正在加载图片...

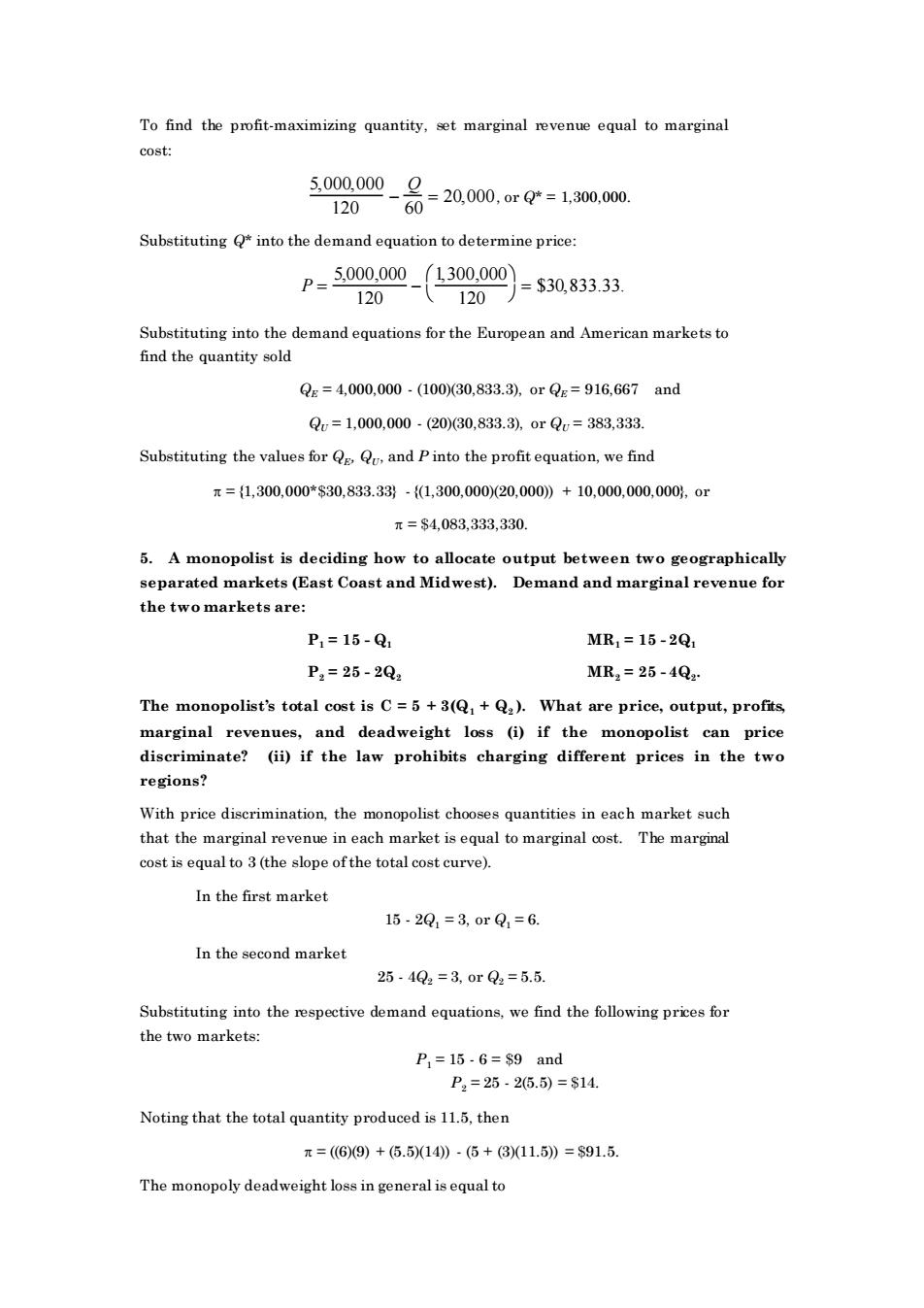

To find the profit-maximizing quantity,set marginal revenue equal to marginal cost: 300.00_g=20,00,org=130,000 120 60 Substitutinginto the demand equation to determine price: P=300.00 (1300,000 =$30,833.33 120 .120 Substituting into the demand equations for the European and American markets to find the quantity sold Qs=4,000,000-(100(30,833.3),orQs=916,667and Q=1,000,000-(20)30,833.3).0rQc=383,333. Substituting the values for Q and Pinto the profit equation,we find π={1.300.000*$30.833.33-1,300.000)20.000)+10.000.000.000.0r π=$4.083.333,330 5.A monopolist is deciding how to allocate output between two geographically ast and Midwest).Den aand and marginal revenue for P,=15-Q MR=15-2Q P2=25-202 MR2=25-4Qg The monopolist's total cost is C=5+3(+).What are price,output,profits marginal revenues,and deadweight loss (i)if the monopolist can price discriminate?(ii)if the law prohibits charging different prices in the two regions? With price discrimination.the monopolist chooses quantities in each market such that the marginl reven in cost is equal to 3(the slope ofthe total cost curve). In the first market 15.201=3,0rQ1=6. In the second market 25.49=3,0r22=5.5. Substituting into the respective demand equations,we find the following prices for the two markets: P,=15.6=s9and P2=2526.5)=$14 Noting that the total quantity produced is 11.5.then T=(6)9)+(5.514)-(6+(811.5)=s91.5 The monopoly deadweight loss in general is equal to To find the profit-maximizing quantity, set marginal revenue equal to marginal cost: 5,000,000 120 − Q 60 = 20,000 , or Q* = 1,300,000. Substituting Q* into the demand equation to determine price: P = 5,000,000 120 − 1,300,000 120 = $30,833.33. Substituting into the demand equations for the European and American markets to find the quantity sold QE = 4,000,000 - (100)(30,833.3), or QE = 916,667 and QU = 1,000,000 - (20)(30,833.3), or QU = 383,333. Substituting the values for QE , QU, and P into the profit equation, we find = {1,300,000*$30,833.33} - {(1,300,000)(20,000)) + 10,000,000,000}, or = $4,083,333,330. 5. A monopolist is deciding how to allocate output between two geographically separated markets (East Coast and Midwest). Demand and marginal revenue for the two markets are: P1 = 15 - Q1 MR1 = 15 - 2Q1 P2 = 25 - 2Q2 MR2 = 25 - 4Q2 . The monopolist’s total cost is C = 5 + 3(Q1 + Q2 ). What are price, output, profits, marginal revenues, and deadweight loss (i) if the monopolist can price discriminate? (ii) if the law prohibits charging different prices in the two regions? With price discrimination, the monopolist chooses quantities in each market such that the marginal revenue in each market is equal to marginal cost. The marginal cost is equal to 3 (the slope of the total cost curve). In the first market 15 - 2Q1 = 3, or Q1 = 6. In the second market 25 - 4Q2 = 3, or Q2 = 5.5. Substituting into the respective demand equations, we find the following prices for the two markets: P1 = 15 - 6 = $9 and P2 = 25 - 2(5.5) = $14. Noting that the total quantity produced is 11.5, then = ((6)(9) + (5.5)(14)) - (5 + (3)(11.5)) = $91.5. The monopoly deadweight loss in general is equal to