正在加载图片...

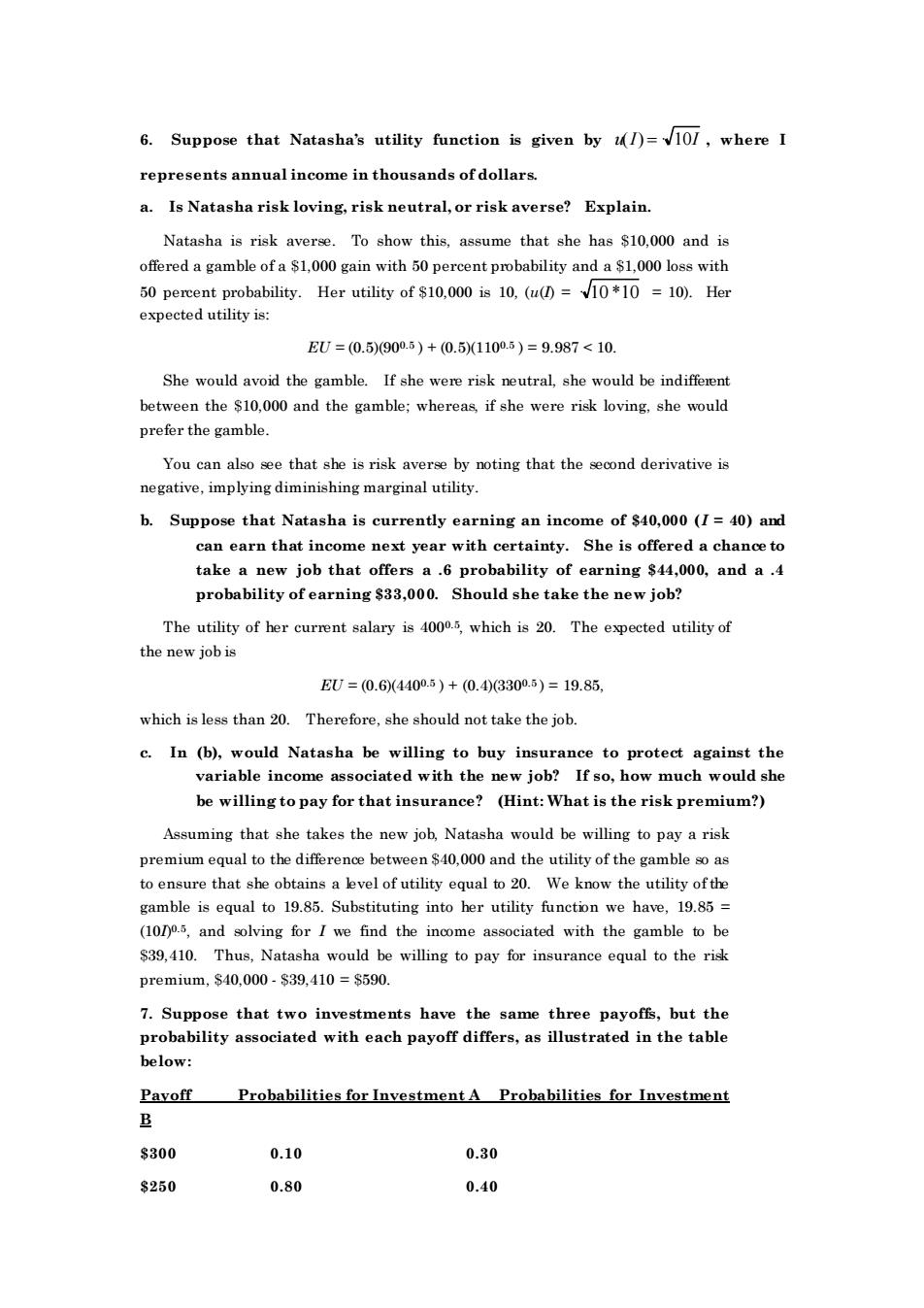

6.Suppose that Natasha's utility function is given by)=107,where I represents annual income in thousands of dollars. a.Is Natasha risk loving,risk neutral,or risk averse?Explain. Natasha is risk averse.To show this,assume that she has $10.000 and is offered a gamble of a $1,000 gain with 50 percent pmobability and a S1,000 loss with 50 percent probability.Her utility of $10.000 is 10.(u(=10*1010).Her expected utility is: EU=0.59006)+0.51100.6)=9.987<10 She would avoid the gamble.If she were risk neutral,she would be indifferent between the $10.000 and the gamble:whereas if she were risk loving.she would You can also see that she is risk averse by noting that the second derivative is negative,implying diminishing marginal utility. b.Suppose that Natasha is currently earning an income of $40,000(I=40)and can earn that income next year with certainty.She is offered a chance to take a new job that offers a .6 probability of earning $44.000,and a.4 probability of earning $33.000.Should she take the new job? The utility of her current salary iswhich is 20.The expected utility of the new job is EU=0.6440.5)+0.4330.)=19.85 which is less than 20.Therefore,she should not take the job. c.In (b),would Natasha be willing to buy insurance to protect against the variable income associated with the new job?If so,how much would she be willing to pay for that insurance?(Hint:What is the risk premium?) Assuming that she takes the new job,Natasha would be willing to pay a risk sa kvel of utility equalo bleequal to 19.85.Substituting into her utility function we have. (101p.s,and solving for I we find the income associated with the gamble to be $39.410.Thus.Natasha would be willing to pay for insurance equal to the risk premium.S40.000-S39,410=$590 7.Suppose that two investments have the same three pavoffs.but the sociated with each payoff differs,as illustrated in the table Probabilities for Investment A Probabilities for Investment 旦 $300 0.10 0.30 $250 0.80 0.40 6. Suppose that Natasha’s utility function is given by u(I) = 10I , where I represents annual income in thousands of dollars. a. Is