正在加载图片...

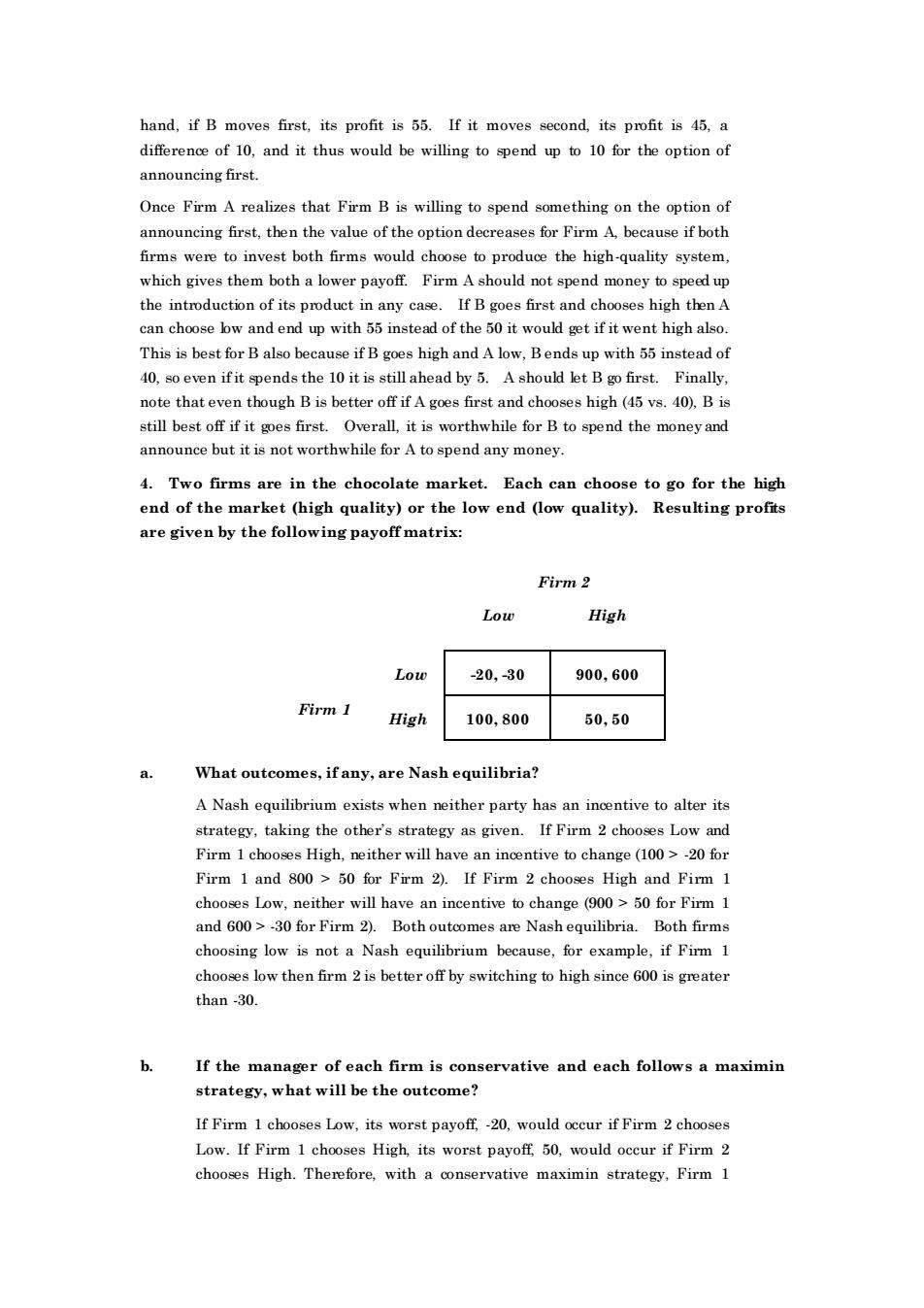

hand,if B moves first,its profit is 55.If it moves second,its profit is 45,a differene of 10,and it thus would be willing topend upto10 for the option of announcing first. Once Firm A realizes that Firm B is willing to spend something on the option of announcing first,then the value of the option decreases for Firm A.because if both firms were to invest both firms would choose to produce the high-quality system. which gives them both a lower pavoff.Firm A should not spend money to speed up the introduction of its product in any case if b goes first and chooses high then A instead of the50it ent high also This is best for B also because if B goes high and A low,Bends up with 55 instead of 40.so even ifit spends the 10 it is still ahead by 5.A should let B go first.Finally. note that even though B is better off if A goes first and chooses high(45 vs.40).B is still best off if it es first.Overall it is worthwhile for B to spend the money and announce but it is not worthwhile for A tospend any money 4.Two firms are in the chocolate market.Each can choose togo for the high end of the market (high quality)or the low end (low quality). Resulting profits are given by the following payoff matrix: Firm2 High Low 20,30 900,600 Firm 1 High 100,800 50,50 What outcomes,if any,are Nash equilibria? A Nash equilibrium exists when neither party has an inentive to alter its strategy,taking the other's strategy as given.If Firm 2 chooses Low and Firm I chooses High,neither will have an incentive to change (100>20 for Firm 1 and 800>50 for Firm 2).If Firm 2 chooses High and Firm 1 chooses low.neither will have an incentive to change (900>50 for Firm 1 and 600>30 for Firm 2).Both outoomes are Nash equilibria.Both firms choosing low is nota Nash equilibrium because,for example,if Firm chooses low then firm 2 is better off by switching to high since 600 is greater than -30. If the manager of each firm is conservative and each follows a maximin strategy,what will be the outcome? If Firm 1 chooses Low.its worst pavoff-20.would occur if Firm 2 chooses Low.If Firm 1 chooses High its worst payoff 50,would occur if Firm chooses High. .Therefore,with a conservative maximin strategy,Firm l hand, if B moves first, its profit is 55. If