正在加载图片...

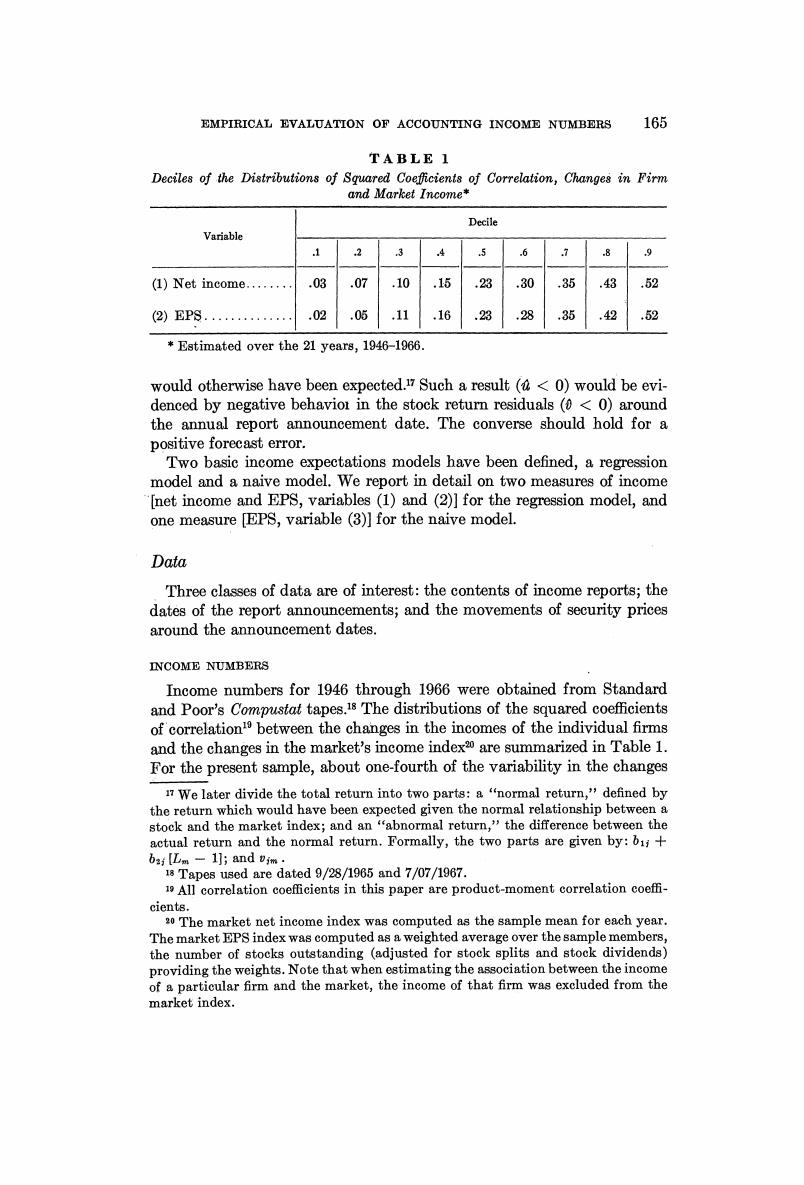

EMPIRICAL EVALUATION OF ACCOUNTING INCOME NUMBERS 165 TABLE 1 Deciles of the Distributions of Squared Coefficients of Correlation,Changes in Firm and Market Income* Decile Variable 3 6 2 9 (1)Net income........ .03 .07 .10 .15 .23 .30 .35 .43 .52 (2)EPS... .02 .05 ,11 .16 .23 .28 .35 .42 .52 Estimated over the 21 years,1946-1966 would otherwise have been expected.17 Such a result (<0)would be evi- denced by negative behavior in the stock return residuals(<0)around the annual report announcement date.The converse should hold for a positive forecast error. Two basic income expectations models have been defined,a regression model and a naive model.We report in detail on two measures of income [net income and EPS,variables (1)and (2)]for the regression model,and one measure [EPS,variable(3)]for the naive model. Data Three classes of data are of interest:the contents of income reports;the dates of the report announcements;and the movements of security prices around the announcement dates. INCOME NUMBERS Income numbers for 1946 through 1966 were obtained from Standard and Poor's Compustat tapes.18 The distributions of the squared coefficients of correlation'between the changes in the incomes of the individual firms and the changes in the market's income index20 are summarized in Table 1. For the present sample,about one-fourth of the variability in the changes We later divide the total return into two parts:a "normal return,"defined by the return which would have been expected given the normal relationship between a stock and the market index;and an "abnormal return,"the difference between the actual return and the normal return.Formally,the two parts are given by:b1;+ bi[Lm-1];and im· 18 Tapes used are dated 9/28/1965 and 7/07/1967. 19 All correlation coefficients in this paper are product-moment correlation coeffi- cients. 20 The market net income index was computed as the sample mean for each year. The market EPS index was computed as a weighted average over the sample members, the number of stocks outstanding (adjusted for stock splits and stock dividends) providing the weights.Note that when estimating the association between the income of a particular firm and the market,the income of that firm was excluded from the market index