Natasha risk loving, risk neutral, or risk averse? Explain. Natasha is risk averse. To show this, assume that she has $10,000 and is offered a gamble of a $1,000 gain with 50 percent probability and a $1,000 loss with 50 percent probability. Her utility of $10,000 is 10, (u(I) = 10 *10 = 10). Her expected utility is: EU = (0.5)(900.5 ) + (0.5)(1100.5 ) = 9.987 < 10. She would avoid the gamble. If she were risk neutral, she would be indifferent between the $10,000 and the gamble; whereas, if she were risk loving, she would prefer the gamble. You can also see that she is risk averse by noting that the second derivative is negative, implying diminishing marginal utility. b. Suppose that Natasha is currently earning an income of $40,000 (I = 40) and can earn that income next year with certainty. She is offered a chance to take a new job that offers a .6 probability of earning $44,000, and a .4 probability of earning $33,000. Should she take the new job? The utility of her current salary is 4000.5, which is 20. The expected utility of the new job is EU = (0.6)(4400.5 ) + (0.4)(3300.5 ) = 19.85, which is less than 20. Therefore, she should not take the job. c. In (b), would Natasha be willing to buy insurance to protect against the variable income associated with the new job? If so, how much would she be willing to pay for that insurance? (Hint: What is the risk premium?) Assuming that she takes the new job, Natasha would be willing to pay a risk premium equal to the difference between $40,000 and the utility of the gamble so as to ensure that she obtains a level of utility equal to 20. We know the utility of the gamble is equal to 19.85. Substituting into her utility function we have, 19.85 = (10I) 0.5, and solving for I we find the income associated with the gamble to be $39,410. Thus, Natasha would be willing to pay for insurance equal to the risk premium, $40,000 - $39,410 = $590. 7. Suppose that two investments have the same three payoffs, but the probability associated with each payoff differs, as illustrated in the table below: Payoff Probabilities for Investment A Probabilities for Investment B $300 0.10 0.30 $250 0.80 0.40