正在加载图片...

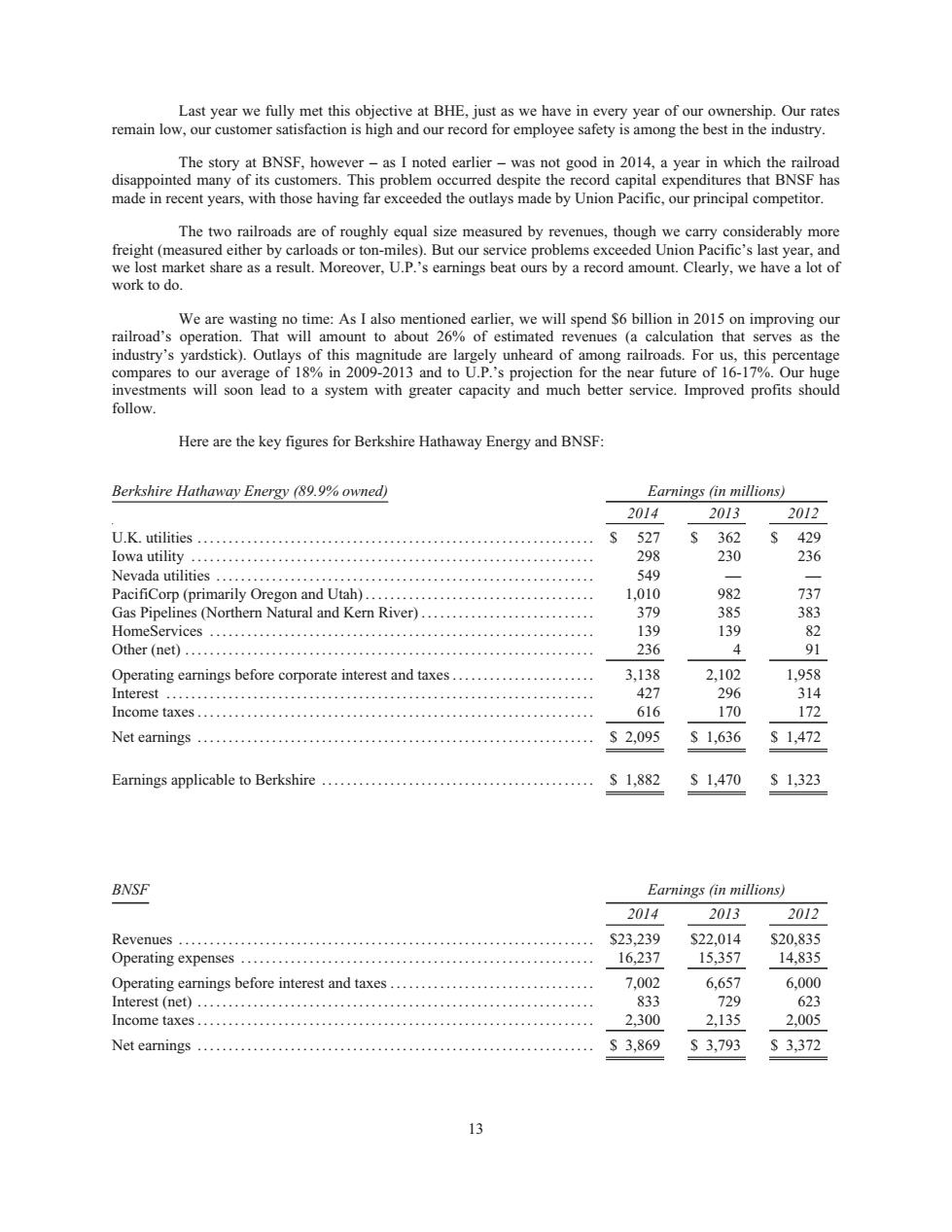

disappointed many of its customers.This problem occurred despite the record capital expenditures that BNSF has made in recent years,with those having far exceeded the outlays made by Union Pacific.our principal competitor. The two railroads are of roughly equal size measured by revenues,though we carry considerably more either by carl lems e nion Pa cific' as a Iesu work to do svstem with ore eater capacity and much better service.Imp ed profits should follow. Here are the key figures for Berkshire Hathaway Energy and BNSF Berkshire Hathaway Energy(89.9%owned) Earnings (in millions) 2014 2013 2012 U.K.utilities S527 362 s429 lowa utility 298 230 236 Nevada utilities ,01 Gas Pir River) HomeServices 13g 13g Other (net).. 236 4 91 Operating earnings before corporate interest and taxes 3138 2102 427 296 Income taxes. 616 170 172 Net earnings S2,095 1,636 1,472 Earnings applicable to Berkshire S1,882 s1,470 s1,323 BNSF Earnings (in millions) 2014 2013 2012 Revenues S22, Operating expense 35 Operating earnings before interest and taxes.......... 7,002 6.6517 2.300 2155 Net earnings ..... S3.869 $3,793 S3,372 Last year we fully met this objective at BHE, just as we have in every year of our ownership. Our rates remain low, our customer satisfaction is high and our record for employee safety is among the best in the industry. The story at BNSF, however – as I noted earlier – was not good in 2014, a year in which the railroad disappointed many of its customers. This problem occurred despite the record capital expenditures that BNSF has made in recent years, with those having far exceeded the outlays made by Union Pacific, our principal competitor. The two railroads are of roughly equal size measured by revenues, though we carry considerably more freight (measured either by carloads or ton-miles). But our service problems exceeded Union Pacific’s last year, and we lost market share as a result. Moreover, U.P.’s earnings beat ours by a record amount. Clearly, we have a lot of work to do. We are wasting no time: As I also mentioned earlier, we will spend $6 billion in 2015 on improving our railroad’s operation. That will amount to about 26% of estimated revenues (a calculation that serves as the industry’s yardstick). Outlays of this magnitude are largely unheard of among railroads. For us, this percentage compares to our average of 18% in 2009-2013 and to U.P.’s projection for the near future of 16-17%. Our huge investments will soon lead to a system with greater capacity and much better service. Improved profits should follow. Here are the key figures for Berkshire Hathaway Energy and BNSF: Berkshire Hathaway Energy (89.9% owned) Earnings (in millions) 2014 2013 2012 U.K. utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 527 $ 362 $ 429 Iowa utility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 298 230 236 Nevada utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 549 — — PacifiCorp (primarily Oregon and Utah) ..................................... 1,010 982 737 Gas Pipelines (Northern Natural and Kern River) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 379 385 383 HomeServices . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 139 139 82 Other (net) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 236 4 91 Operating earnings before corporate interest and taxes ....................... 3,138 2,102 1,958 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 427 296 314 Income taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 616 170 172 Net earnings ................................................................ $ 2,095 $ 1,636 $ 1,472 Earnings applicable to Berkshire ............................................ $ 1,882 $ 1,470 $ 1,323 BNSF Earnings (in millions) 2014 2013 2012 Revenues ................................................................... $23,239 $22,014 $20,835 Operating expenses ......................................................... 16,237 15,357 14,835 Operating earnings before interest and taxes ................................. 7,002 6,657 6,000 Interest (net) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 833 729 623 Income taxes................................................................ 2,300 2,135 2,005 Net earnings ................................................................ $ 3,869 $ 3,793 $ 3,372 13