正在加载图片...

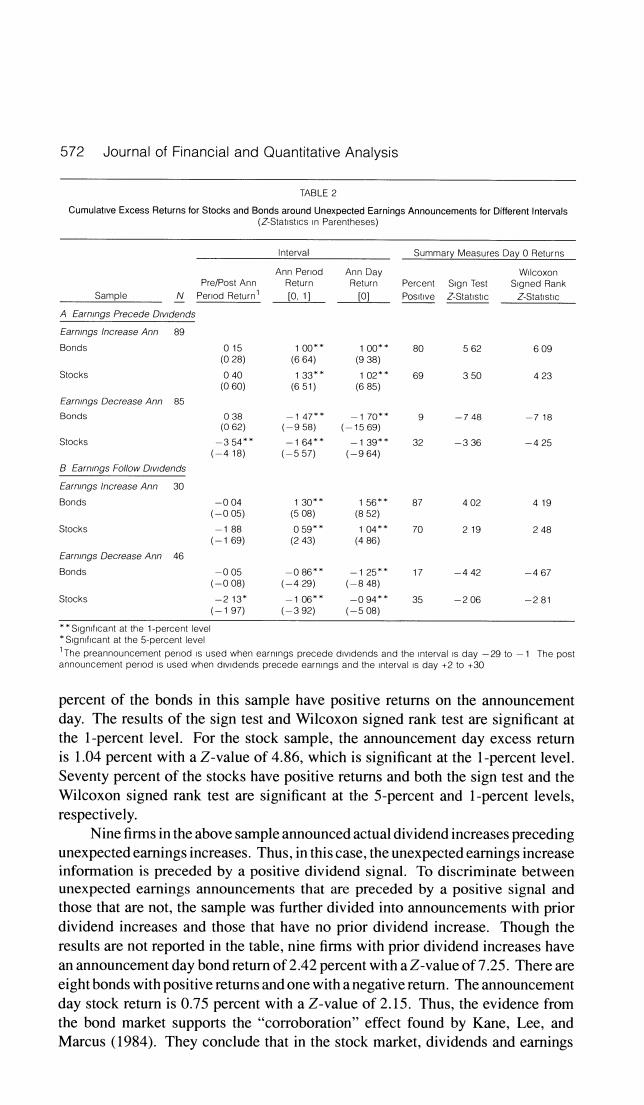

572 Journal of Financial and Quantitative Analysis TABLE 2 Cumulative Excess Returns for Stocks and Bonds around Unexpected Earnings Announcements for Different Intervals (Z-Statistics in Parentheses) Interval Summary Measures Day 0 Returns Ann Penod Ann Day Wilcoxon Pre/Post Ann Return Return Percent Sign Test Signed Rank Sample N Period Return 0.1] o] Positive 2-Statistic Z-Statistic A Earnings Precede Drvidends Earnings Increase Ann 89 Bonds 015 100*· 100*+ 80 562 609 (028) (664) (938) Stocks 040 133** 102*+ 69 350 423 (060) 651) (685) Earnings Decrease Ann 85 Bonds 029 -147年 -170*中 9 -748 -718 (062) (-958) (-1569) Stocks -354* -164*4 -139** 32 -336 -425 (-418) (-557) (-964) B Earnings Follow Drvidends Earnings increase Ann 30 Bonds -004 130* 156** 402 419 (-005) (508) (852) Stocks -188 059✉ 104*· 70 219 248 (-169) (243) {486) Earnings Decrease Ann 46 Bonds -005 -086*- -125* 17 -442 -467 (-008) (-429) (-848) Stocks -213 -106" -094*4 的 -206 -281 (-197 (-392) (-508) Signcant at the 1-percent level Significant at the 5-percent level 1The preannouncement penod is used when earnings precede divdends and the interval is day-29 to-1 The post announcement perod is used when divdends precede earnings and the interval is day +2 to +30 percent of the bonds in this sample have positive returns on the announcement day.The results of the sign test and Wilcoxon signed rank test are significant at the 1-percent level.For the stock sample,the announcement day excess return is 1.04 percent with a Z-value of 4.86,which is significant at the 1-percent level. Seventy percent of the stocks have positive returns and both the sign test and the Wilcoxon signed rank test are significant at the 5-percent and 1-percent levels, respectively. Nine firms in the above sample announced actual dividend increases preceding unexpected earnings increases.Thus,in this case,the unexpected earnings increase information is preceded by a positive dividend signal.To discriminate between unexpected earnings announcements that are preceded by a positive signal and those that are not,the sample was further divided into announcements with prior dividend increases and those that have no prior dividend increase.Though the results are not reported in the table,nine firms with prior dividend increases have an announcement day bond return of 2.42 percent with a Z-value of 7.25.There are eight bonds with positive returns and one with a negative return.The announcement day stock return is 0.75 percent with a Z-value of 2.15.Thus,the evidence from the bond market supports the "corroboration"effect found by Kane,Lee,and Marcus(1984).They conclude that in the stock market,dividends and earnings