正在加载图片...

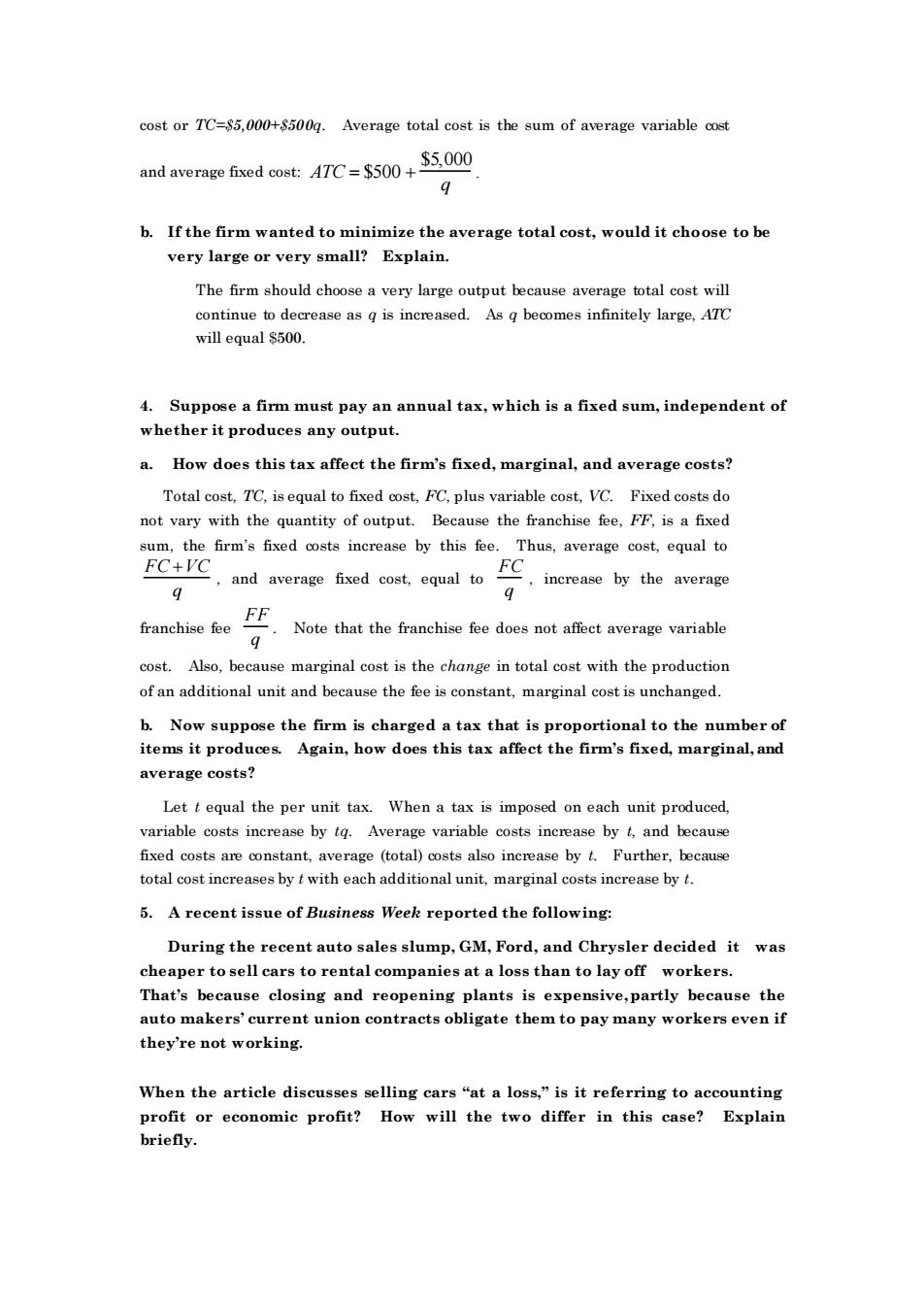

cost or TC=$5,000+8500g.Average total cost is the sum of average variable cost 9 b.If the firm wanted to minimize the average total cost,would it choose to be very large or very small?Explain. The firm should choose a very large output because average total cost will ne s i inced beomee infinitel arge,A 4.Suppose a firm must pay an annual tax,which is a fixed sum,independent of whether it produces any output. a.How does this tax affect the firm's fixed,marginal,and average costs? Total cost TC,is equal to fixed ost FC.plus variable cost,VC.Fixed costs do not vary with the quantity of output.Because the franchise fee,FF,is a fixed sum,the firm's fixed costs increase by this fee.Thus,average cost,equal to FC+VC .and average fixed oqutF increase by the average Note that the franchise fee does not affect average variable cost.Also,because marginal cost is the change in total cost with the production of an additional unit and because the fee is constant,marginal cost is unchanged. b.Now su rtional to the number of Again,how does this tax affect firm's fixe marginal,and average costs? Let t equal the per unit tax.When a tax is imposed on each unit produced, variable costs increase by lq.Average variable costs increase by /and because fixed costs are constant,average (total)costs also increase by.Further.because total cost increases by t with each additional unit,marginal costs increase by t. 5.A recent issue of Business Week reported the following: During the recent auto salesslump,GM,Ford,and Chrysler decided it was r tosell cars to rental companies at a loss than to lay off workers. closing and reopening pats is expesive.parcset auto makers'current union contracts obligate them to pay many workers even if they're not working When the article discusses selling cars"at a loss,"is it referring to ac counting How will the two differ in this case?Explaincost or TC=$5,000+$500q. Average total cost is the sum of average variable cost and average fixed cost: ATC = $500 + $5,000 q . b. If the firm wanted to minimize the average total cost, would it choose to be very large or very small? Explain. The firm should choose a very large output because average total cost will continue to decrease as q is increased. As q becomes infinitely large, ATC will equal $500. 4. Suppose a firm must pay an annual tax, which is a fixed sum, independent of whether it produces any output. a. How does this tax affect the firm’s fixed, marginal, and average costs? Total cost, TC, is equal to fixed cost, FC, plus variable cost, VC. Fixed costs do not vary with the quantity of output. Because the franchise fee, FF, is a fixed sum, the firm’s fixed costs increase by this fee. Thus, average cost, equal to FC +VC q , and average fixed cost, equal to FC q , increase by the average franchise fee FF q . Note that the franchise fee does not affect average variable cost. Also, because marginal cost is the change in total cost with the production of an additional unit and because the fee is constant, marginal cost is unchanged. b. Now suppose the firm is charged a tax that is proportional to the number of items it produces. Again, how does this tax affect the firm’s fixed, marginal, and average costs? Let t equal the per unit tax. When a tax is imposed on each unit produced, variable costs increase by tq. Average variable costs increase by t, and because fixed costs are constant, average (total) costs also increase by t. Further, because total cost increases by t with each additional unit, marginal costs increase by t. 5. A recent issue of Business Week reported the following: During the recent auto sales slump, GM, Ford, and Chrysler decided it was cheaper to sell cars to rental companies at a loss than to lay off workers. That’s because closing and reopening plants is expensive,partly because the auto makers’ current union contracts obligate them to pay many workers even if they’re not working. When the article discusses selling cars “at a loss,” is it referring to accounting profit or economic profit? How will the two differ in this case? Explain briefly