it moves second, its profit is 45, a difference of 10, and it thus would be willing to spend up to 10 for the option of announcing first. Once Firm A realizes that Firm B is willing to spend something on the option of announcing first, then the value of the option decreases for Firm A, because if both firms were to invest both firms would choose to produce the high-quality system, which gives them both a lower payoff. Firm A should not spend money to speed up the introduction of its product in any case. If B goes first and chooses high then A can choose low and end up with 55 instead of the 50 it would get if it went high also. This is best for B also because if B goes high and A low, B ends up with 55 instead of 40, so even if it spends the 10 it is still ahead by 5. A should let B go first. Finally, note that even though B is better off if A goes first and chooses high (45 vs. 40), B is still best off if it goes first. Overall, it is worthwhile for B to spend the money and announce but it is not worthwhile for A to spend any money. 4. Two firms are in the chocolate market. Each can choose to go for the high end of the market (high quality) or the low end (low quality). Resulting profits are given by the following payoff matrix: Firm 2 Low High Low -20, -30 900, 600 Firm 1 High 100, 800 50, 50 a. What outcomes, if any, are Nash equilibria? A Nash equilibrium exists when neither party has an incentive to alter its strategy, taking the other’s strategy as given. If Firm 2 chooses Low and Firm 1 chooses High, neither will have an incentive to change (100 > -20 for Firm 1 and 800 > 50 for Firm 2). If Firm 2 chooses High and Firm 1 chooses Low, neither will have an incentive to change (900 > 50 for Firm 1 and 600 > -30 for Firm 2). Both outcomes are Nash equilibria. Both firms choosing low is not a Nash equilibrium because, for example, if Firm 1 chooses low then firm 2 is better off by switching to high since 600 is greater than -30. b. If the manager of each firm is conservative and each follows a maximin strategy, what will be the outcome? If Firm 1 chooses Low, its worst payoff, -20, would occur if Firm 2 chooses Low. If Firm 1 chooses High, its worst payoff, 50, would occur if Firm 2 chooses High. Therefore, with a conservative maximin strategy, Firm 1