正在加载图片...

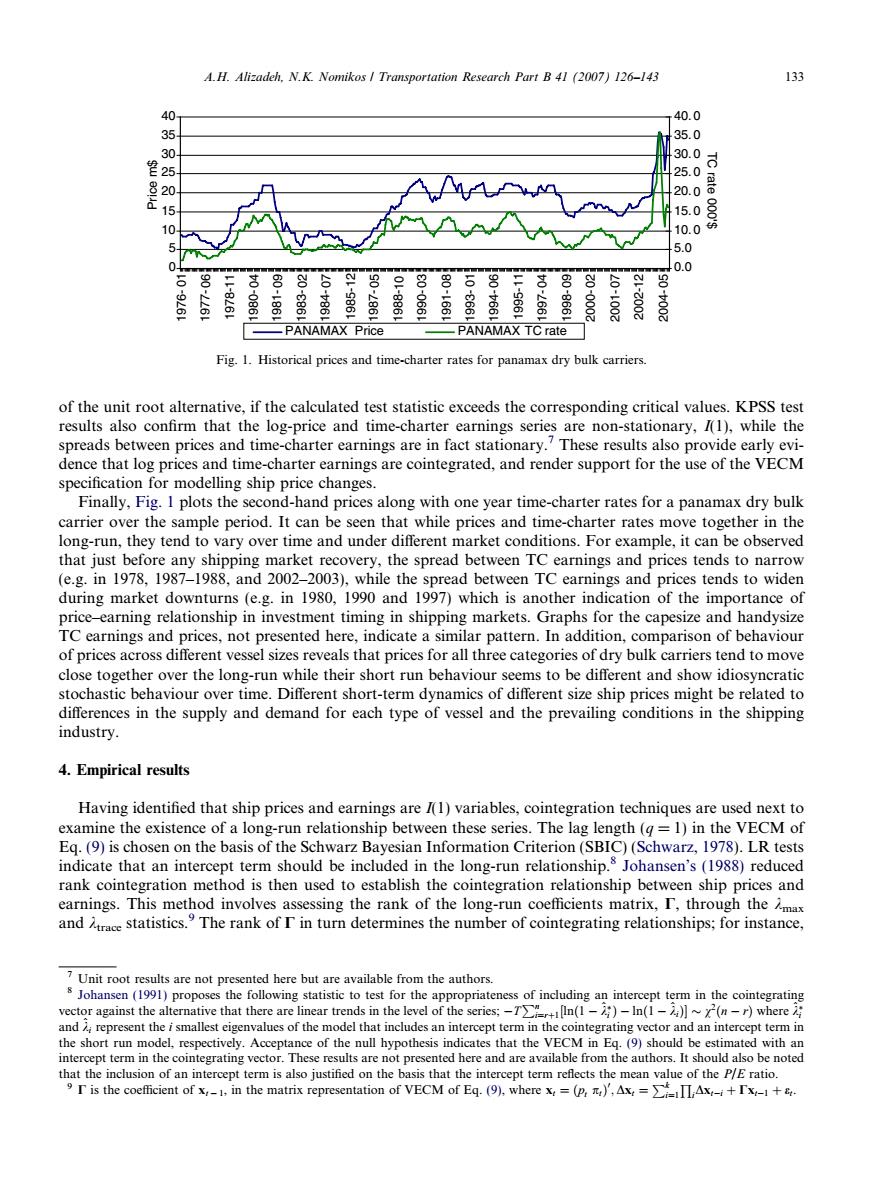

A.H.Alizadeh,N.K.Nomikos Transportation Research Part B 41 (2007)126-143 133 40 40.0 35 35.0 3 30.0 25 d 25. 0 20.0 15.0 at000:6 10.0 5.0 0 0.0 6 8 00 00m .PANAMAX Price PANAMAX TC rate Fig.1.Historical prices and time-charter rates for panamax dry bulk carriers. of the unit root alternative,if the calculated test statistic exceeds the corresponding critical values.KPSS test results also confirm that the log-price and time-charter earnings series are non-stationary,I(1),while the spreads between prices and time-charter earnings are in fact stationary.'These results also provide early evi- dence that log prices and time-charter earnings are cointegrated,and render support for the use of the VECM specification for modelling ship price changes. Finally,Fig.I plots the second-hand prices along with one year time-charter rates for a panamax dry bulk carrier over the sample period.It can be seen that while prices and time-charter rates move together in the long-run,they tend to vary over time and under different market conditions.For example,it can be observed that just before any shipping market recovery,the spread between TC earnings and prices tends to narrow (e.g.in 1978,1987-1988,and 2002-2003),while the spread between TC earnings and prices tends to widen during market downturns (e.g.in 1980,1990 and 1997)which is another indication of the importance of price-earning relationship in investment timing in shipping markets.Graphs for the capesize and handysize TC earnings and prices,not presented here,indicate a similar pattern.In addition,comparison of behaviour of prices across different vessel sizes reveals that prices for all three categories of dry bulk carriers tend to move close together over the long-run while their short run behaviour seems to be different and show idiosyncratic stochastic behaviour over time.Different short-term dynamics of different size ship prices might be related to differences in the supply and demand for each type of vessel and the prevailing conditions in the shipping industry. 4.Empirical results Having identified that ship prices and earnings are I(1)variables,cointegration techniques are used next to examine the existence of a long-run relationship between these series.The lag length(g=1)in the VECM of Eq.(9)is chosen on the basis of the Schwarz Bayesian Information Criterion(SBIC)(Schwarz,1978).LR tests indicate that an intercept term should be included in the long-run relationship.s Johansen's (1988)reduced rank cointegration method is then used to establish the cointegration relationship between ship prices and earnings.This method involves assessing the rank of the long-run coefficients matrix,I,through the max and statistics.The rank ofI in turn determines the number of cointegrating relationships;for instance, 7 Unit root results are not presented here but are available from the authors. s Johansen(1991)proposes the following statistic to test for the appropriateness of including an intercept term in the cointegrating vector against the alternative that there are linear trends in the level of the series;-T[n(1)-In(1-(n-r)where and represent the i smallest eigenvalues of the model that includes an intercept term in the cointegrating vector and an intercept term in the short run model,respectively.Acceptance of the null hypothesis indicates that the VECM in Eq.(9)should be estimated with an intercept term in the cointegrating vector.These results are not presented here and are available from the authors.It should also be noted that the inclusion of an intercept term is also justified on the basis that the intercept term reflects the mean value of the P/E ratio. I is the coefficient of x,-1,in the matrix representation of VECM of Eq.