正在加载图片...

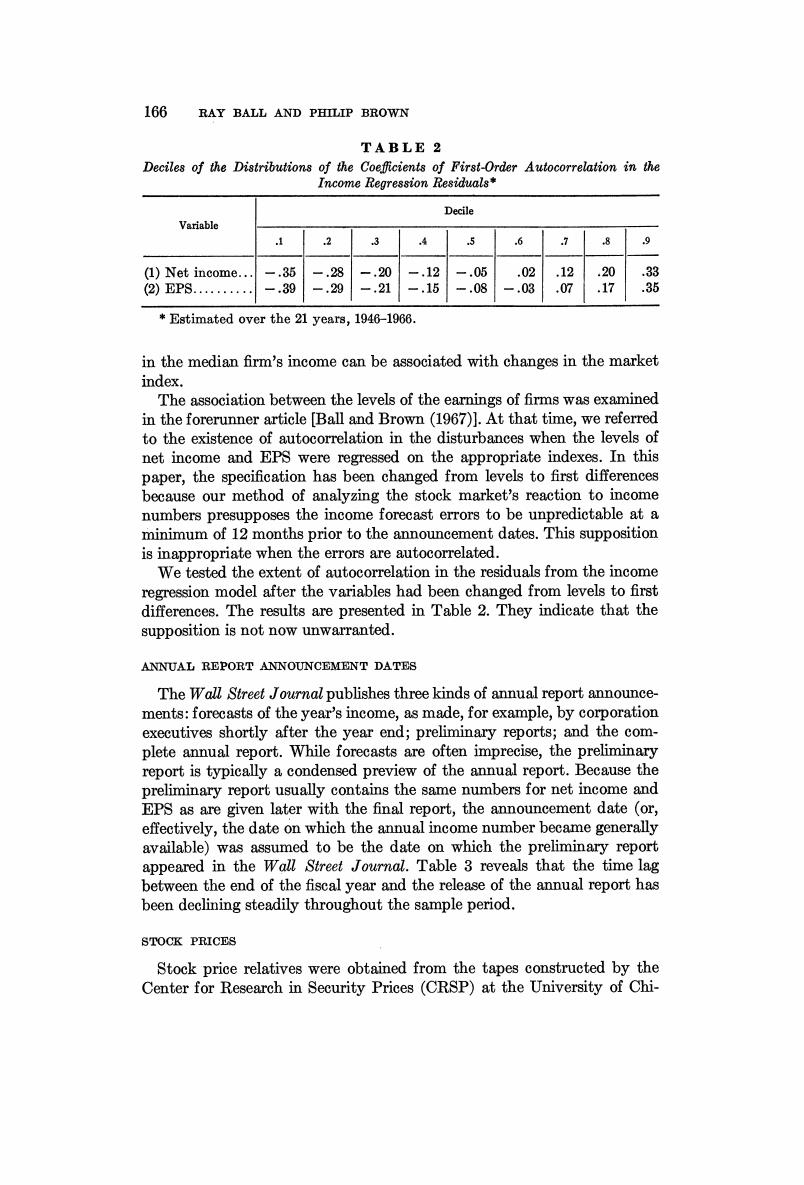

166 RAY BALL AND PHILIP BROWN TABLE 2 Deciles of the Distributions of the Coefficients of First-Order Autocorrelation in the Income Regression Residuals* Decile Variable 1 2 3 .4 .5 .6 8 9 (1)Net income. -.35 =.28 -.20 -.12 -.05 .02 .12 .20 .33 (2)EP8.. .39 -.29 -.21 -.15 -.08 -.03 .07 .17 .35 Estimated over the 21 years,1946-1966. in the median firm's income can be associated with changes in the market index. The association between the levels of the earnings of firms was examined in the forerunner article [Ball and Brown(1967)].At that time,we referred to the existence of autocorrelation in the disturbances when the levels of net income and EPS were regressed on the appropriate indexes.In this paper,the specification has been changed from levels to first differences because our method of analyzing the stock market's reaction to income numbers presupposes the income forecast errors to be unpredictable at a minimum of 12 months prior to the announcement dates.This supposition is inappropriate when the errors are autocorrelated. We tested the extent of autocorrelation in the residuals from the income regression model after the variables had been changed from levels to first differences.The results are presented in Table 2.They indicate that the supposition is not now unwarranted. ANNUAL REPORT ANNOUNCEMENT DATES The Wall Street Journal publishes three kinds of annual report announce- ments:forecasts of the year's income,as made,for example,by corporation executives shortly after the year end;preliminary reports;and the com- plete annual report.While forecasts are often imprecise,the preliminary report is typically a condensed preview of the annual report.Because the preliminary report usually contains the same numbers for net income and EPS as are given later with the final report,the announcement date (or, effectively,the date on which the annual income number became generally available)was assumed to be the date on which the preliminary report appeared in the Wall Street Journal.Table 3 reveals that the time lag between the end of the fiscal year and the release of the annual report has been declining steadily throughout the sample period. STOCK PRICES Stock price relatives were obtained from the tapes constructed by the Center for Research in Security Prices(CRSP)at the University of Chi-