正在加载图片...

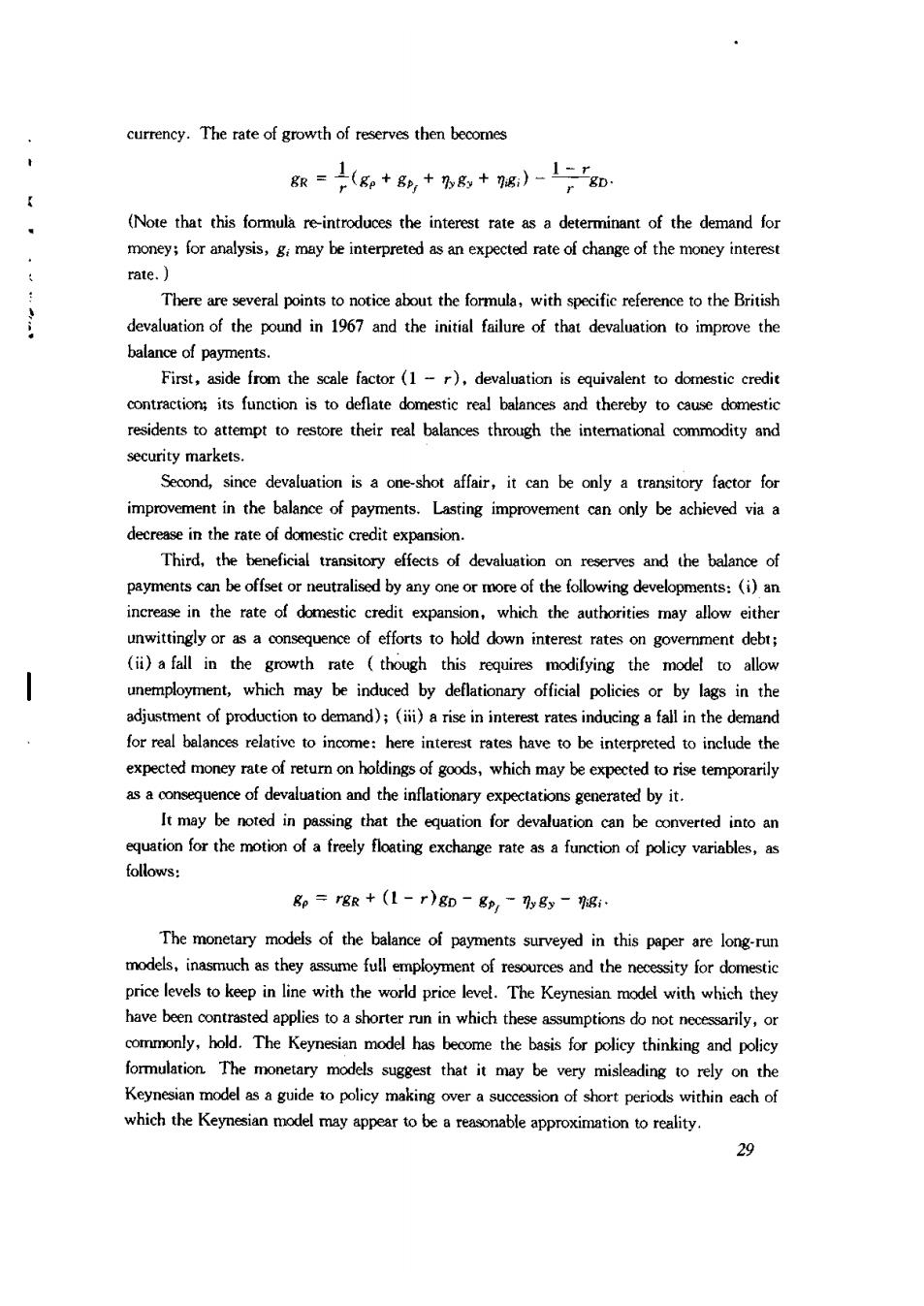

currency.The rate of growth of reserves then becomes 服=上(g+8,+%,+隔)-片知 (Note that this formula re-introduces the interest rate as a determinant of the demand for money;for analysis,g may be interpreted asan expected rate of change of the money interes rate.)】 There are several points to notice about the formula,with specific reference to the British devaluation of the pound in 1967 and the initi failure of that the balance of payments. First,aside from the scale factor(1-r),devaluation is equivalent to domestic credit is todeflate domestic al residents to attempt to restore their real balances through the intemational commodity and security markets. Seond,since devaluation is a one-shot affair,it can be ony a transitory factor for improvement in the balance of payments.Lasting improvement can only be achieved via a decrease in domestic credit expansion. Third,the beneficial transitory effects of devaluation on reserves and the balance of payments can be offset or neutralised by any one or more of the following developments:(i)an increase in the rate of domestic credit expansion,which the authorities may allow either unwittingly or as a of efforts to hold down interest rates on goverment debt; (ii)a fall in the growth rate though this requires modifying the model to allow unemployment,which may be induced by deflationary official policies or by lags in the adjustment of production to demand);()a rise in interest rates inducing a fall in the demand for real balances relative to income:here interest rates have to be interpreted to include the expected of gods,which may asaonsequence of devaluation and the inflationary expectations generated by it. It may be noted in passing that the equation for devaluation can be converted into an ollows: =rgR+(1-r)g-g,-%8y- The monetary models of the balance of payments surveyed in this paper are long-run models,inasmuch as they assume full employment of resources and the necessity for domestic rice keep in line with the world price level.The Keynesian model with which they have been contrasted applies to a shorter run in which these assumptions do not necessarily,or commony,hold.The Keynesian model has become the basis for policy thinking and policy foruation The monetary models suggest that it may be very misleadingorely on the Keynesian model as a guide to policy making over a succession of short periods within each of which the Keynesian model may appearo bereasonable approximation to reality. 29