(9),where x=(p:)',Ax,==,Ax+x1+hof the unit root alternative, if the calculated test statistic exceeds the corresponding critical values. KPSS test results also confirm that the log-price and time-charter earnings series are non-stationary, I(1), while the spreads between prices and time-charter earnings are in fact stationary.7 These results also provide early evidence that log prices and time-charter earnings are cointegrated, and render support for the use of the VECM specification for modelling ship price changes. Finally, Fig. 1 plots the second-hand prices along with one year time-charter rates for a panamax dry bulk carrier over the sample period. It can be seen that while prices and time-charter rates move together in the long-run, they tend to vary over time and under different market conditions. For example, it can be observed that just before any shipping market recovery, the spread between TC earnings and prices tends to narrow (e.g. in 1978, 1987–1988, and 2002–2003), while the spread between TC earnings and prices tends to widen during market downturns (e.g. in 1980, 1990 and 1997) which is another indication of the importance of price–earning relationship in investment timing in shipping markets. Graphs for the capesize and handysize TC earnings and prices, not presented here, indicate a similar pattern. In addition, comparison of behaviour of prices across different vessel sizes reveals that prices for all three categories of dry bulk carriers tend to move close together over the long-run while their short run behaviour seems to be different and show idiosyncratic stochastic behaviour over time. Different short-term dynamics of different size ship prices might be related to differences in the supply and demand for each type of vessel and the prevailing conditions in the shipping industry. 4. Empirical results Having identified that ship prices and earnings are I(1) variables, cointegration techniques are used next to examine the existence of a long-run relationship between these series. The lag length (q = 1) in the VECM of Eq. (9) is chosen on the basis of the Schwarz Bayesian Information Criterion (SBIC) (Schwarz, 1978). LR tests indicate that an intercept term should be included in the long-run relationship.8 Johansen’s (1988) reduced rank cointegration method is then used to establish the cointegration relationship between ship prices and earnings. This method involves assessing the rank of the long-run coefficients matrix, C, through the kmax and ktrace statistics.9 The rank of C in turn determines the number of cointegrating relationships; for instance, 0 5 10 15 20 25 30 35 40 1976- 01 1977-06 1978-11 1980-04 1981-09 1983-02 1984-07 1985-12 1987-05 1988-10 1990-03 1991-08 1993- 01 1994-06 1995-11 1997-04 1998-09 2000-02 2001-07 2002-12 2004-05 Price m$ 0.0 5.0 10. 0 15. 0 20. 0 25. 0 30. 0 35. 0 40. 0 TC rate 000'$ PANAMAX Price PANAMAX TC rate Fig. 1. Historical prices and time-charter rates for panamax dry bulk carriers. 7 Unit root results are not presented here but are available from the authors. 8 Johansen (1991) proposes the following statistic to test for the appropriateness of including an intercept term in the cointegrating vector against the alternative that there are linear trends in the level of the series; T Pn i¼rþ1½lnð1 ^k i Þ lnð1 ^kiÞ v2ðn rÞ where ^k i and ^ki represent the i smallest eigenvalues of the model that includes an intercept term in the cointegrating vector and an intercept term in the short run model, respectively. Acceptance of the null hypothesis indicates that the VECM in Eq. (9) should be estimated with an intercept term in the cointegrating vector. These results are not presented here and are available from the authors. It should also be noted that the inclusion of an intercept term is also justified on the basis that the intercept term reflects the mean value of the P/E ratio. 9 C is the coefficient of xt 1, in the matrix representation of VECM of Eq. (9), where xt ¼ ðpt ptÞ 0 ;Dxt ¼ Pk i¼1 Q i Dxti þ Cxt1 þ et. A.H. Alizadeh, N.K. Nomikos / Transportation Research Part B 41 (2007) 126–143 133���������