正在加载图片...

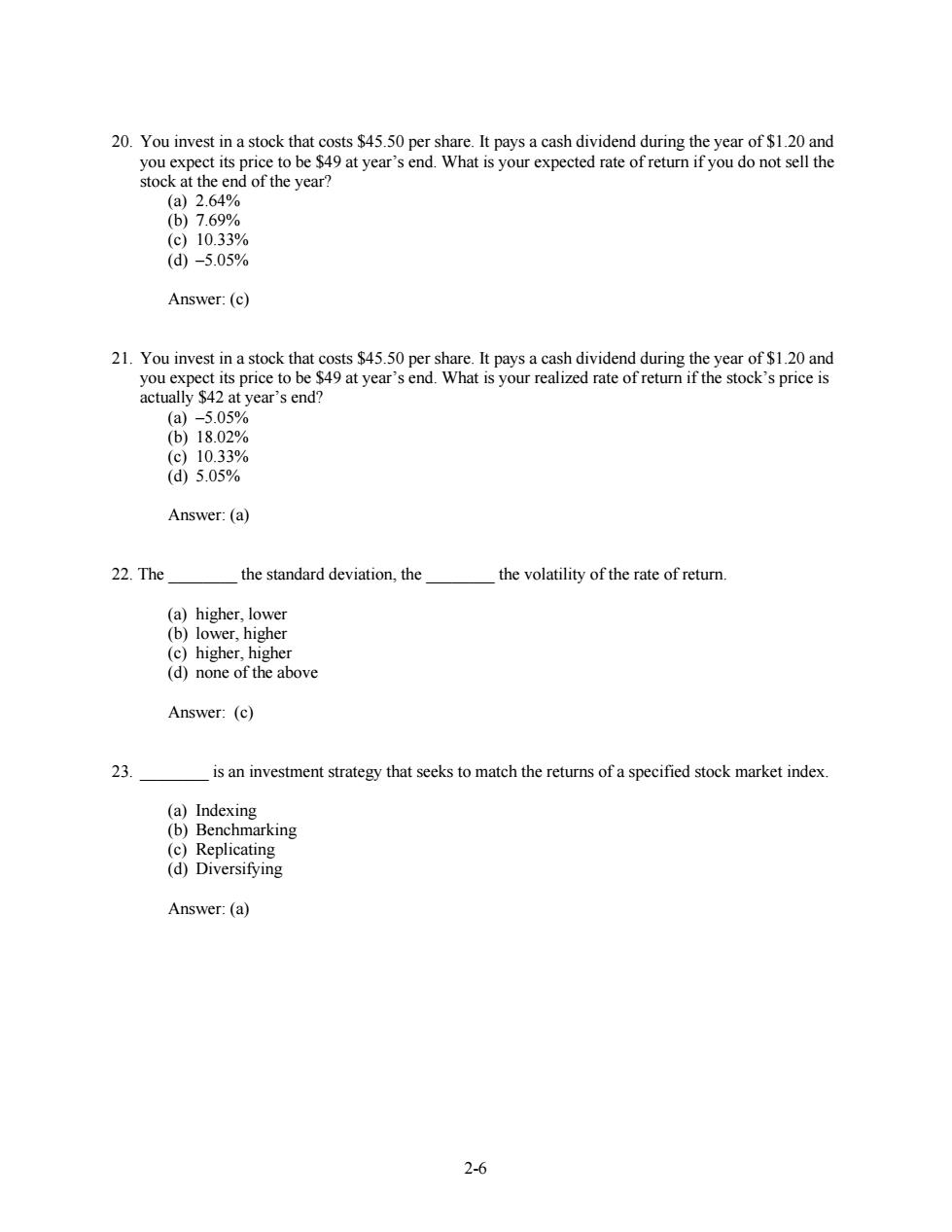

20.You invest in a stock that costs $45.50 per share.It pays a cash dividend during the year of $1.20 and you expect its price to be $49 at year's end.What is your expected rate of return if you do not sell the stock at the end of the year? (a)2.64% (b)7.69% (c)10.33% (d-5.05% Answer:(c) 21.You invest in a stock that costs $45.50 per share.It pays a cash dividend during the year of $1.20 and you expect its price to be $49 at year's end.What is your realized rate of return if the stock's price is actually $42 at year's end? (a)-5.05% (b)18.02% (c)10.33% (d5.05% Answer:(a) 22.The the standard deviation,the the volatility of the rate of return. (a)higher,lower (b)lower,higher (c)higher,higher (d)none of the above Answer:(c) 23. is an investment strategy that seeks to match the returns of a specified stock market index. (a)Indexing (b)Benchmarking (c)Replicating (d)Diversifying Answer:(a) 2-62-6 20. You invest in a stock that costs $45.50 per share. It pays a cash dividend during the year of $1.20 and you expect its price to be $49 at year’s end. What is your expected rate of return if you do not sell the stock at the end of the year? (a) 2.64% (b) 7.69% (c) 10.33% (d) –5.05% Answer: (c) 21. You invest in a stock that costs $45.50 per share. It pays a cash dividend during the year of $1.20 and you expect its price to be $49 at year’s end. What is your realized rate of return if the stock’s price is actually $42 at year’s end? (a) –5.05% (b) 18.02% (c) 10.33% (d) 5.05% Answer: (a) 22. The ________ the standard deviation, the ________ the volatility of the rate of return. (a) higher, lower (b) lower, higher (c) higher, higher (d) none of the above Answer: (c) 23. ________ is an investment strategy that seeks to match the returns of a specified stock market index. (a) Indexing (b) Benchmarking (c) Replicating (d) Diversifying Answer: (a)