正在加载图片...

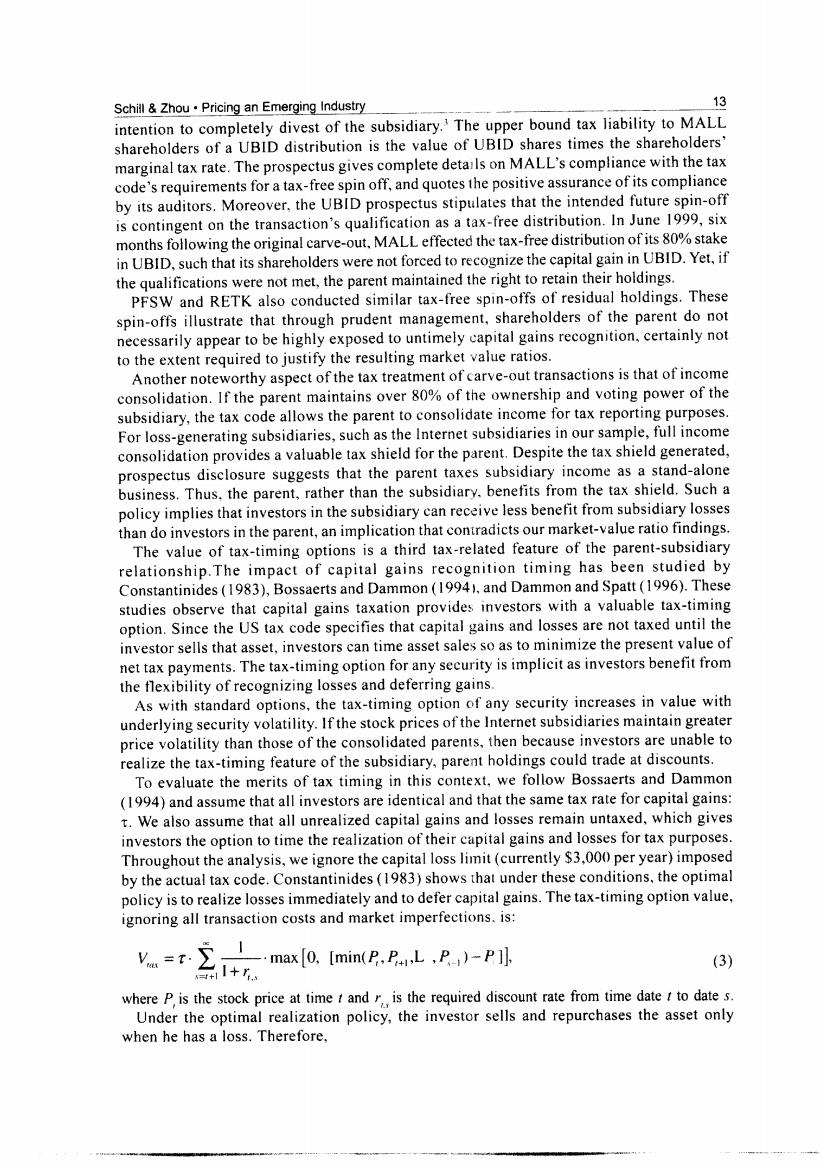

Schill Zhou.Pricing an Emerging Industry 9 intention to completely divest of the subsidiary.The upper bound tax liability to MALL shareholders of a UBID distribution is the value of UBID shares times the shareholders marginal tax rate.The prospectus gives complete details on MALL's compliance with the tax code's requirements for a tax-free spin off,and quotes the positive assurance of its compliance by its auditors.Moreover,the UBID prospectus stipulates that the intended future spin-off is contingent on the transaction's qualification as a tax-free distribution.In June 1999,six months following the original carve-out,MALL effected the tax-free distribution of its 80%stake in UBID,such that its shareholders were not forced to recognize the capital gain in UBID.Yet,if the qualifications were not met,the parent maintained the right to retain their holdings PFSW and RETK also conducted similar tax-free spin-offs of residual holdings.These spin-offs illustrate that through prudent management,shareholders of the parent do not necessarily appear to be highly exposed to untimely capital gains recognition,certainly not to the extent required to justify the resulting market value ratios. Another noteworthy aspect of the tax treatment of carve-out transactions is that of income consolidation.If the parent maintains over 80%of the ownership and voting power of the subsidiary,the tax code allows the parent to consolidate income for tax reporting purposes. For loss-generating subsidiaries,such as the Internet subsidiaries in our sample,full income consolidation provides a valuable tax shield for the parent.Despite the tax shield generated, prospectus disclosure suggests that the parent taxes subsidiary income as a stand-alone business.Thus,the parent,rather than the subsidiary.benefits from the tax shield.Such a policy implies that investors in the subsidiary can receive less benefit from subsidiary losses than do investors in the parent,an implication that contradicts our market-value ratio findings. The value of tax-timing options is a third tax-related feature of the parent-subsidiary relationship.The impact of capital gains recognition timing has been studied by Constantinides(1983),Bossaerts and Dammon(1994),and Dammon and Spatt(1996).These studies observe that capital gains taxation provides investors with a valuable tax-timing option.Since the US tax code specifies that capital gains and losses are not taxed until the investor sells that asset,investors can time asset sales so as to minimize the present value of net tax payments.The tax-timing option for any security is implicit as investors benefit from the flexibility of recognizing losses and deferring gains. As with standard options,the tax-timing option of any security increases in value with underlying security volatility.If the stock prices of the Internet subsidiaries maintain greater price volatility than those of the consolidated parents,then because investors are unable to realize the tax-timing feature of the subsidiary,parent holdings could trade at discounts. To evaluate the merits of tax timing in this context,we follow Bossaerts and Dammon (1994)and assume that all investors are identical and that the same tax rate for capital gains: t.We also assume that all unrealized capital gains and losses remain untaxed,which gives investors the option to time the realization of their capital gains and losses for tax purposes. Throughout the analysis,we ignore the capital loss limit(currently $3,000 per year)imposed by the actual tax code.Constantinides(1983)shows that under these conditions,the optimal policy is to realize losses immediately and to defer capital gains.The tax-timing option value, ignoring all transaction costs and market imperfections.is: vmax[9.(min(.1 1+r (3) where P is the stock price at time t and r is the required discount rate from time date t to date s. Under the optimal realization policy,the investor sells and repurchases the asset only when he has a loss.Therefore