正在加载图片...

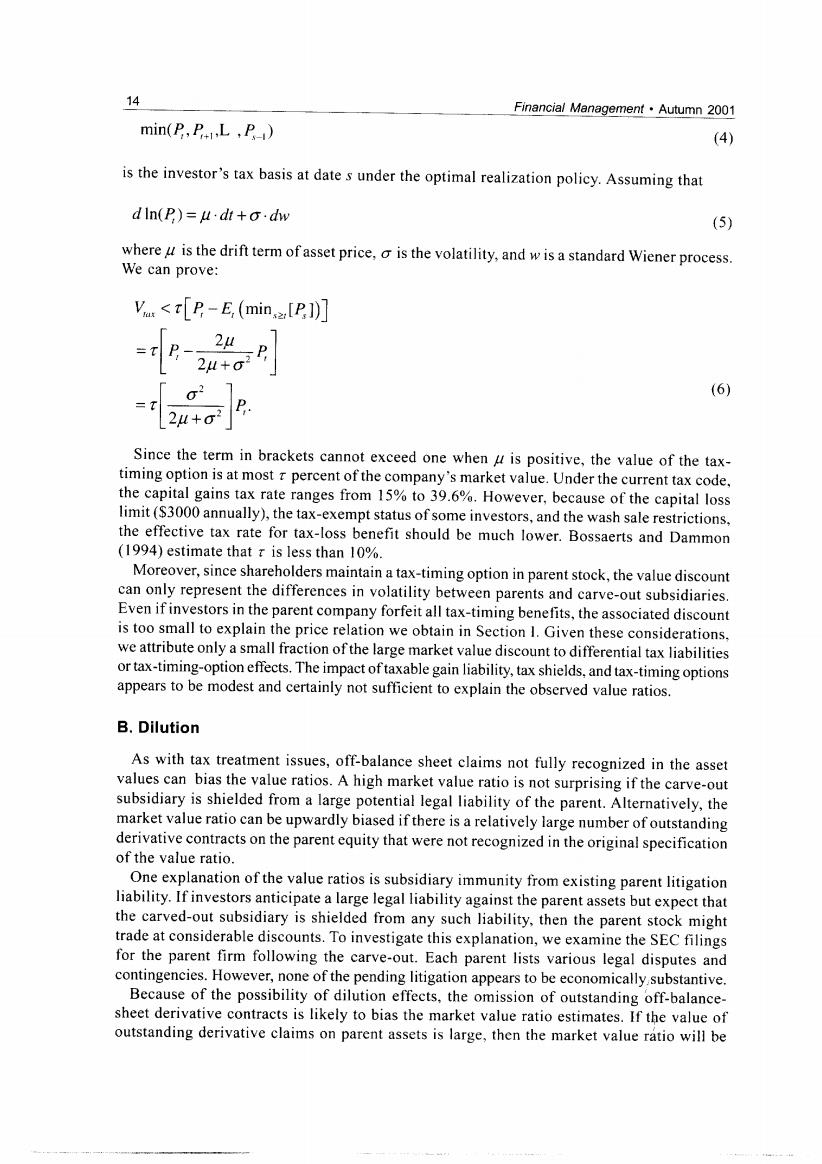

14 Financial Management.Autumn 2001 min(P,PLP) (4) is the investor's tax basis at date s under the optimal realization policy.Assuming that dln(P)=·dt+o·dhw (5) where u is the drift term of asset price,o is the volatility,and w is a standard Wiener process. We can prove: V<[P-E (min,[P1)] n-zui H+02 02 (6) =T 24+σ Since the term in brackets cannot exceed one when u is positive,the value of the tax- timing option is at most r percent of the company's market value.Under the current tax code, the capital gains tax rate ranges from 15%to 39.6%.However,because of the capital loss limit($3000 annually),the tax-exempt status of some investors,and the wash sale restrictions, the effective tax rate for tax-loss benefit should be much lower.Bossaerts and Dammon (1994)estimate that r is less than 10%. Moreover,since shareholders maintain a tax-timing option in parent stock,the value discount can only represent the differences in volatility between parents and carve-out subsidiaries. Even if investors in the parent company forfeit all tax-timing benefits,the associated discount is too small to explain the price relation we obtain in Section I.Given these considerations, we attribute only a small fraction of the large market value discount to differential tax liabilities or tax-timing-option effects.The impact of taxable gain liability,tax shields,and tax-timing options appears to be modest and certainly not sufficient to explain the observed value ratios. B.Dilution As with tax treatment issues,off-balance sheet claims not fully recognized in the asset values can bias the value ratios.A high market value ratio is not surprising if the carve-out subsidiary is shielded from a large potential legal liability of the parent.Alternatively,the market value ratio can be upwardly biased if there is a relatively large number of outstanding derivative contracts on the parent equity that were not recognized in the original specification of the value ratio. One explanation of the value ratios is subsidiary immunity from existing parent litigation liability.If investors anticipate a large legal liability against the parent assets but expect that the carved-out subsidiary is shielded from any such liability,then the parent stock might trade at considerable discounts.To investigate this explanation,we examine the SEC filings for the parent firm following the carve-out.Each parent lists various legal disputes and contingencies.However,none of the pending litigation appears to be economically substantive. Because of the possibility of dilution effects,the omission of outstanding off-balance- sheet derivative contracts is likely to bias the market value ratio estimates.If the value of outstanding derivative claims on parent assets is large,then the market value ratio will be