正在加载图片...

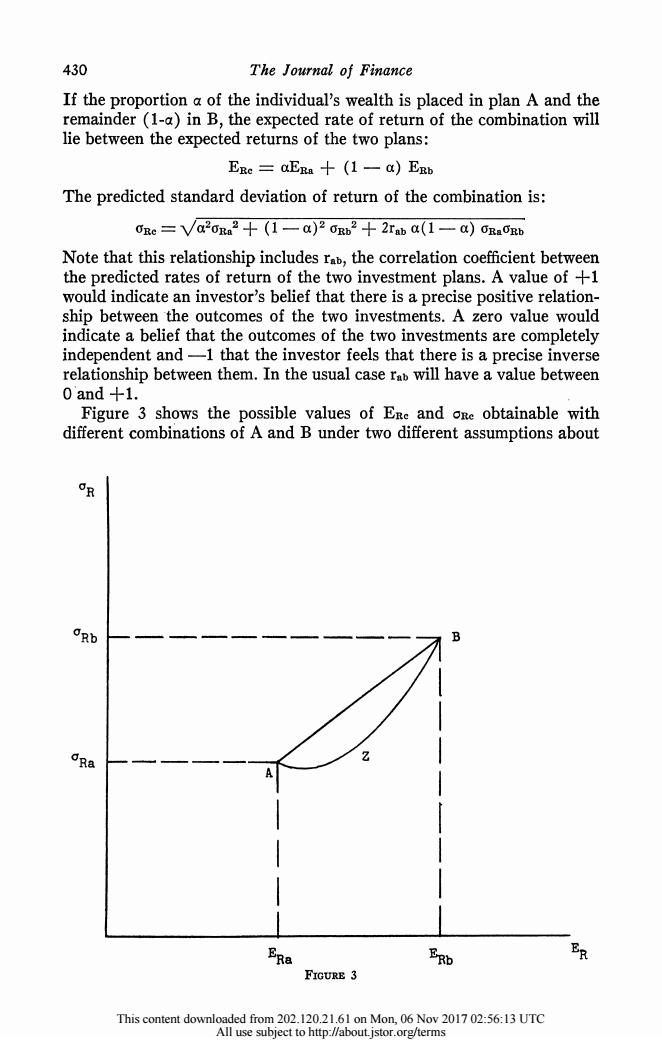

430 The Journal of Finance If the proportion a of the individual's wealth is placed in plan A and the remainder(1-a)in B,the expected rate of return of the combination will lie between the expected returns of the two plans: ERe=aERa十(1一a)ERb The predicted standard deviation of return of the combination is: 0Re=Va2ora2十(1一a)20rb2+2raba(1一a)Ragb Note that this relationship includes rab,the correlation coefficient between the predicted rates of return of the two investment plans.A value of +1 would indicate an investor's belief that there is a precise positive relation- ship between the outcomes of the two investments.A zero value would indicate a belief that the outcomes of the two investments are completely independent and-1 that the investor feels that there is a precise inverse relationship between them.In the usual case rab will have a value between 0 and +1. Figure 3 shows the possible values of Ere and oRe obtainable with different combinations of A and B under two different assumptions about oRb 0R3 Z pRo 如 FIGURE 3 This content downloaded from 202.120.21.61 on Mon,06 Nov 2017 02:56:13 UTC All use subject to http://about.istor.org/terms430 The Journal of Finance If the proportion a of the individual's wealth is placed in plan A and the remainder (1-a) in B, the expected rate of return of the combination will lie between the expected returns of the two plans: ER= aERa + (1 a) ERb The predicted standard deviation of return of the combination is: RC Va2Ra 2 + (1 a)2 Rb2 + 2rab a(1 - a) CRaORb Note that this relationship includes rab, the correlation coefficient between the predicted rates of return of the two investment plans. A value of +1 would indicate an investor's belief that there is a precise positive relation- ship between 'the outcomes of the two investments. A zero value would indicate a belief that the outcomes of the two investments are completely independent and -1 that the investor feels that there is a precise inverse relationship between them. In the usual case rab will have a value between o and +1. Figure 3 shows the possible values of ERc and ORC obtainable with different combinations of A and B under two different assumptions about OR aRb -B CRa- I I l I I I ERa ERb ER FIGURE 3 This content downloaded from 202.120.21.61 on Mon, 06 Nov 2017 02:56:13 UTC All use subject to http://about.jstor.org/terms