正在加载图片...

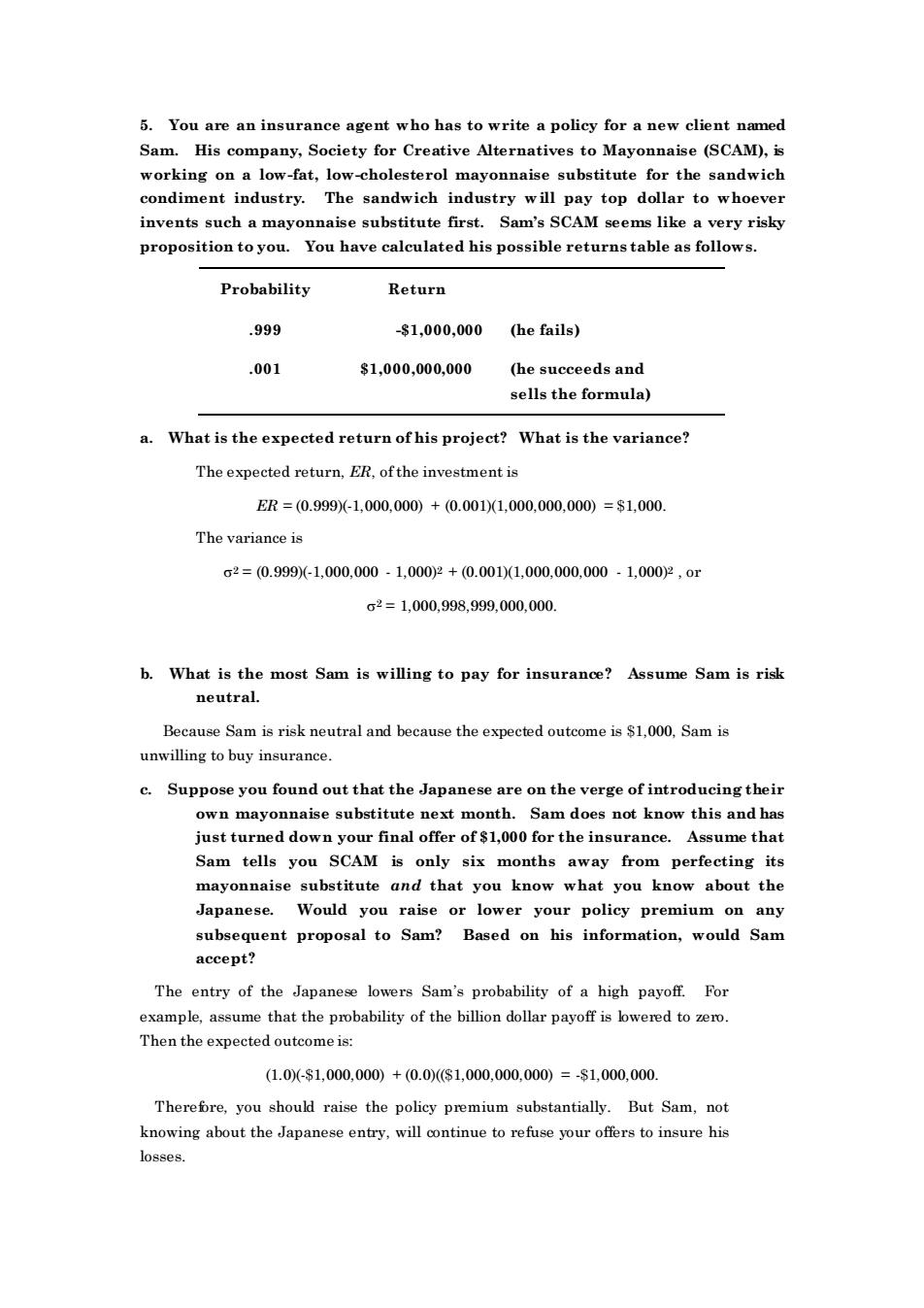

5.You are an insurance agent who has to write a policy for a new client named Sam.His company,Society for Creative Alternatives to Mayonnaise (SCAM), working on a low-fat,low-chol sterol mayonnaise substitute for the sandwich condiment industry.The sandwich industry will pay top dollar to whoever invents such a mayonnaise substitute first.Sam's SCAM seems like a very risky proposition to you.You have calculated his possible returns table as follows. Probability Return ,999 -81,000,000 (he fails) .001 $1.000.000.000 (he succeeds and sells the formula a.What is the expected return of his project?What is the variance? The expected return,ER,ofthe investment is ER=(0.999-1,000.000)+0.001)1,000.000,000)=$1.000 The variance is 2=(0.999-1,000,000.1.000y2+0.0011,000,000,000.1.000y,0 c2=1,000,998,999.000,000 b.What is the most Sam is willing to pay for insurance?Assume Sam is risk neutral. Because Sam is risk neutral and because the expected outcome is S1,000.Sam is unwilling to buy insurance. e.Suppose you found out that the Japanese are on the verge of introducing their onnaise substitute next month.Sam does not know this and has j扣stur ed do nal offer ssume that Sam tells you SCAM is only six months away from perfecting its mayonnaise substitute and that you know what you know about the Japanese.Would you raise or lower your policy premium on any subsequent proposal to Sam?Based on his information,would Sam accept? The entry of the Japanese lowers Sam's probability of a high payoff.For example,assume that the probability of the billion dollar payoff is owered to. Then the expected outcome is: (1.0-s1,000,000)+(0.0s1,000,000,000)=-$1,000,000. Therefre,you should raise the policy premium substantially.But Sam,not knowing about the Japanese entry,will continue to refuse your offers to insure his losses」5. You are an insurance agent who has to write a policy for a new client named Sam. His company, Society for Creative Alternatives to Mayonnaise (SCAM), is working on a low-fat, low-cholesterol mayonnaise substitute for the sandwich condiment industry. The sandwich industry will pay top dollar to whoever invents such a mayonnaise substitute first. Sam’s SCAM seems like a very risky proposition to you. You have calculated his possible returns table as follows. Probability Return .999 -$1,000,000 (he fails) .001 $1,000,000,000 (he succeeds and sells the formula) a. What is the expected return of his project? What is the variance? The expected return, ER, of the investment is ER = (0.999)(-1,000,000) + (0.001)(1,000,000,000) = $1,000. The variance is 2 = (0.999)(-1,000,000 - 1,000)2 + (0.001)(1,000,000,000 - 1,000)2 , or 2 = 1,000,998,999,000,000. b. What is the most Sam is willing to pay for insurance? Assume Sam is risk neutral. Because Sam is risk neutral and because the expected outcome is $1,000, Sam is unwilling to buy insurance. c. Suppose you found out that the Japanese are on the verge of introducing their own mayonnaise substitute next month. Sam does not know this and has just turned down your final offer of $1,000 for the insurance. Assume that Sam tells you SCAM is only six months away from perfecting its mayonnaise substitute and that you know what you know about the Japanese. Would you raise or lower your policy premium on any subsequent proposal to Sam? Based on his information, would Sam accept? The entry of the Japanese lowers Sam’s probability of a high payoff. For example, assume that the probability of the billion dollar payoff is lowered to zero. Then the expected outcome is: (1.0)(-$1,000,000) + (0.0)(($1,000,000,000) = -$1,000,000. Therefore, you should raise the policy premium substantially. But Sam, not knowing about the Japanese entry, will continue to refuse your offers to insure his losses