正在加载图片...

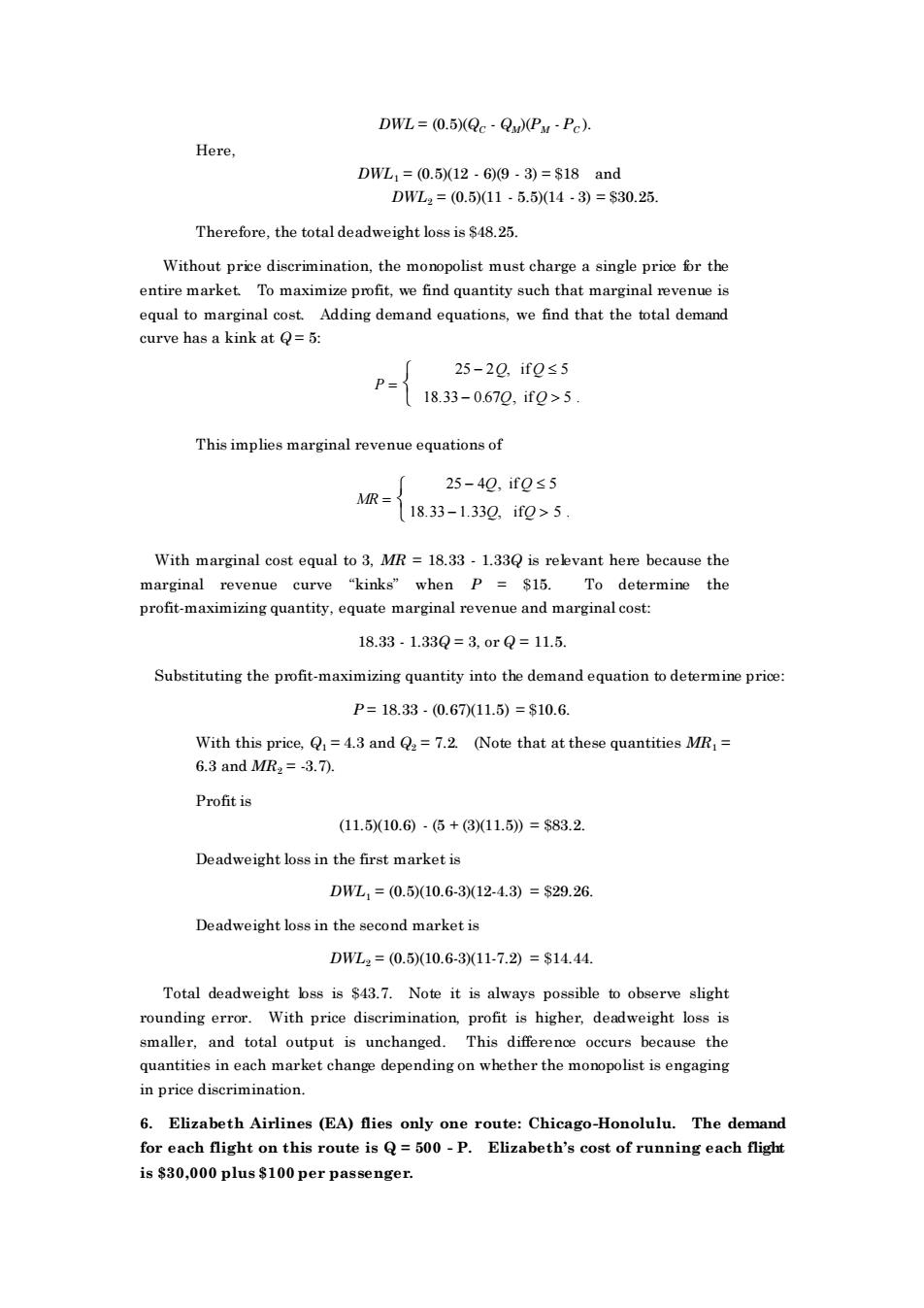

DWL=(0.5XQc-Qx)(Pu-Pc). Here, DW1=(0.512-69.3)=$18and DWL2=(0.50(11-5.514-3)=$30.25 Therefore,the total deadweight loss is $48.25. Without price discrimination,the monopolist must charge a single price for the entire market To maximize profit,we find quantity such that marginal revenue is curve has a kink at Q=5: 25-20.if0≤5 P= 18.33-0.670,if0>5 This implies marginal revenue equations of 25-40,if0s5 MR={1838-130.i0>5 With marginal cost equal.3 rekvant here because the marginal revenue curve "kinks"when P =$15.To determine the profit-maximizing quantity,equate marginal revenue and marginal cost: 18.33.1.33Q=3,orQ=11.5. Substituting the profit-maximizing quantity into the demand equation to determine price: P=18.33.(0.6711.5)=s10.6. With this price,Q=4.3 and Q=7.2.(Note that at these quantities MR,= 6.3 and MR2=-3.7). Profit is (11.510.6)-6+(11.5)=$83.2 Deadweight loss in the first market is DWL,=(0.510.6-3(12-4.3)=$29.26 Deadweight loss in the second marketis DWL2=(0.510.6-311-7.2=$1444. Total deadweightss is$43.7.Note it is always possible to obeerve sligh rounding error.With price discrimination,profit is higher,deadweight loss is smaller,and total output is unchanged.This difference occurs because the quantities in each market change depending on whether the monopolist is engaging in price discrimination. 6.Elizabeth Airlines (A)nies only one route:Chicago-Honolulu.The demand for each flight on this route isQ500-P.Elizabeth's cost of running each fligh is $30,000 plus $100 per passenger.DWL = (0.5)(QC - QM)(PM - PC ). Here, DWL1 = (0.5)(12 - 6)(9 - 3) = $18 and DWL2 = (0.5)(11 - 5.5)(14 - 3) = $30.25. Therefore, the total deadweight loss is $48.25. Without price discrimination, the monopolist must charge a single price for the entire market. To maximize profit, we find quantity such that marginal revenue is equal to marginal cost. Adding demand equations, we find that the total demand curve has a kink at Q = 5: P = 25 − 2Q, if Q 5 18.33 − 0.67Q, if Q 5 . This implies marginal revenue equations of MR = 25 − 4Q, if Q 5 18.33 −1.33Q, if Q 5 . With marginal cost equal to 3, MR = 18.33 - 1.33Q is relevant here because the marginal revenue curve “kinks” when P = $15. To determine the profit-maximizing quantity, equate marginal revenue and marginal cost: 18.33 - 1.33Q = 3, or Q = 11.5. Substituting the profit-maximizing quantity into the demand equation to determine price: P = 18.33 - (0.67)(11.5) = $10.6. With this price, Q1 = 4.3 and Q2 = 7.2. (Note that at these quantities MR1 = 6.3 and MR2 = -3.7). Profit is (11.5)(10.6) - (5 + (3)(11.5)) = $83.2. Deadweight loss in the first market is DWL1 = (0.5)(10.6-3)(12-4.3) = $29.26. Deadweight loss in the second market is DWL2 = (0.5)(10.6-3)(11-7.2) = $14.44. Total deadweight loss is $43.7. Note it is always possible to observe slight rounding error. With price discrimination, profit is higher, deadweight loss is smaller, and total output is unchanged. This difference occurs because the quantities in each market change depending on whether the monopolist is engaging in price discrimination. 6. Elizabeth Airlines (EA) flies only one route: Chicago-Honolulu. The demand for each flight on this route is Q = 500 - P. Elizabeth’s cost of running each flight is $30,000 plus $100 per passenger