,250. Jill's expected utility from investment B is EU=,3*(6*300+.4*(6*250+.3*(6*200)=1,250. Since both investments give Jill the same expected utility she will be indifferent between the two. c.Ken has the utility function U=5/.Which investment will he choose? Ken's expected utility from investment A is EU=.1*(5*300)0.5+.8*(5*250)0.5+.1*(5*200)0.5=35.32 Ken's expected utility from investment B is EU=.3*(5*3000.5+.4*(6*2500.+.3*(6*2000.5=35.25. ken will choose investment a since it has a higher expected utility Notice that since Ken is risk averse,he will prefer the investment with less variability. d.Laura has the utility function U=5/.Which investment will she choose? Laura's expected utility from investment Ais EU=.1*(6*300*300+.8*6*250*250)+.1*6*200*200=315,000 Laura's expected utility from investment B is EU=.3*(6*300*300+.4*(6*250*250)+.3*(6*200*200=320,000 Laura will choose investment B since it has a higher expected utility$200 0.10 0.30 a. Find the expected return and standard deviation of each investment. The expected value of the return on investment A is EV = (0.1)(300) + (0.8)(250) + (0.1)(200) = $250. The variance on investment A is 2 = (0.1)(300 - 250)2 + (0.8)(250 - 250)2 + (0.1)(200 - 250)2 = $500. The expected value of the return on investment B is EV = (0.3)(300) + (0.4)(250) + (0.3)(200) = $250. The variance on investment B is 2 = (0.3)(300 - 250)2 + (0.4)(250 - 250)2 + (0.3)(200 - 250)2 = $1,500. b. Jill has the utility function U = 5I , where I denotes the payoff. Which investment will she choose? Jill’s expected utility from investment A is EU=.1*(5*300)+.8*(5*250)+.1*(5*200)=1,250. Jill’s expected utility from investment B is EU=.3*(5*300)+.4*(5*250)+.3*(5*200)=1,250. Since both investments give Jill the same expected utility she will be indifferent between the two. c. Ken has the utility function U = 5I . Which investment will he choose? Ken’s expected utility from investment A is EU=.1*(5*300)0.5+.8*(5*250)0.5+.1*(5*200)0.5=35.32. Ken’s expected utility from investment B is EU=.3*(5*300)0.5+.4*(5*250)0.5+.3*(5*200)0.5=35.25. Ken will choose investment A since it has a higher expected utility. Notice that since Ken is risk averse, he will prefer the investment with less variability. d. Laura has the utility function U = 5I 2 . Which investment will she choose? Laura’s expected utility from investment A is EU=.1*(5*300*300)+.8*(5*250*250)+.1*(5*200*200)=315,000. Laura’s expected utility from investment B is EU=.3*(5*300*300)+.4*(5*250*250)+.3*(5*200*200)=320,000. Laura will choose investment B since it has a higher expected utility