正在加载图片...

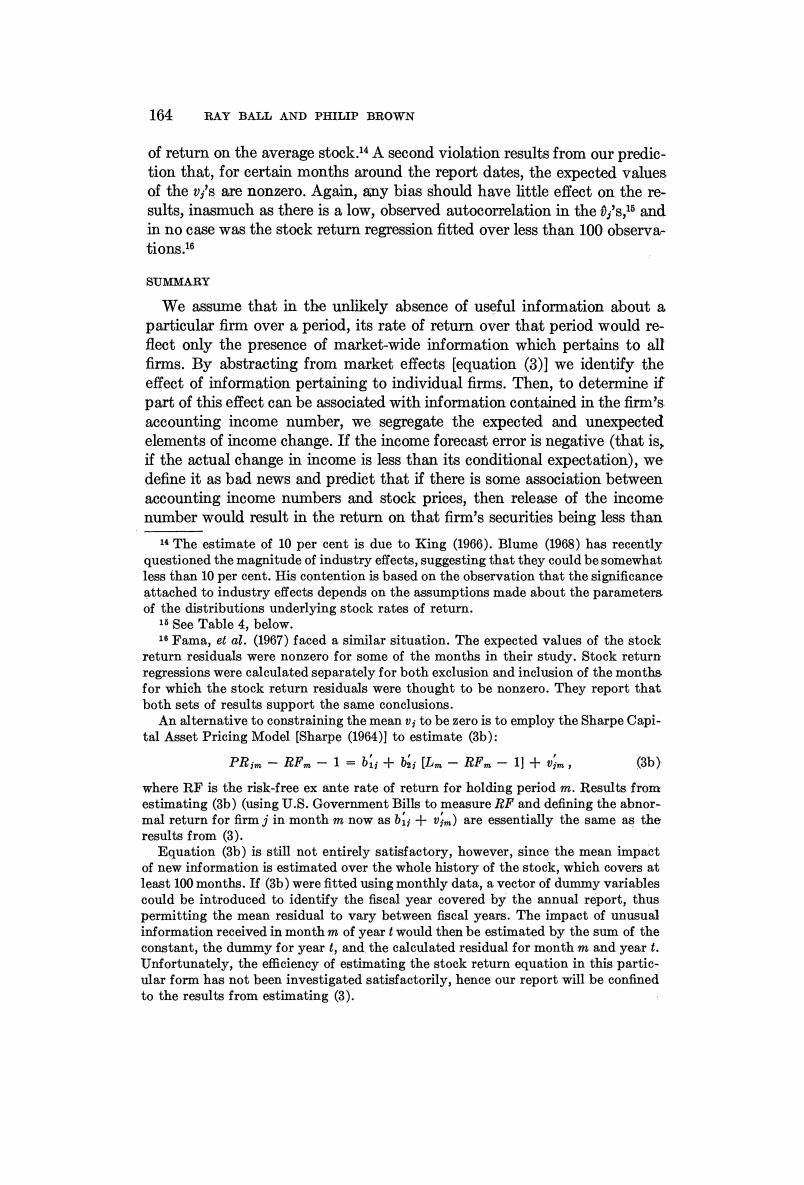

164 RAY BALL AND PHILIP BROWN of return on the average stock.14 A second violation results from our predic- tion that,for certain months around the report dates,the expected values of the v,'s are nonzero.Again,any bias should have little effect on the re- sults,inasmuch as there is a low,observed autocorrelation in the ,'s,15 and in no case was the stock return regression fitted over less than 100 observa- tions.16 SUMMARY We assume that in the unlikely absence of useful information about a particular firm over a period,its rate of return over that period would re- flect only the presence of market-wide information which pertains to all firms.By abstracting from market effects [equation (3)]we identify the effect of information pertaining to individual firms.Then,to determine if part of this effect can be associated with information contained in the firm's accounting income number,we segregate the expected and unexpected elements of income change.If the income forecast error is negative (that is, if the actual change in income is less than its conditional expectation),we define it as bad news and predict that if there is some association between accounting income numbers and stock prices,then release of the income number would result in the return on that firm's securities being less than 14 The estimate of 10 per cent is due to King (1966).Blume(1968)has recently questioned the magnitude of industry effects,suggesting that they could be somewhat less than 10 per cent.His contention is based on the observation that the significance attached to industry effects depends on the assumptions made about the parameters of the distributions underlying stock rates of return. 18 See Table 4,below. Fama,et al.(1967)faced a similar situation.The expected values of the stock return residuals were nonzero for some of the months in their study.Stock return regressions were calculated separately for both exclusion and inclusion of the months for which the stock return residuals were thought to be nonzero.They report that both sets of results support the same conclusions. An alternative to constraining the mean v;to be zero is to employ the Sharpe Capi- tal Asset Pricing Model [Sharpe (1964)]to estimate (3b): PRim -RFm-1 =bii+bsj [Lm RFm -1]vim, (3b) where RF is the risk-free ex ante rate of return for holding period m.Results from estimating (3b)(using U.S.Government Bills to measure RF and defining the abnor- mal return for firm j in month m now as biim)are essentially the same as the results from (3). Equation(3b)is still not entirely satisfactory,however,since the mean impact of new information is estimated over the whole history of the stock,which covers at least 100 months.If(3b)were fitted using monthly data,a vector of dummy variables could be introduced to identify the fiscal year covered by the annual report,thus permitting the mean residual to vary between fiscal years.The impact of unusual information received in month m of year t would then be estimated by the sum of the constant,the dummy for year t,and the calculated residual for month m and year t. Unfortunately,the efficiency of estimating the stock return equation in this partic- ular form has not been investigated satisfactorily,hence our report will be confined to the results from estimating (3)