正在加载图片...

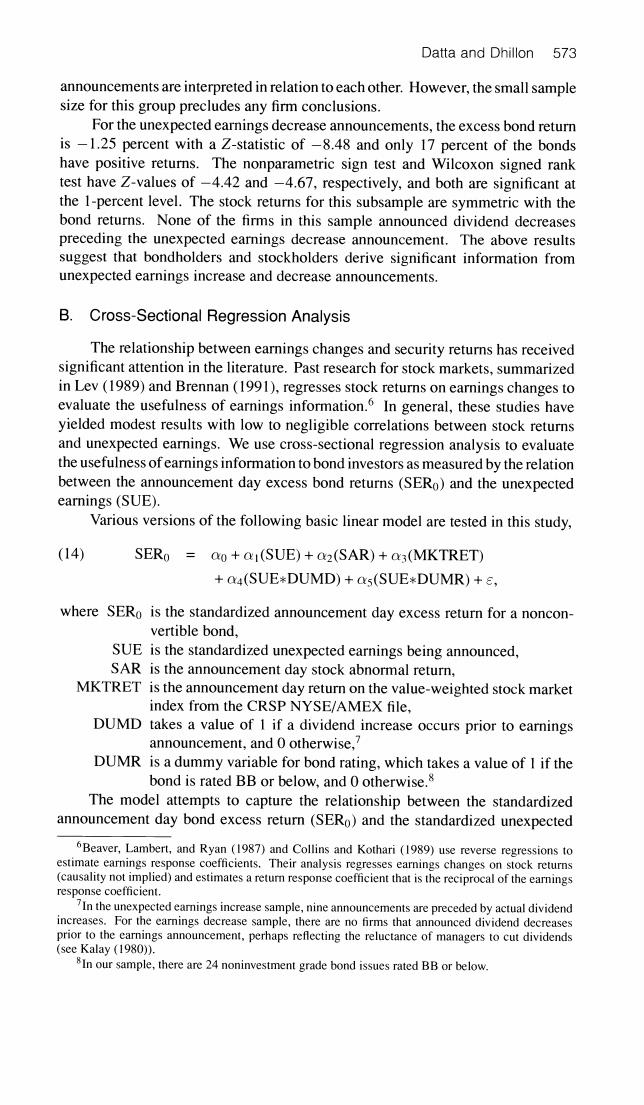

Datta and Dhillon 573 announcements are interpreted in relation to each other.However,the small sample size for this group precludes any firm conclusions. For the unexpected earnings decrease announcements,the excess bond return is -1.25 percent with a Z-statistic of-8.48 and only 17 percent of the bonds have positive returns.The nonparametric sign test and Wilcoxon signed rank test have Z-values of-4.42 and-4.67,respectively,and both are significant at the 1-percent level.The stock returns for this subsample are symmetric with the bond returns.None of the firms in this sample announced dividend decreases preceding the unexpected earnings decrease announcement.The above results suggest that bondholders and stockholders derive significant information from unexpected earnings increase and decrease announcements. B.Cross-Sectional Regression Analysis The relationship between earnings changes and security returns has received significant attention in the literature.Past research for stock markets,summarized in Lev(1989)and Brennan (1991),regresses stock returns on earnings changes to evaluate the usefulness of earnings information.In general,these studies have yielded modest results with low to negligible correlations between stock returns and unexpected earnings.We use cross-sectional regression analysis to evaluate the usefulness of earnings information to bond investors as measured by the relation between the announcement day excess bond returns (SERo)and the unexpected earnings(SUE). Various versions of the following basic linear model are tested in this study, (14) SERo ao+(SUE)+02(SAR)+03(MKTRET) +a4(SUE*DUMD)+as(SUE*DUMR)+s, where SERo is the standardized announcement day excess return for a noncon- vertible bond, SUE is the standardized unexpected earnings being announced, SAR is the announcement day stock abnormal return, MKTRET is the announcement day return on the value-weighted stock market index from the CRSP NYSE/AMEX file, DUMD takes a value of 1 if a dividend increase occurs prior to earnings announcement,and 0 otherwise,? DUMR is a dummy variable for bond rating,which takes a value of I if the bond is rated BB or below,and 0 otherwise.8 The model attempts to capture the relationship between the standardized announcement day bond excess return (SERo)and the standardized unexpected 6Beaver,Lambert,and Ryan (1987)and Collins and Kothari(1989)use reverse regressions to estimate earnings response coefficients.Their analysis regresses earnings changes on stock returns (causality not implied)and estimates a retur response coefficient that is the reciprocal of the earnings response coefficient. 7In the unexpected earnings increase sample,nine announcements are preceded by actual dividend increases.For the earnings decrease sample,there are no firms that announced dividend decreases prior to the earnings announcement,perhaps reflecting the reluctance of managers to cut dividends (see Kalay (1980)). 8In our sample,there are 24 noninvestment grade bond issues rated BB or below