正在加载图片...

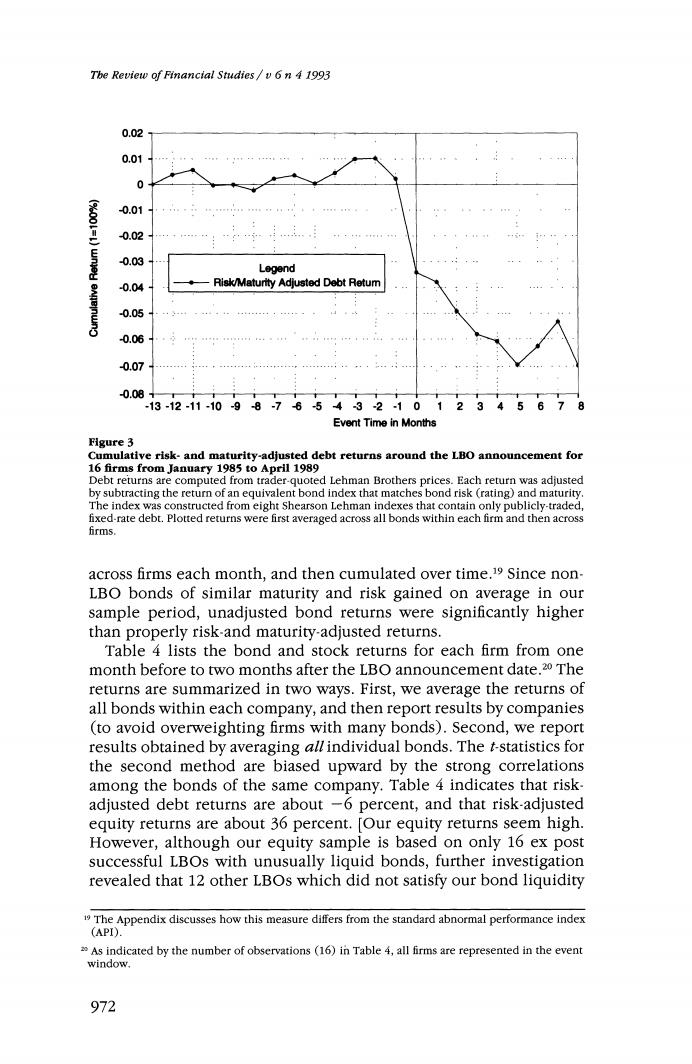

Tbe Review of Financial Studies /v 6 n 4 1993 0.02 0.01 0 0.01 0.02 0.03 Legend 0.04 Risk/Maturity Adjusted Debt Retum 0.05 -0.06 0.07 4 0.08 -13-12-11-1098-765432-1012345678 Event Time in Months Figure 3 Cumulative risk-and maturity-adjusted debt returns around the LBO announcement for 16 firms from January 1985 to April 1989 Debt returns are computed from trader-quoted Lehman Brothers prices.Each return was adjusted by subtracting the return of an equivalent bond index that matches bond risk (rating)and maturity The index was constructed from eight Shearson Lehman indexes that contain only publicly-traded, fixed-rate debt.Plotted returns were first averaged across all bonds within each firm and then across 6rm5. across firms each month,and then cumulated over time.19 Since non LBO bonds of similar maturity and risk gained on average in our sample period,unadjusted bond returns were significantly higher than properly risk-and maturity-adjusted returns. Table 4 lists the bond and stock returns for each firm from one month before to two months after the LBO announcement date.20 The returns are summarized in two ways.First,we average the returns of all bonds within each company,and then report results by companies (to avoid overweighting firms with many bonds).Second,we report results obtained by averaging all individual bonds.The t-statistics for the second method are biased upward by the strong correlations among the bonds of the same company.Table 4 indicates that risk- adjusted debt returns are about -6 percent,and that risk-adjusted equity returns are about 36 percent.[Our equity returns seem high. However,although our equity sample is based on only 16 ex post successful LBOs with unusually liquid bonds,further investigation revealed that 12 other LBOs which did not satisfy our bond liquidity The Appendix discusses how this measure differs from the standard abnormal performance index (API). As indicated by the number of observations (16)in Table 4,all firms are represented in the event window. 972