正在加载图片...

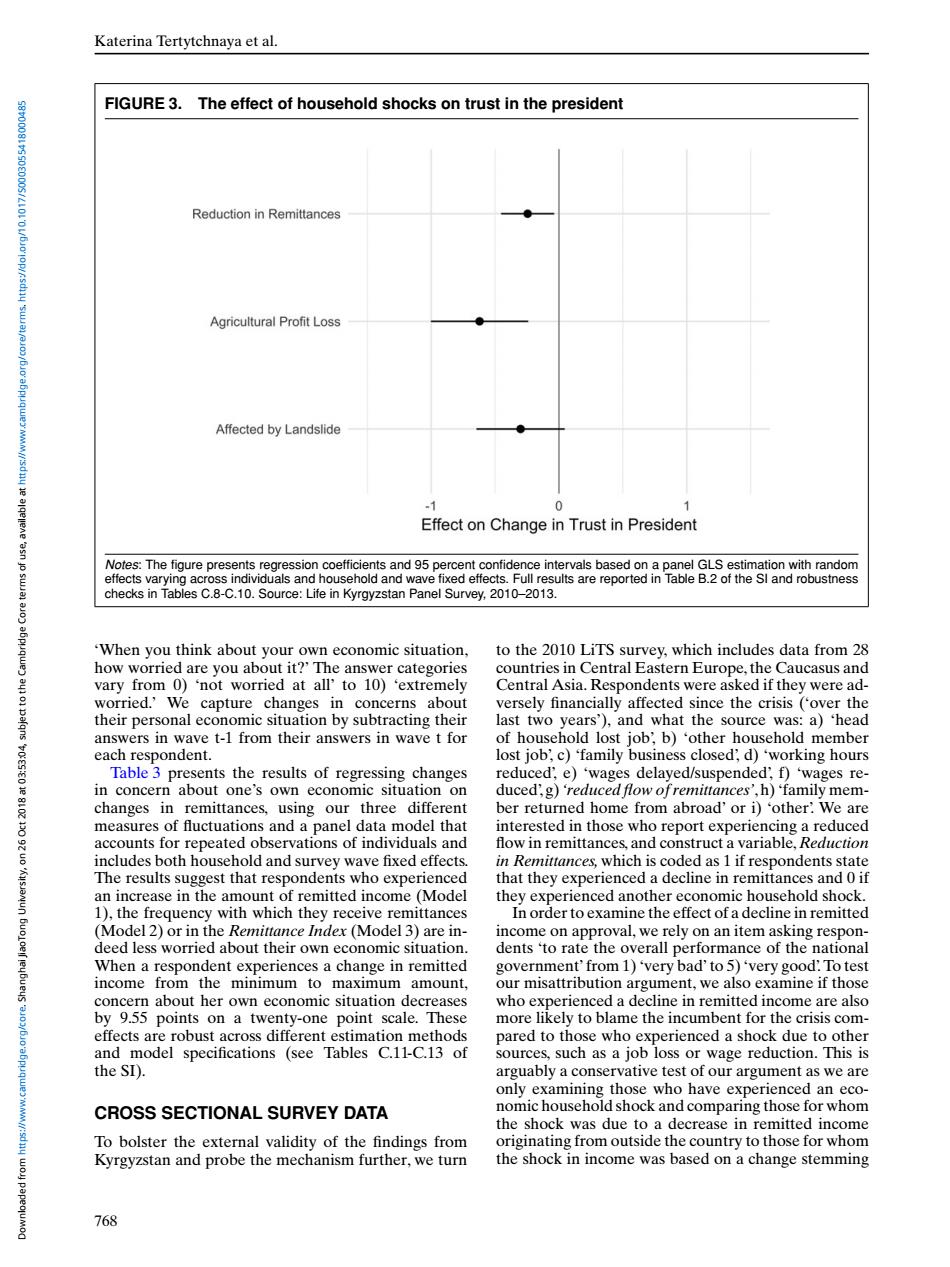

Katerina Tertytchnaya et al. FIGURE 3.The effect of household shocks on trust in the president Reduction in Remittances Agricultural Profit Loss Affected by Landslide -1 0 Effect on Change in Trust in President & Notes:The figure presents regression coefficients and 95 percent confidence intervals based on a panel GLS estimation with random effects varying across individuals and household and wave fixed effects.Full results are reported in Table B.2 of the SI and robustness checks in Tables C.8-C.10.Source:Life in Kyrgyzstan Panel Survey,2010-2013. 'When you think about your own economic situation, to the 2010 LiTS survey,which includes data from 28 how worried are you about it?'The answer categories countries in Central Eastern Europe,the Caucasus and vary from 0)'not worried at all'to 10)'extremely Central Asia.Respondents were asked if they were ad- worried.'We capture changes in concerns about versely financially affected since the crisis ('over the their personal economic situation by subtracting their last two years'),and what the source was:a)'head answers in wave t-1 from their answers in wave t for of household lost job;b)'other household member each respondent. lost job;c)'family business closed;d)'working hours Table 3 presents the results of regressing changes reduced,e)'wages delayed/suspended,f)'wages re- in concern about one's own economic situation on duced,g)'reduced flow ofremittances',h)'family mem- changes in remittances,using our three different ber returned home from abroad'or i)'other:We are measures of fluctuations and a panel data model that interested in those who report experiencing a reduced accounts for repeated observations of individuals and flow in remittances,and construct a variable.Reduction includes both household and survey wave fixed effects. in Remittances,which is coded as 1 if respondents state The results suggest that respondents who experienced that they experienced a decline in remittances and 0 if an increase in the amount of remitted income (Model they experienced another economic household shock. 1),the frequency with which they receive remittances In order to examine the effect of a decline in remitted (Model 2)or in the Remittance Index (Model 3)are in- income on approval,we rely on an item asking respon- deed less worried about their own economic situation. dents 'to rate the overall performance of the national When a respondent experiences a change in remitted government'from 1)'very bad'to 5)'very good:To test income from the minimum to maximum amount. our misattribution argument,we also examine if those concern about her own economic situation decreases who experienced a decline in remitted income are also by 9.55 points on a twenty-one point scale.These more likely to blame the incumbent for the crisis com- effects are robust across different estimation methods pared to those who experienced a shock due to other and model specifications (see Tables C.11-C.13 of sources,such as a job loss or wage reduction.This is the SI). arguably a conservative test of our argument as we are only examining those who have experienced an eco- CROSS SECTIONAL SURVEY DATA nomic household shock and comparing those for whom the shock was due to a decrease in remitted income To bolster the external validity of the findings from originating from outside the country to those for whom Kyrgyzstan and probe the mechanism further,we turn the shock in income was based on a change stemming 768Katerina Tertytchnaya et al. FIGURE 3. The effect of household shocks on trust in the president Notes: The figure presents regression coefficients and 95 percent confidence intervals based on a panel GLS estimation with random effects varying across individuals and household and wave fixed effects. Full results are reported in Table B.2 of the SI and robustness checks in Tables C.8-C.10. Source: Life in Kyrgyzstan Panel Survey, 2010–2013. ‘When you think about your own economic situation, how worried are you about it?’ The answer categories vary from 0) ‘not worried at all’ to 10) ‘extremely worried.’ We capture changes in concerns about their personal economic situation by subtracting their answers in wave t-1 from their answers in wave t for each respondent. Table 3 presents the results of regressing changes in concern about one’s own economic situation on changes in remittances, using our three different measures of fluctuations and a panel data model that accounts for repeated observations of individuals and includes both household and survey wave fixed effects. The results suggest that respondents who experienced an increase in the amount of remitted income (Model 1), the frequency with which they receive remittances (Model 2) or in the Remittance Index (Model 3) are indeed less worried about their own economic situation. When a respondent experiences a change in remitted income from the minimum to maximum amount, concern about her own economic situation decreases by 9.55 points on a twenty-one point scale. These effects are robust across different estimation methods and model specifications (see Tables C.11-C.13 of the SI). CROSS SECTIONAL SURVEY DATA To bolster the external validity of the findings from Kyrgyzstan and probe the mechanism further, we turn to the 2010 LiTS survey, which includes data from 28 countries in Central Eastern Europe, the Caucasus and Central Asia. Respondents were asked if they were adversely financially affected since the crisis (‘over the last two years’), and what the source was: a) ‘head of household lost job’, b) ‘other household member lost job’, c) ‘family business closed’, d) ‘working hours reduced’, e) ‘wages delayed/suspended’, f) ‘wages reduced’, g)‘reduced flow of remittances’, h) ‘family member returned home from abroad’ or i) ‘other’. We are interested in those who report experiencing a reduced flow in remittances, and construct a variable, Reduction in Remittances, which is coded as 1 if respondents state that they experienced a decline in remittances and 0 if they experienced another economic household shock. In order to examine the effect of a decline in remitted income on approval, we rely on an item asking respondents ‘to rate the overall performance of the national government’ from 1) ‘very bad’ to 5) ‘very good’.To test our misattribution argument, we also examine if those who experienced a decline in remitted income are also more likely to blame the incumbent for the crisis compared to those who experienced a shock due to other sources, such as a job loss or wage reduction. This is arguably a conservative test of our argument as we are only examining those who have experienced an economic household shock and comparing those for whom the shock was due to a decrease in remitted income originating from outside the country to those for whom the shock in income was based on a change stemming 768 Downloaded from https://www.cambridge.org/core. Shanghai JiaoTong University, on 26 Oct 2018 at 03:53:04, subject to the Cambridge Core terms of use, available at https://www.cambridge.org/core/terms. https://doi.org/10.1017/S0003055418000485