正在加载图片...

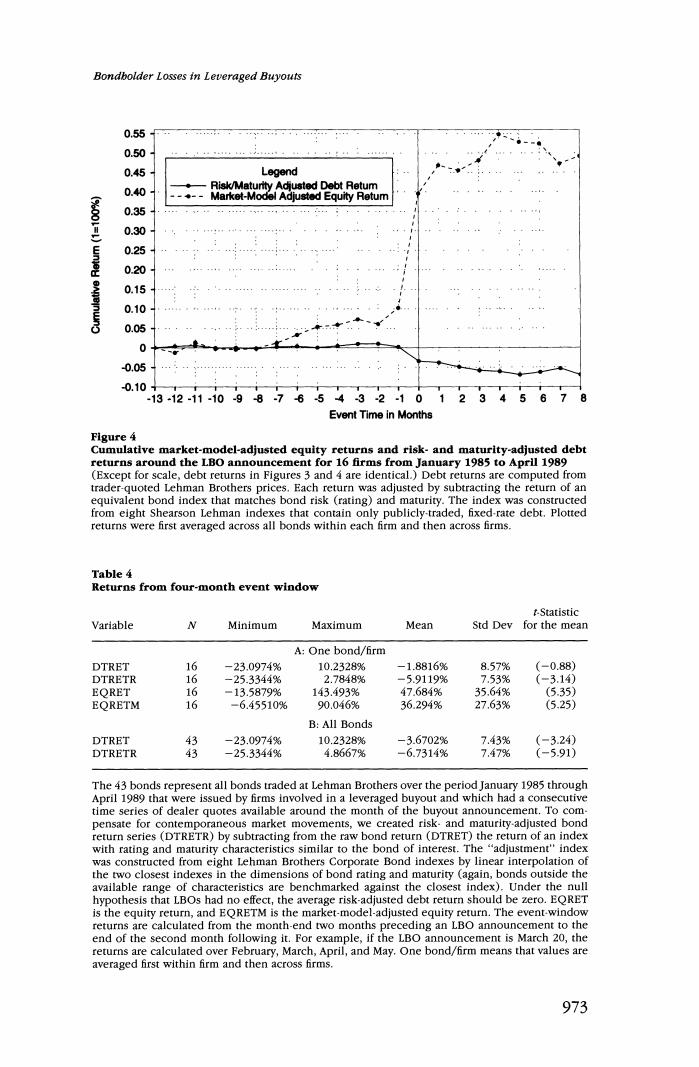

Bondbolder Losses in Leveraged Buyouts 0.55 0.50 0.45 Legend 0.40 Risk/Maturity Adjusted Debt Retum ---Market-Model Adjusted Equity Retum 0.35 0.30 0.25 0.20 ,。 0.15 0.10 0.05 0 0.05 -0.10 -13-12-11.10-9-8-7654-3-2-1012345678 Event Time in Months Figure 4 Cumulative market-model-adjusted equity returns and risk-and maturity-adjusted debt returns around the LBO announcement for 16 firms from January 1985 to April 1989 (Except for scale,debt returns in Figures 3 and 4 are identical.)Debt returns are computed from trader-quoted Lehman Brothers prices.Each return was adjusted by subtracting the return of an equivalent bond index that matches bond risk (rating)and maturity.The index was constructed from eight Shearson Lehman indexes that contain only publicly-traded,fixed-rate debt.Plotted returns were first averaged across all bonds within each firm and then across firms. Table 4 Returns from four-month event window tStatistic Variable N Minimum Maximum Mean Std Dev for the mean A:One bond/firm DTRET 16 -23.0974% 10.2328% -1.8816% 8.57% (-0.88) DTRETR 16 -25.3344% 2.7848% -5.9119% 7.53% (-3.14) EORET 1 -13.5879% 143.493% 47.684% 35.64% (5.35) EQRETM 16 -6.45510% 90.046% 36.294% 27.63% (5.25) B:All Bonds DTRET 3 -23.0974% 10.2328% -3.6702% 7.43% (-3.24) DTRETR 43 -25.3344% 4.8667% -6.7314% 7.47% (-5.91) The 43 bonds represent all bonds traded at Lehman Brothers over the period January 1985 through April 1989 that were issued by firms involved in a leveraged buyout and which had a consecutive time series of dealer quotes available around the month of the buyout announcement.To com pensate for contemporaneous market movements,we created risk.and maturity-adjusted bond return series (DTRETR)by subtracting from the raw bond return (DTRET)the return of an index with rating and maturity characteristics similar to the bond of interest.The "adjustment"index was constructed from eight Lehman Brothers Corporate Bond indexes by linear interpolation of the two closest indexes in the dimensions of bond rating and maturity (again,bonds outside the available range of characteristics are benchmarked against the closest index).Under the null hypothesis that LBOs had no effect,the average risk-adjusted debt return should be zero.EQRET is the equity return,and EQRETM is the market-model-adjusted equity return.The event-window returns are calculated from the month-end two months preceding an LBO announcement to the end of the second month following it.For example,if the LBO announcement is March 20,the returns are calculated over February,March,April,and May.One bond/frm means that values are averaged first within firm and then across hrms. 973