正在加载图片...

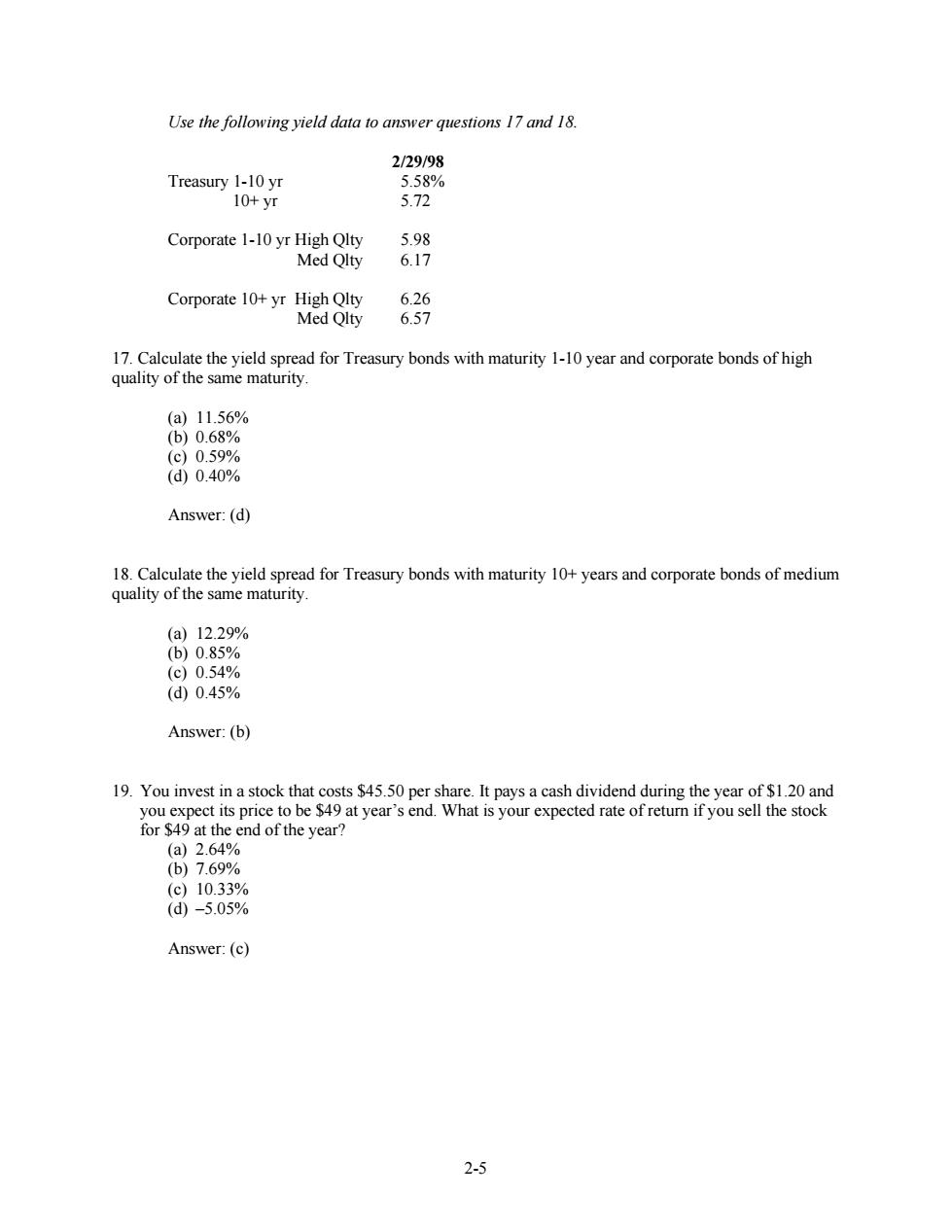

Use the following yield data to answer questions 17 and 18. 2/29/98 Treasury 1-10 yr 5.58% 10+yr 5.72 Corporate 1-10 yr High Qlty 5.98 Med Qlty 6.17 Corporate 10+yr High Qlty 6.26 Med Olty 6.57 17.Calculate the yield spread for Treasury bonds with maturity 1-10 year and corporate bonds of high quality of the same maturity. (a)11.56% (b)0.68% (c)0.59% (d0.40% Answer:(d) 18.Calculate the yield spread for Treasury bonds with maturity 10+years and corporate bonds of medium quality of the same maturity. (a)12.29% (b)0.85% (c)0.54% (d0.45% Answer:(b) 19.You invest in a stock that costs $45.50 per share.It pays a cash dividend during the year of $1.20 and you expect its price to be $49 at year's end.What is your expected rate of return if you sell the stock for $49 at the end of the year? (a)2.64% (b)7.69% (c)10.33% (d)-5.05% Answer:(c) 2-52-5 Use the following yield data to answer questions 17 and 18. 2/29/98 Treasury 1-10 yr 5.58% 10+ yr 5.72 Corporate 1-10 yr High Qlty 5.98 Med Qlty 6.17 Corporate 10+ yr High Qlty 6.26 Med Qlty 6.57 17. Calculate the yield spread for Treasury bonds with maturity 1-10 year and corporate bonds of high quality of the same maturity. (a) 11.56% (b) 0.68% (c) 0.59% (d) 0.40% Answer: (d) 18. Calculate the yield spread for Treasury bonds with maturity 10+ years and corporate bonds of medium quality of the same maturity. (a) 12.29% (b) 0.85% (c) 0.54% (d) 0.45% Answer: (b) 19. You invest in a stock that costs $45.50 per share. It pays a cash dividend during the year of $1.20 and you expect its price to be $49 at year’s end. What is your expected rate of return if you sell the stock for $49 at the end of the year? (a) 2.64% (b) 7.69% (c) 10.33% (d) –5.05% Answer: (c)