正在加载图片...

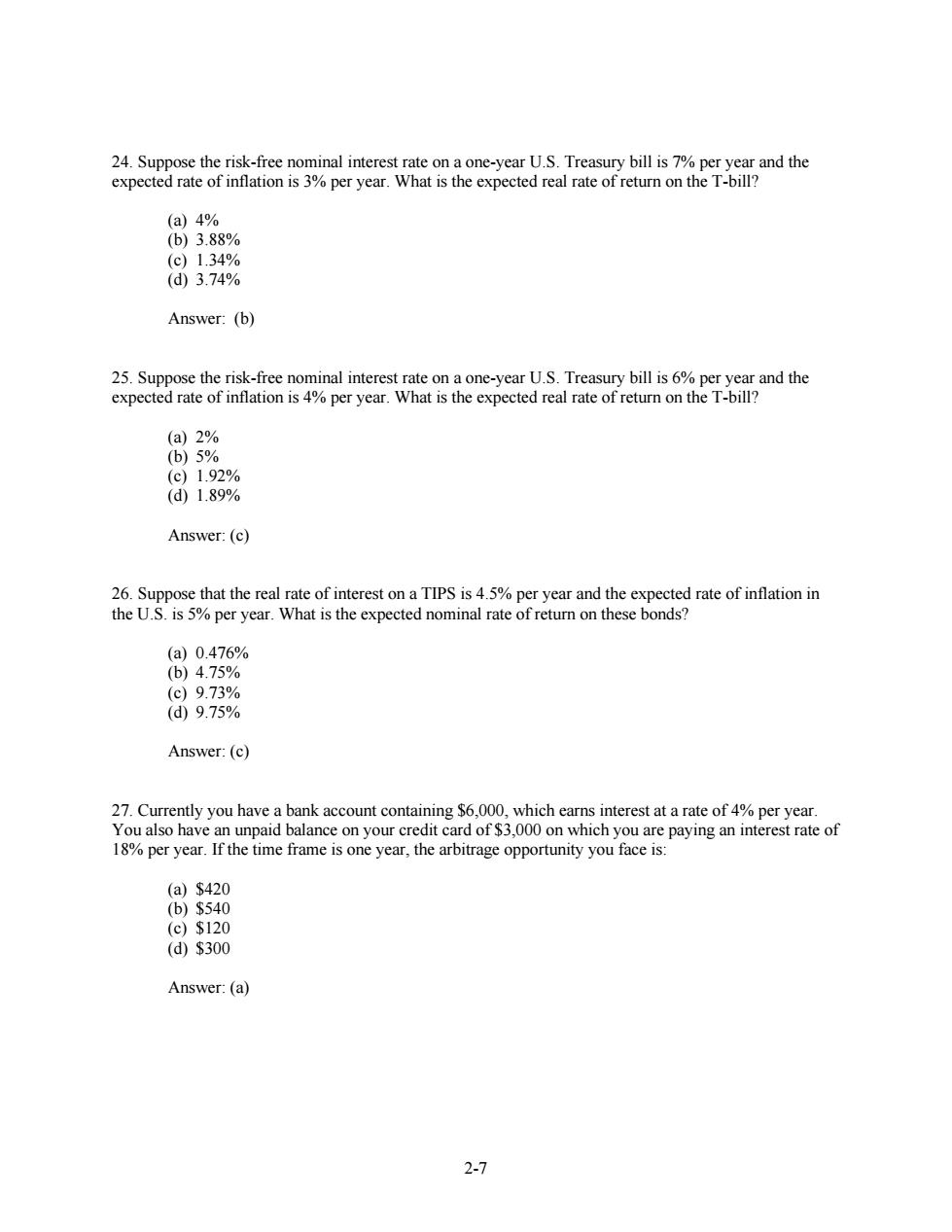

24.Suppose the risk-free nominal interest rate on a one-year U.S.Treasury bill is 7%per year and the expected rate of inflation is 3%per year.What is the expected real rate of return on the T-bill? (a)4% (b)3.88% (c)1.34% (d3.74% Answer:(b) 25.Suppose the risk-free nominal interest rate on a one-year U.S.Treasury bill is 6%per year and the expected rate of inflation is 4%per year.What is the expected real rate of return on the T-bill? (a)2% (b)5% (c)1.92% (d1.89% Answer:(c) 26.Suppose that the real rate of interest on a TIPS is 4.5%per year and the expected rate of inflation in the U.S.is 5%per year.What is the expected nominal rate of return on these bonds? (a)0.476% (b)4.75% (c)9.73% (d9.75% Answer:(c) 27.Currently you have a bank account containing $6,000,which earns interest at a rate of 4%per year. You also have an unpaid balance on your credit card of $3,000 on which you are paying an interest rate of 18%per year.If the time frame is one year,the arbitrage opportunity you face is: (a)$420 (b)$540 (c)$120 (d$300 Answer:(a) 2-72-7 24. Suppose the risk-free nominal interest rate on a one-year U.S. Treasury bill is 7% per year and the expected rate of inflation is 3% per year. What is the expected real rate of return on the T-bill? (a) 4% (b) 3.88% (c) 1.34% (d) 3.74% Answer: (b) 25. Suppose the risk-free nominal interest rate on a one-year U.S. Treasury bill is 6% per year and the expected rate of inflation is 4% per year. What is the expected real rate of return on the T-bill? (a) 2% (b) 5% (c) 1.92% (d) 1.89% Answer: (c) 26. Suppose that the real rate of interest on a TIPS is 4.5% per year and the expected rate of inflation in the U.S. is 5% per year. What is the expected nominal rate of return on these bonds? (a) 0.476% (b) 4.75% (c) 9.73% (d) 9.75% Answer: (c) 27. Currently you have a bank account containing $6,000, which earns interest at a rate of 4% per year. You also have an unpaid balance on your credit card of $3,000 on which you are paying an interest rate of 18% per year. If the time frame is one year, the arbitrage opportunity you face is: (a) $420 (b) $540 (c) $120 (d) $300 Answer: (a)